Get the free Form 1701

Show details

This document provides guidelines for public schools in completing Form 1701, which collects essential student data for funding and reporting purposes within the education system.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 1701

Edit your form 1701 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1701 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 1701 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 1701. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

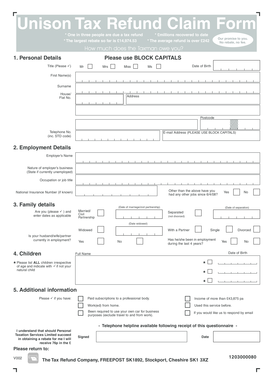

How to fill out form 1701

How to fill out Form 1701

01

Obtain a copy of Form 1701 from the official website or authorized office.

02

Fill out your personal information in the designated sections, including your tax identification number and contact information.

03

Declare your income for the applicable tax year, providing details about sources of income.

04

List any allowable deductions and exemptions relevant to your situation.

05

Calculate your total tax due based on the provided guidelines.

06

Review the form for accuracy and completeness.

07

Sign and date the form in the provided area.

08

Submit the completed form to the appropriate tax authority by the deadline.

Who needs Form 1701?

01

Individuals who are self-employed or professionals required to file income tax returns.

02

Businesses registered under certain tax regimes needing to report their income and expenses.

Fill

form

: Try Risk Free

People Also Ask about

What is business tax return form?

C corporations file Form 1120, U.S. Corporation Income Tax Return, which is a separate tax return solely for the business. S corporations and LLCs taxed as S corporations file Form 1120-S, U.S. Income Tax Return for an S corporation. Like partnerships, S corps pass income and losses to their shareholders.

What is the difference between 1701 and 1701A?

A Special Set of Criteria for 1701A Those who availed of the 8% flat income tax rate whose sales/receipts and other non-operating income do not exceed P3 million. You cannot file both forms since if you are earning a regular salary outside of being self-employed, you are then required to file form 1701 and not 1701A.

What is the meaning of 1701?

BIR Form 1701, also known as the Annual Income Tax Return for Self-Employed Individuals, Mixed Income Earners, Estates, and Trusts, is a tax form that summarizes all the transactions made over the tax calendar year.

Who is qualified to get ITR in the Philippines?

Citizens or foreigners residing in the Philippines and receiving income inside or outside the country must file an ITR. Companies usually file their employees' ITRs, while freelancers and business owners do it themselves. In 2021, there were about 26.8 million individual 26.8 million individual taxpayers.

What is the 1701 form?

Description. BIR Form No. 1701 shall be filed by individuals who are engaged in trade/business or the practice of profession including those with mixed income (i.e., those engaged in the trade/business or profession who are also earning compensation income) in ance with Sec. 51 of the Code, as amended.

What is the meaning of 1701?

BIR Form 1701, also known as the Annual Income Tax Return for Self-Employed Individuals, Mixed Income Earners, Estates, and Trusts, is a tax form that summarizes all the transactions made over the tax calendar year.

Who is required to file 1701A?

Who needs to file? The return shall be filed by individuals earning income PURELY from trade/business or from the practice of profession, to wit: 1. A resident citizen (within and without the Philippines);

What is the difference between 1700 and 1701?

Depending on your income type and situation, you may need BIR Form 1701, 1701A, or 1700 as an Individual taxpayer. Form 1701A can be used if you are receiving income from your profession or business. Form 1700 can be used for individuals who are earning based on employment income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 1701?

Form 1701 is a tax return form used in the Philippines for individual taxpayers engaged in business or profession, providing a summary of income and expenses to determine taxable income.

Who is required to file Form 1701?

Individuals earning income from business or profession, including self-employed individuals and freelancers, are required to file Form 1701.

How to fill out Form 1701?

To fill out Form 1701, taxpayers need to provide their personal information, detail their income from business or profession, list allowable deductions, and compute taxable income, including any additional required sections for specific circumstances.

What is the purpose of Form 1701?

The purpose of Form 1701 is to facilitate the reporting of income and deductions for income tax purposes, ensuring compliance with tax laws and enabling the Bureau of Internal Revenue to assess the correct tax liability of individual taxpayers.

What information must be reported on Form 1701?

Form 1701 requires taxpayers to report personal details, gross income earned from business or profession, deductible expenses, net income, and any applicable tax credits or payments made.

Fill out your form 1701 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1701 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.