Get the free FORM 2 - SPOUSE’S WAIVER OF ENTITLEMENT UNDER A PENSION PLAN, AN RRSP, A LIFE ANNUIT...

Show details

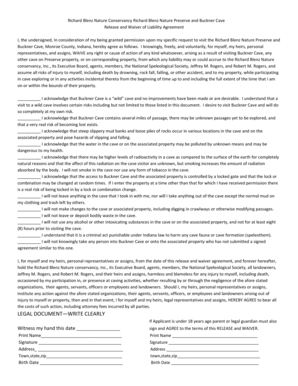

This document serves as a waiver form for a spouse's entitlement to a minimum 60% joint and survivor pension under the Pension Benefits Standards Act in British Columbia.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 2 - spouses

Edit your form 2 - spouses form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 2 - spouses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 2 - spouses online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 2 - spouses. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 2 - spouses

How to fill out FORM 2 - SPOUSE’S WAIVER OF ENTITLEMENT UNDER A PENSION PLAN, AN RRSP, A LIFE ANNUITY OR A LIF CONTRACT

01

Obtain FORM 2 from the appropriate authority or website.

02

Read the instructions carefully to understand the requirements.

03

Fill in the personal information at the top of the form (names, addresses, etc.).

04

Indicate the name of the pension plan, RRSP, life annuity, or LIF contract from which the entitlement is being waived.

05

Clearly state your intention to waive entitlement and provide a signed declaration.

06

Ensure both parties (spouse and plan member) sign the form where required.

07

Double-check all entered information for accuracy.

08

Submit the completed form to the relevant pension plan administrator or financial institution.

Who needs FORM 2 - SPOUSE’S WAIVER OF ENTITLEMENT UNDER A PENSION PLAN, AN RRSP, A LIFE ANNUITY OR A LIF CONTRACT?

01

Spouses or common-law partners of individuals who have a pension plan, RRSP, life annuity, or LIF contract.

02

Individuals who wish to waive their entitlement to benefits under their spouse's pension plan.

03

Those involved in a separation or divorce where waiver of benefits is necessary.

Fill

form

: Try Risk Free

People Also Ask about

What is a spousal waiver form used for?

A Member's spouse uses the Spousal Waiver Form to waive his/her legal right to pension benefits after the Member's death. If the Member wishes to select a form of pension that doesn't provide income to his spouse after the Member dies, then the spouse must complete this form prior to the Member's retirement.

What is the waiver of joint and survivor pension?

By signing the waiver, your spouse is agreeing to give up or reduce their right to your pension benefit when you die.

Why is a spousal waiver required?

If, and to the extent, you have waived the QPSA (with your spouse's consent), your account will be paid to your designated nonspouse beneficiary. To waive the QPSA, you must complete the Beneficiary Designation form attached.

What happens if I waive QPSA?

Payments start at 71.5% of your spouse's benefit and increase the longer you wait to apply. For example, you might get: Over 75% at age 61. Over 80% at age 63.

What is the spousal waiver of joint and survivor pension?

If your spouse waives all beneficiary rights, it means that after you (the plan member) die, they will not receive any pension payments. You can then name someone else as your beneficiary to receive the death benefit when you die.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM 2 - SPOUSE’S WAIVER OF ENTITLEMENT UNDER A PENSION PLAN, AN RRSP, A LIFE ANNUITY OR A LIF CONTRACT?

FORM 2 is a legal document that allows a spouse to waive their entitlement to benefits under a pension plan, a Registered Retirement Savings Plan (RRSP), a life annuity, or a Life Income Fund (LIF) contract.

Who is required to file FORM 2 - SPOUSE’S WAIVER OF ENTITLEMENT UNDER A PENSION PLAN, AN RRSP, A LIFE ANNUITY OR A LIF CONTRACT?

It is typically required to be filed by the spouse of a plan member who wishes to waive their entitlement to the benefits provided by the pension plan, RRSP, life annuity, or LIF contract.

How to fill out FORM 2 - SPOUSE’S WAIVER OF ENTITLEMENT UNDER A PENSION PLAN, AN RRSP, A LIFE ANNUITY OR A LIF CONTRACT?

To fill out FORM 2, the spouse must provide personal information, including their name and relationship to the plan member, indicate their understanding of the waiver, and sign the form to confirm their consent.

What is the purpose of FORM 2 - SPOUSE’S WAIVER OF ENTITLEMENT UNDER A PENSION PLAN, AN RRSP, A LIFE ANNUITY OR A LIF CONTRACT?

The purpose of FORM 2 is to formally document a spouse's decision to waive their rights to future benefits under a specified financial plan, allowing the plan member to manage those benefits according to their wishes.

What information must be reported on FORM 2 - SPOUSE’S WAIVER OF ENTITLEMENT UNDER A PENSION PLAN, AN RRSP, A LIFE ANNUITY OR A LIF CONTRACT?

The form must report details such as the names of both the spouse and the plan member, the type of plan being waived, and any relevant dates, as well as the spouse's signature indicating their consent to waive.

Fill out your form 2 - spouses online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 2 - Spouses is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.