Get the free Informal Trust Account Application - managedmoneyreporter

Show details

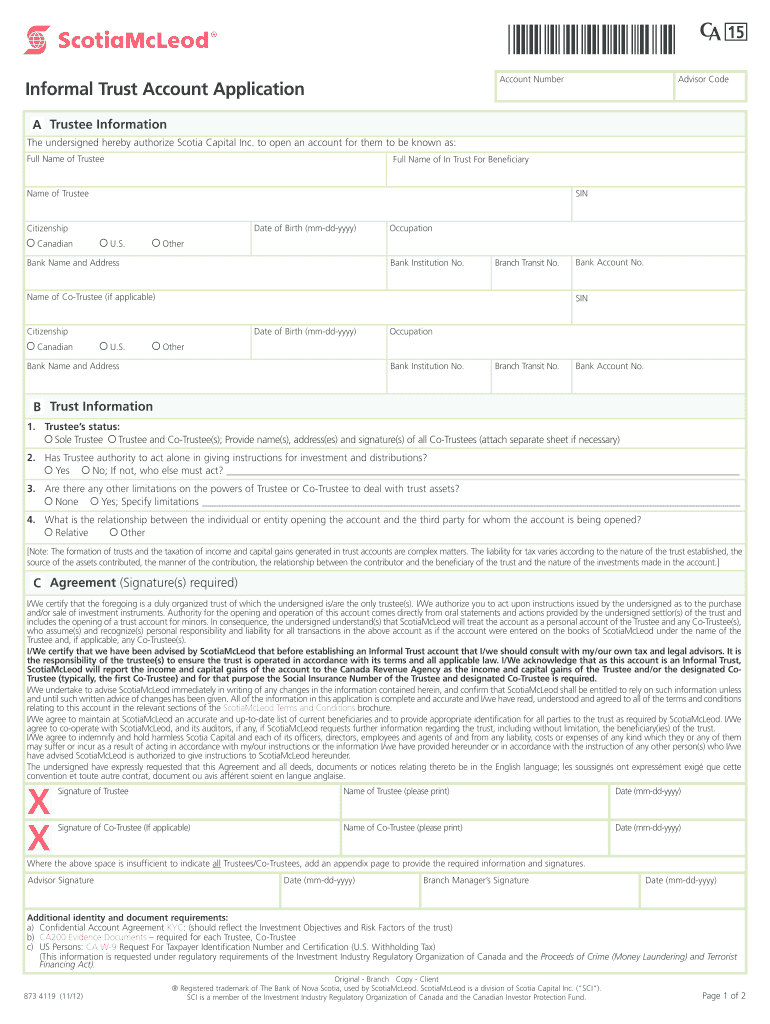

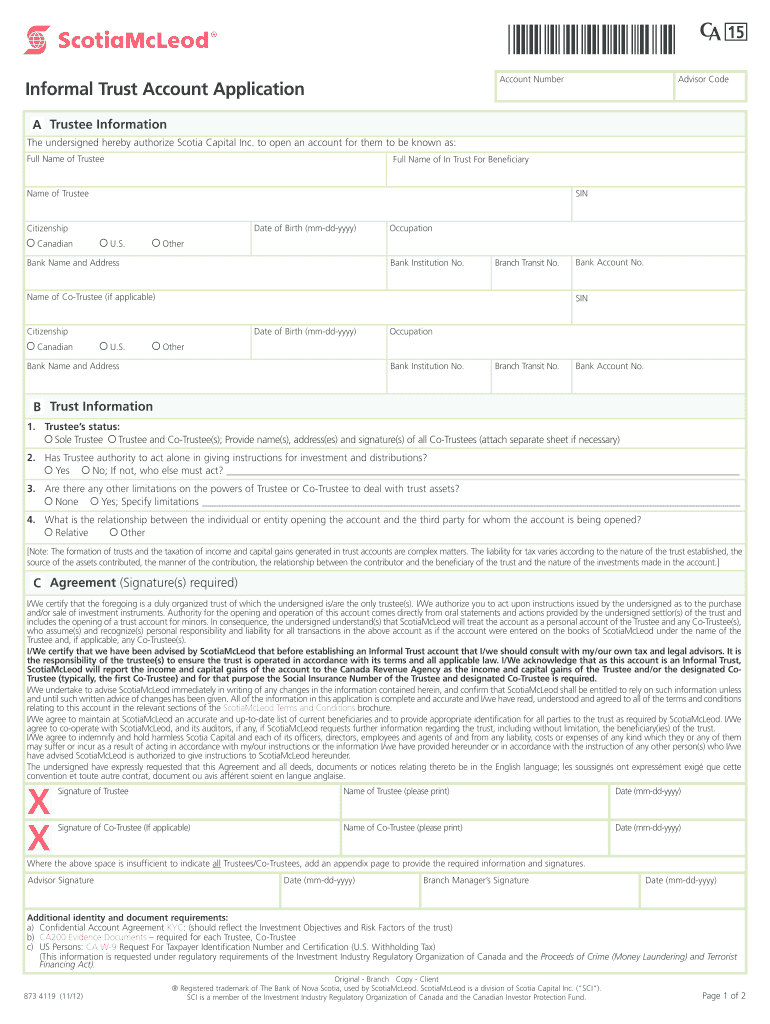

Application form for establishing an informal trust account with Scotia Capital Inc.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign informal trust account application

Edit your informal trust account application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your informal trust account application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit informal trust account application online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit informal trust account application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out informal trust account application

How to fill out Informal Trust Account Application

01

Obtain the Informal Trust Account Application form from the relevant financial institution or their website.

02

Carefully read the instructions provided with the application form.

03

Fill out the applicant's personal information, including full name, address, and contact details.

04

Provide details of the trust, including the name and purpose of the trust.

05

Include the names and details of the trustees and beneficiaries involved in the trust.

06

Specify the initial deposit amount that will be held in the trust account.

07

Sign and date the application form to certify that all information is accurate.

08

Submit the completed application form along with any required identification documents and proof of relationship to the trust.

09

Wait for confirmation from the financial institution regarding the opening of the account.

Who needs Informal Trust Account Application?

01

Individuals who want to manage funds for minors or beneficiaries without formal court proceedings.

02

Non-profit organizations or community groups managing funds for charitable purposes.

03

Anyone looking to set up a trust account to manage specific funds for a designated purpose.

Fill

form

: Try Risk Free

People Also Ask about

What is a trust account in English?

A trust account is an account that is held in trust for someone else, such as a minor or an estate. It may be illegal to take money out of a trust account and not use it for the benefit of the beneficiary.

What is an informal trust account?

An informal trust is typically opened by an adult for the benefit of another person, usually a minor. Compared to a formal trust, there is less legal documentation required (a trust agreement is not required).

How do you set up a trust account for someone?

5 steps to create a trust fund Step 1: Designate your trustee. Step 2: Choose your beneficiary(ies) Step 3: Decide on how your trust will be administered. Step 4: Write up, sign, and notarize your trust document. Step 5: Open and fund your trust account.

