Get the free SCHEDULE “B”

Show details

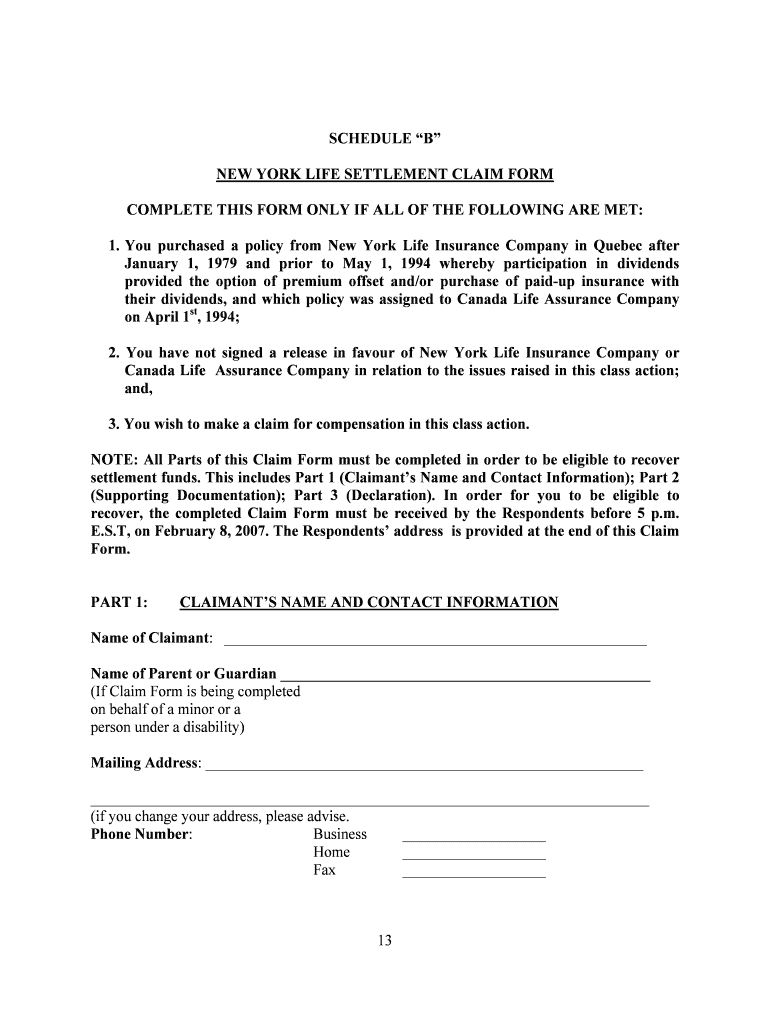

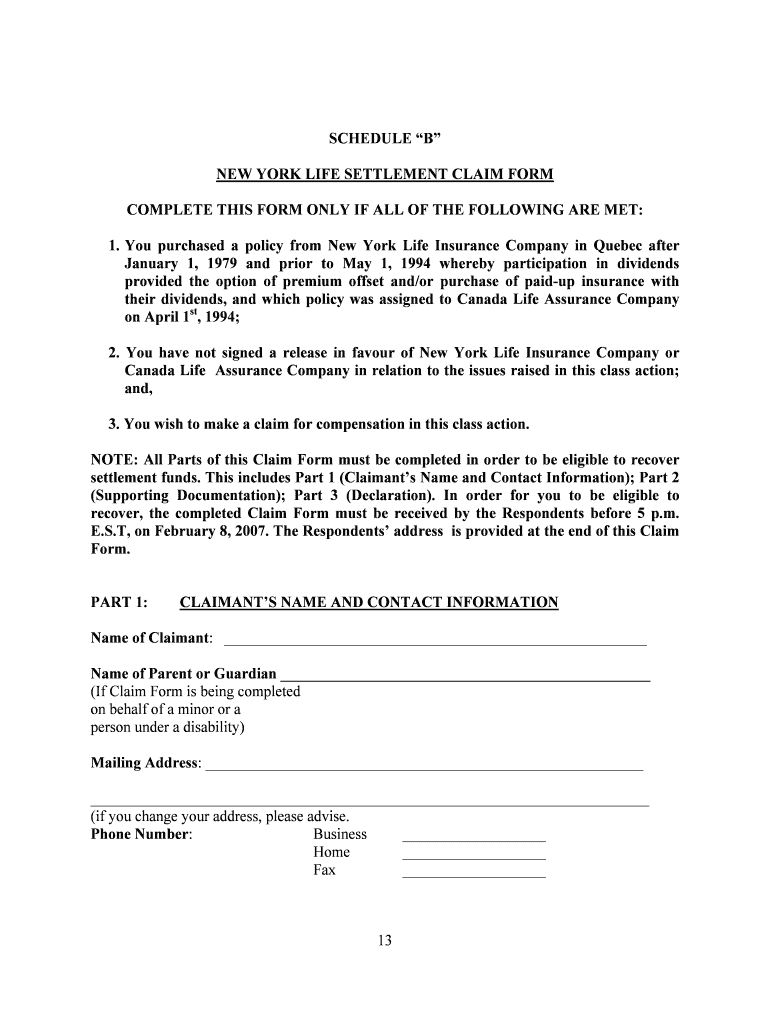

This form is for claimants who purchased a policy from New York Life Insurance Company and wish to claim compensation in a class action related to their policies. It outlines the necessary conditions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule b

Edit your schedule b form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule b form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit schedule b online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit schedule b. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule b

How to fill out SCHEDULE “B”

01

Begin by obtaining a copy of SCHEDULE 'B' from the relevant authority or website.

02

Fill in your personal details at the top of the form, including your name, address, and contact information.

03

Identify the specific sections that apply to your situation and read the instructions carefully.

04

Input the required information accurately in each designated box or field.

05

Review your entries for any errors or omissions before moving to the next step.

06

If necessary, collect any accompanying documents or evidence that may be required to support your entries.

07

Sign and date the form at the bottom where indicated to certify that the information provided is true and correct.

08

Submit the completed SCHEDULE 'B' according to the provided instructions, either online or by mail as applicable.

Who needs SCHEDULE “B”?

01

SCHEDULE 'B' is needed by individuals or entities who are required to provide additional information for their tax filings or regulatory submissions.

02

Specifically, it may be required for taxpayers claiming specific deductions, credits, or other adjustments.

03

Companies or organizations that need to report financial data or compliance with specific regulations may also need to fill out SCHEDULE 'B'.

Fill

form

: Try Risk Free

People Also Ask about

What is a schedule B for?

Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

Which employers must use Schedule B?

Schedule B is specifically required for employers who are classified as semiweekly schedule depositors. You must file Schedule B if you: Reported more than $50,000 of employment taxes in the lookback period, OR. Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year.

What is a schedule B in a contract?

Schedule B contains the details of the contractor's general and administrative expenses.

What is Schedule B in Canada?

This schedule is used by non-residents of Canada to calculate their allowable amount of federal and provincial or territorial non-refundable tax credits when they file an income tax and benefit return for non-residents and deemed residents of Canada.

What happens if you don't file Schedule B?

