Get the free Tax Exemption for Non-Profit Organizations Renewal Form 2005-2006 - halifax

Show details

This document serves as a renewal application for tax exemption status for non-profit organizations in Nova Scotia, requiring specific information and documentation to be submitted by a deadline.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax exemption for non-profit

Edit your tax exemption for non-profit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax exemption for non-profit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax exemption for non-profit online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax exemption for non-profit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax exemption for non-profit

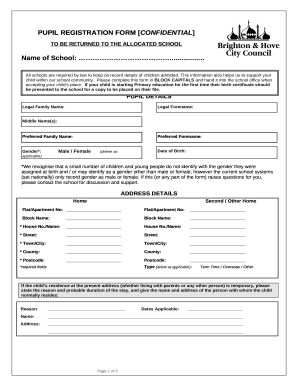

How to fill out Tax Exemption for Non-Profit Organizations Renewal Form 2005-2006

01

Obtain the Tax Exemption for Non-Profit Organizations Renewal Form 2005-2006 from the relevant government website or office.

02

Fill in the organization’s name, address, and contact information accurately.

03

Provide the organization's federal tax identification number (EIN) in the designated field.

04

Indicate the type of non-profit organization (e.g., 501(c)(3), 501(c)(4), etc.) as applicable.

05

Attach any required documentation that supports the organization's non-profit status.

06

Review the completed form for accuracy and completeness to ensure all necessary information is included.

07

Sign and date the form, ensuring the signature is from an authorized individual within the organization.

08

Submit the completed form by the deadline specified to the relevant tax authority, either electronically or via mail.

Who needs Tax Exemption for Non-Profit Organizations Renewal Form 2005-2006?

01

Non-profit organizations seeking to maintain their tax-exempt status for the fiscal year 2005-2006.

02

Organizations that are required to renew their tax exemption status as per state or federal regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a copy of my 501c3 tax-exempt form?

The request should be submitted using Form 4506-A, or in a letter containing the name and employer identification number of the organization along with the name, address, and phone number of the requester. Securing a copy of the original determination letter to send to you may take up to 60 days or longer.

How do I request a copy of exempt or political organization IRS form?

Use Form 4506-A, Request for a copy of Exempt or Political Organization IRS Form. Application for exemption (Most recent Forms 1023, 1023-EZ, 1024, 1024-A, etc. and associated documents such as Articles of Incorporation, Bylaws, etc.)

What is the IRS exemption form for non-profit organizations?

You may be eligible to file Form 1023-EZ, a streamlined version of the application for recognition of tax exemption.

How do I prove I am a 501c3?

Any of the following is acceptable evidence of nonprofit status: (a) a reference to the applicant organization's listing in the Internal Revenue Service's (IRS) most recent list of tax-exempt organizations described in section 501(c)(3) of the IRS Code; (b) a copy of a currently valid IRS tax exemption certificate; (c)

How do I get a tax exemption certificate?

Generally, to obtain a sales tax exemption certificate, an exempt institution must first have a valid sales tax account. That account number is put on a form certificate issued by that state and the certificate can be used to purchase goods tax-free.

Is a tax-exempt form the same as a 501c3 form?

501(c)(3) means a nonprofit organization that has been recognized by the IRS as being tax-exempt by virtue of its charitable programs. Tax-exemption is the result of a nonprofit organization being recognized by the IRS as being organized for any purpose allowable under 501(c)(3) – 501(c)(27).

How do I find my 501c3 filings?

The IRS website is one of the most comprehensive sources for nonprofit tax returns. The Tax Exempt Organization Search is an IRS 501(c)(3) search tool where you can search by nonprofit tax ID, name, or location to find: Form 990 series returns. Publication 78 data.

Is a tax-exempt form the same as a 501c3?

501(c)(3) means a nonprofit organization that has been recognized by the IRS as being tax-exempt by virtue of its charitable programs. Tax-exemption is the result of a nonprofit organization being recognized by the IRS as being organized for any purpose allowable under 501(c)(3) – 501(c)(27).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Exemption for Non-Profit Organizations Renewal Form 2005-2006?

The Tax Exemption for Non-Profit Organizations Renewal Form 2005-2006 is a document that non-profit organizations must submit to renew their tax-exempt status and ensure compliance with existing tax laws.

Who is required to file Tax Exemption for Non-Profit Organizations Renewal Form 2005-2006?

Non-profit organizations that wish to maintain their tax-exempt status under applicable local, state, or federal laws must file the Tax Exemption for Non-Profit Organizations Renewal Form 2005-2006.

How to fill out Tax Exemption for Non-Profit Organizations Renewal Form 2005-2006?

To fill out the form, organizations must provide accurate information regarding their mission, activities, financial status, and compliance with tax regulations. Each section of the form must be completed as instructed, and any required supporting documents should be attached.

What is the purpose of Tax Exemption for Non-Profit Organizations Renewal Form 2005-2006?

The purpose of the form is to verify that the organization still meets the criteria for tax-exempt status and to allow the tax authorities to assess compliance with tax laws, thereby ensuring that non-profits continue to operate within their legal obligations.

What information must be reported on Tax Exemption for Non-Profit Organizations Renewal Form 2005-2006?

Organizations must report information such as their legal name, address, mission statement, details of activities, financial statements, and changes in organizational structure or leadership since the last registration.

Fill out your tax exemption for non-profit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Exemption For Non-Profit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.