Which bank is best for opening a trust account?

Having served generations of families, we have the knowledge, resources and experience to administer trusts and estates with sensitivity and professionalism. is ranked #1 as the largest provider of personal trust services with $130.4B under management.

Who owns the funds in a trust account?

While establishing a trust can be more expensive and time-consuming than establishing a will, trusts offer several potential benefits, including: Avoiding probate, simplifying and speeding up the distribution of your assets.

What are the disadvantages of a trust account?

A trust is considered a legal entity, and the trust's grantor will retitle their assets and property to the trust. Transferring assets and property into a trust makes the trust the owner of the assets, and this property is then considered trust property.

What is the main purpose of a trust account?

A trust account is a legal arrangement through which funds or assets are held by a third party (the trustee) for the benefit of another party (the beneficiary). The beneficiary may be an individual or a group.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Informal Trust Account Application?

The Informal Trust Account Application is a form used to establish a trust account for managing assets that are held in trust for beneficiaries, typically designed for simpler and less formal arrangements.

Who is required to file Informal Trust Account Application?

Individuals or entities that manage trust assets on behalf of beneficiaries, such as trustees or estate administrators, are required to file an Informal Trust Account Application.

How to fill out Informal Trust Account Application?

To fill out the Informal Trust Account Application, provide necessary information such as the names and contact details of the trustor and beneficiaries, a description of the trust assets, and any applicable signatures.

What is the purpose of Informal Trust Account Application?

The purpose of the Informal Trust Account Application is to formally document the establishment of a trust account, ensuring proper management and distribution of assets according to the terms of the trust.

What information must be reported on Informal Trust Account Application?

The Informal Trust Account Application must report information including the names of the trustor and beneficiaries, the purpose of the trust, a description of trust assets, and any other relevant identifying details.

Fill out your informal trust account application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Informal Trust Account Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.