Failing to file Schedule B or report foreign accounts can lead to IRS scrutiny and penalties. To avoid costly mistakes, taxpayers should review filing requirements, ensure they file an FBAR if required, and consult a tax professional if unsure. Complete Schedule B correctly to remain in compliance with U.S. tax laws.

What does schedule B mean?

Taxpayers who earn more than $1,500 of taxable interest or ordinary dividends during the year need to file Schedule B with their tax return. To file Schedule B, you need the name of each person or entity that paid you taxable interest or ordinary dividends, as well as the amount you received.

What does schedule B stand for?

Schedule B reports the interest and dividend income you receive during the tax year. However, you don't need to attach a Schedule B every year you earn interest or dividends. It is only required when the total exceeds certain thresholds.

What happens if you don't file Schedule B?

Failing to file Schedule B or report foreign accounts can lead to IRS scrutiny and penalties. To avoid costly mistakes, taxpayers should review filing requirements, ensure they file an FBAR if required, and consult a tax professional if unsure. Complete Schedule B correctly to remain in compliance with U.S. tax laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SCHEDULE “B”?

SCHEDULE 'B' is a form used to report additional information related to specific tax obligations, often associated with income earned from certain sources or investments.

Who is required to file SCHEDULE “B”?

Individuals who have received taxable interest or ordinary dividends that exceed a certain threshold are required to file SCHEDULE 'B'. Additionally, any taxpayer who has foreign accounts or who has invested in specific financial products may need to complete this schedule.

How to fill out SCHEDULE “B”?

To fill out SCHEDULE 'B', taxpayers must provide their name and Social Security number, and list all sources of interest and ordinary dividends. Each source must be detailed along with the corresponding amount earned. If applicable, taxpayers must also disclose information regarding foreign accounts.

What is the purpose of SCHEDULE “B”?

The purpose of SCHEDULE 'B' is to ensure that taxpayers accurately report their income from interest and dividends, and to provide the IRS with information about foreign bank accounts, which helps in compliance monitoring.

What information must be reported on SCHEDULE “B”?

SCHEDULE 'B' requires reporting the names of financial institutions or sources of income, the dollar amounts of interest and dividends earned, along with details on foreign accounts if applicable.

Fill out your schedule b online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule B is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.