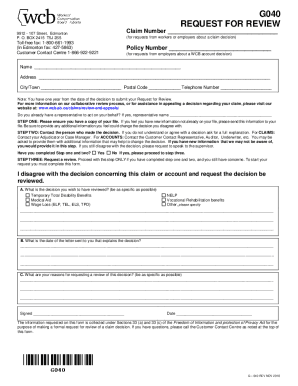

Canada G-040 2011 free printable template

Get, Create, Make and Sign Canada G-040

Editing Canada G-040 online

Uncompromising security for your PDF editing and eSignature needs

Canada G-040 Form Versions

How to fill out Canada G-040

How to fill out Canada G-040

Who needs Canada G-040?

Instructions and Help about Canada G-040

The WEB vision is to eliminate injuries and restore abilities in the event that we are unable to prevent an injury from occurring we work towards reducing the impact of that entry on workers employers the workers' family is involved and any impacted stakeholders and now for the second time I will give it over to Tara all right testing we're good okay so thanks Pam my name is Tara I am a team leader as well, and I'm just going to talk about a couple different topics here the goal of effective claim handling so first and foremost we as WEB would like to prevent injuries from happening and unfortunately sometimes that's something we can't do and an injury does occur in this situation we want to make sure that we're minimizing the impact to the worker but also to the employer any dependents anyone who's involved in the work accident there's more than just one person who is impacted by a work injury so in order for us to minimize the impact it involves the help from everyone the employer the worker the care providers making sure that we can talk about a return to work plan so one way we want to do that is restoring function to the worker so when an injury does occur the worker is injured we want to try and minimize that impact have them return to work to their full abilities sometimes that doesn't happen though, and we do have to talk about accommodated duties and would work with a worker to restore their abilities to the best of their function allows them so this ties into the next slide which is the recovery and return to work so with recovery and return to work partnership we work with the injured worker we work with the employer the care providers as well as a vast majority of staff at WEB, so our intent is to communicate with the employer the worker in the health care provider to come up with a return to work program and to allow that worker to reintegrate themselves into the workforce so during the claim process there are a few key things that we do look at and that you should be aware of so at this time I'm actually going to hand it back over to Pam, and she's going to talk about some of these key processes when we talk about the key steps in the WEB process at a high level we're really outlining what each of us needs to do this includes the injured worker the employer the health care provider and of course the WEB the first step is to report an injury to the WEB and provide the details or information about the injury the WEB would then review the information and make a decision which allows us to move towards return to work planning and administering benefits however we also recognize that even before an injury happens you as an employer have steps that you can take so that if an injury occurs both you as the employer and your employees know what the next steps are this may include developing a return to work program and process and then educating your staff so that everyone is familiar with the steps and their responsibilities so if an...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my Canada G-040 in Gmail?

How do I make changes in Canada G-040?

Can I create an electronic signature for the Canada G-040 in Chrome?

What is Canada G-040?

Who is required to file Canada G-040?

How to fill out Canada G-040?

What is the purpose of Canada G-040?

What information must be reported on Canada G-040?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.