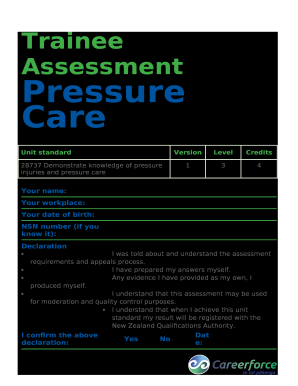

Get the free REGISTERED RETIREMENT INCOME FUND (RRIF) - APPLICATION FORM

Show details

This document is an application form for registering a Registered Retirement Income Fund (RRIF) and includes sections for personal information, payment options, and terms applicable to the fund.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign registered retirement income fund

Edit your registered retirement income fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your registered retirement income fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit registered retirement income fund online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit registered retirement income fund. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out registered retirement income fund

How to fill out REGISTERED RETIREMENT INCOME FUND (RRIF) - APPLICATION FORM

01

Obtain the RRIF Application Form from your financial institution or the Canada Revenue Agency (CRA) website.

02

Provide your personal information including your name, address, and Social Insurance Number (SIN).

03

Indicate the name of your RRIF account and any additional account details.

04

Choose the type of investments you would like the RRIF to hold.

05

Specify your spouse's details if applicable, as well as any beneficiaries for the RRIF.

06

Review your income options and select how you would like to receive payments from the RRIF.

07

Sign and date the application form to confirm the information is accurate.

08

Submit the completed form to your financial institution.

Who needs REGISTERED RETIREMENT INCOME FUND (RRIF) - APPLICATION FORM?

01

Individuals approaching retirement age looking for a way to manage their retirement savings.

02

Retirees who want to convert their Registered Retirement Savings Plan (RRSP) into a vehicle that provides regular income.

03

Individuals who have reached the age of 71, as they must convert their RRSP to a RRIF or withdraw the funds.

Fill

form

: Try Risk Free

People Also Ask about

What is the minimum RRIF withdrawal after 71?

RRIF minimum withdrawal chart AgeRRIF Factors 71 5.28% 72 5.40% 73 5.53% 74 5.67%6 more rows

What are the disadvantages of RRIF?

Because RRIF withdrawals are considered taxable income, taking money out too early or more than you need could put you in a higher tax bracket and leave you with a larger tax bill. Withdrawals could also potentially reduce certain government benefits, like Old Age Security (OAS).

How do I calculate my minimum RRIF withdrawal?

You calculate this amount by multiplying the fair market value (FMV) of the property held in the RRIF at the start of the year by a prescribed factor.

What is the difference between RIF and RRIF?

What is the difference between RRIF and RIF? A RRIF (Registered Retirement Income Fund) account's purpose is to pay you a percentage of the funds in the account every year. An RIF (Retirement Income Fund) is an investment account that pays a yearly yield amount for retirement income.

How much do you have to withdraw from your RRIF each year?

The older you are, the higher the percentage that needs to be withdrawn. For example, if your RRIF is valued at $1,000,000 and you're 75, you'd need to make a minimum withdrawal of $58,200 (5.82% x 1,000,000). Whereas if you were 85, you'd need to withdraw a minimum of $85,100 (8.51% x 1,000,000).

How to set up a RRIF in Canada?

You set up a registered retirement income fund (RRIF) account through a financial institution such as a bank, credit union, trust or insurance company. Your financial institution will advise you on the types of RRIFs and the investments they can contain.

What are the disadvantages of RRIF?

Because RRIF withdrawals are considered taxable income, taking money out too early or more than you need could put you in a higher tax bracket and leave you with a larger tax bill. Withdrawals could also potentially reduce certain government benefits, like Old Age Security (OAS).

What are the withdrawal rules for a RRIF?

The older you are, the higher the percentage that needs to be withdrawn. For example, if your RRIF is valued at $1,000,000 and you're 75, you'd need to make a minimum withdrawal of $58,200 (5.82% x 1,000,000). Whereas if you were 85, you'd need to withdraw a minimum of $85,100 (8.51% x 1,000,000).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is REGISTERED RETIREMENT INCOME FUND (RRIF) - APPLICATION FORM?

The RRIF Application Form is a document used to establish a Registered Retirement Income Fund, which allows individuals to withdraw income from their retirement savings in a tax-efficient manner.

Who is required to file REGISTERED RETIREMENT INCOME FUND (RRIF) - APPLICATION FORM?

Individuals who wish to convert their Registered Retirement Savings Plans (RRSPs) into RRIFs must file the RRIF Application Form, typically upon reaching retirement age or when they wish to start drawing income.

How to fill out REGISTERED RETIREMENT INCOME FUND (RRIF) - APPLICATION FORM?

To fill out the RRIF Application Form, individuals should provide personal information, details about their previous RRSP, the selected financial institution, investment choices, and the amount of income they wish to withdraw.

What is the purpose of REGISTERED RETIREMENT INCOME FUND (RRIF) - APPLICATION FORM?

The purpose of the RRIF Application Form is to facilitate the transition from an RRSP to a RRIF by allowing individuals to formalize their choice of investment and set up a systematic withdrawal plan for retirement income.

What information must be reported on REGISTERED RETIREMENT INCOME FUND (RRIF) - APPLICATION FORM?

The RRIF Application Form requires information such as the account holder's name, address, social insurance number, details of the RRSP being converted, investment preferences, and the chosen withdrawal schedule.

Fill out your registered retirement income fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Registered Retirement Income Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.