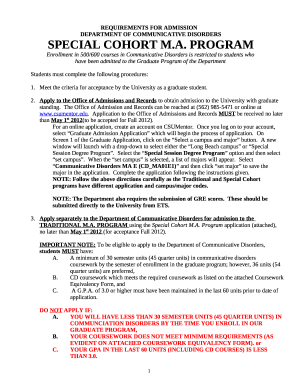

Get the free REGISTERED RETIREMENT INCOME FUND (RRIF) - APPLICATION FORM

Show details

This document is an application form for establishing a Registered Retirement Income Fund (RRIF), requesting personal details from the annuitant and their spouse, and outlining responsibilities related

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign registered retirement income fund

Edit your registered retirement income fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your registered retirement income fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing registered retirement income fund online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit registered retirement income fund. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out registered retirement income fund

How to fill out REGISTERED RETIREMENT INCOME FUND (RRIF) - APPLICATION FORM

01

Obtain the Registered Retirement Income Fund (RRIF) Application Form from a financial institution or their website.

02

Complete the personal information section by providing your name, address, and date of birth.

03

Indicate your Social Insurance Number (SIN) as required on the form.

04

Select your preferred RRIF account type and input any existing registered funds you wish to transfer into the RRIF.

05

Choose your payment schedule (monthly, quarterly, annually) for withdrawals from the RRIF.

06

Provide any additional information requested, such as your investment choices or beneficiaries.

07

Review the completed application form for accuracy and completeness.

08

Sign and date the application form.

09

Submit the application to your chosen financial institution either in person or online.

Who needs REGISTERED RETIREMENT INCOME FUND (RRIF) - APPLICATION FORM?

01

Individuals who are transitioning from saving for retirement to withdrawing income.

02

Those who have accumulated registered retirement savings plans (RRSPs) that need to be converted into income.

03

Retirees looking for a structured way to draw income during retirement while managing tax implications.

04

People over the age of 71 who are required by law to convert their RRSP to a RRIF.

Fill

form

: Try Risk Free

People Also Ask about

What are the disadvantages of a RRIF?

Because RRIF withdrawals are considered taxable income, taking money out too early or more than you need could put you in a higher tax bracket and leave you with a larger tax bill. Withdrawals could also potentially reduce certain government benefits, like Old Age Security (OAS).

How to set up a RRIF in Canada?

You set up a registered retirement income fund (RRIF) account through a financial institution such as a bank, credit union, trust or insurance company. Your financial institution will advise you on the types of RRIFs and the investments they can contain.

How much do you have to withdraw from your RRIF each year?

The older you are, the higher the percentage that needs to be withdrawn. For example, if your RRIF is valued at $1,000,000 and you're 75, you'd need to make a minimum withdrawal of $58,200 (5.82% x 1,000,000). Whereas if you were 85, you'd need to withdraw a minimum of $85,100 (8.51% x 1,000,000).

Is first $2000 from RRIF tax free in Canada?

The federal non- refundable pension income tax credit is on the first $2,000 of eligible pension income, which translates into maximum federal annual tax savings of $300. The amount of additional provincial/territorial tax savings varies depending on where you reside.

What happens if I don't convert my RRSP to a RRIF?

An RRSP matures at the end of the year the taxpayer turns 69. If an RRSP is not rolled over into a RRIF prior to age 70 or used to purchase an annuity, the amount is fully taxable as income in the year you turn 69.

What is the difference between RIF and RRIF?

What is the difference between RRIF and RIF? A RRIF (Registered Retirement Income Fund) account's purpose is to pay you a percentage of the funds in the account every year. An RIF (Retirement Income Fund) is an investment account that pays a yearly yield amount for retirement income.

How much tax do you pay on a RRIF in Canada?

Federal withholding taxes on RRIF withdrawals Withdrawal amount% Federal tax withheld Provinces/territories except QC Quebec* From $0 to $5,000 10% 5% From $5,001 to $15,000 20% 10% Greater than $15,000 30% 15%

What are the disadvantages of RRIF?

Because RRIF withdrawals are considered taxable income, taking money out too early or more than you need could put you in a higher tax bracket and leave you with a larger tax bill. Withdrawals could also potentially reduce certain government benefits, like Old Age Security (OAS).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is REGISTERED RETIREMENT INCOME FUND (RRIF) - APPLICATION FORM?

The Registered Retirement Income Fund (RRIF) Application Form is a document used by individuals to establish a RRIF, allowing them to withdraw funds from their registered retirement savings in a structured manner during retirement.

Who is required to file REGISTERED RETIREMENT INCOME FUND (RRIF) - APPLICATION FORM?

Individuals who wish to convert their Registered Retirement Savings Plan (RRSP) into a RRIF must file the RRIF Application Form. This typically applies to those who have reached retirement age and wish to start receiving income from their retirement savings.

How to fill out REGISTERED RETIREMENT INCOME FUND (RRIF) - APPLICATION FORM?

To fill out the RRIF Application Form, individuals need to provide personal information such as their name, address, Social Insurance Number (SIN), and details of their RRSP account. They should also specify the financial institution managing the RRIF and the desired withdrawal schedule.

What is the purpose of REGISTERED RETIREMENT INCOME FUND (RRIF) - APPLICATION FORM?

The purpose of the RRIF Application Form is to facilitate the transition from a RRSP to a RRIF, enabling retirees to receive periodic income payments while adhering to regulatory requirements and providing information necessary for account management.

What information must be reported on REGISTERED RETIREMENT INCOME FUND (RRIF) - APPLICATION FORM?

The information that must be reported on the RRIF Application Form includes the account holder's personal details (name, address, SIN), RRSP details being converted, financial institution information, and the elected withdrawal options (e.g., frequency and amount of payments).

Fill out your registered retirement income fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Registered Retirement Income Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.