Canada Certificate of Insurance - Toronto City 2005 free printable template

Show details

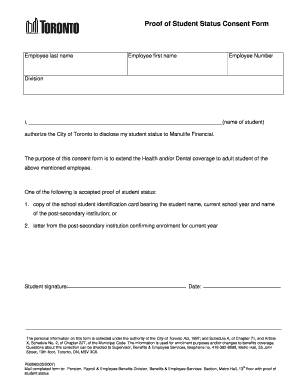

CERTIFICATE OF INSURANCE to be completed by the Insurer or its authorized representative Name of Insured Telephone No. Address of Insured Postal Code Operations of the named insured for which this Certificate is issued COMMERCIAL GENERAL LIABILITY minimum limit to be evidenced - 2 000 000. 00 per occurrence Policy No. / Insuring Co. Effective Date Expiry Date dd/mm/yy Coverage per occurrence dd/mm/yy PROVISIONS OF AMENDMENTS OR ENDORSEMENTS OF LISTED POLICY IES Commercial General Liability is...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada Certificate of Insurance - Toronto City

Edit your Canada Certificate of Insurance - Toronto City form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada Certificate of Insurance - Toronto City form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada Certificate of Insurance - Toronto City online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada Certificate of Insurance - Toronto City. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada Certificate of Insurance - Toronto City Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada Certificate of Insurance - Toronto City

How to fill out Canada Certificate of Insurance - Toronto City

01

Obtain the official Canada Certificate of Insurance form.

02

Fill in the name and address of the insured.

03

Provide the coverage details, including liability limits and types of insurance.

04

Enter the policy number and effective dates of coverage.

05

Include the insurance provider's name and contact information.

06

Ensure the document is signed by an authorized representative of the insurance company.

07

Include any additional endorsements or documents required by the Toronto City regulations.

08

Submit the completed Certificate of Insurance to the appropriate city department.

Who needs Canada Certificate of Insurance - Toronto City?

01

Individuals or businesses applying for permits in Toronto City that require proof of insurance.

02

Contractors working on city projects that mandate liability insurance.

03

Event organizers seeking permission to hold events in public spaces.

Fill

form

: Try Risk Free

People Also Ask about

How can I get proof of insurance certificate?

How To Get a Certificate of Insurance. If your client requests a COI, you can get one from your insurance company. Some states may also let businesses use an electronic version or insurance ID cards to prove they have insurance. It's a good idea to make sure you know what's acceptable in your state.

How do I download an existing insurance copy?

How to Get Insurance Copy Online? Visit the official website of the insurer from where you purchased your car insurance. Login to your account by entering the requested details, such as your policy number, name, phone number, etc. After logging in, go to the option of downloading the motor policy document.

How to get insurance copy online?

How to Get Insurance Copy Online? Visit the official website of the insurer from where you purchased your car insurance. Login to your account by entering the requested details, such as your policy number, name, phone number, etc. After logging in, go to the option of downloading the motor policy document.

What is a valid certificate of insurance?

A certificate of insurance (COI) is a document that proves the existence of an insurance policy. A COI describes the policy's key features and conditions, and is supplied by your broker or insurance company.

How do I download an insurance policy?

How do I Download an Insurance Copy? The insurance copy can be downloaded from the online portal or dialing the toll free number 1800-123-4003. Also the insurance policy can be downloaded from the website of the insurance company by entering the basic details related to the insurance policy.

What is a proof of insurance letter called?

It may also be called a contract, evidence of coverage, or summary plan description (SPD). You can call your insurance customer service department at any point during your coverage and ask for a written copy of your certificate of coverage. This should be provided free of charge.

What is the purpose of a certificate of insurance?

A COI is a statement of coverage issued by the company that insures your business. Usually no more than one page, a COI provides a summary of your business coverage. It serves as verification that your business is indeed insured. Potential clients may request a COI as a condition of doing business with you.

When should I ask for a certificate of insurance?

When Should I Get a Certificate of Insurance? You should ask for and receive a COI before anyone works on your home or property. If you have a written contract, it should contain insurance requirements, including coverage and limits required that are verified with a COI.

Why do we need insurance certificate?

Need for Insurance Insurance plans are beneficial to anyone looking to protect their family, assets/property and themselves from financial risk/losses: Insurance plans will help you pay for medical emergencies, hospitalisation, contraction of any illnesses and treatment, and medical care required in the future.

What does a certificate of insurance include?

The COI verifies the existence of an insurance policy and summarizes the key aspects and conditions of the policy. For example, a standard COI lists the policyholder's name, policy effective date, the type of coverage, policy limits, and other important details of the policy.

Why would a customer need a certificate of insurance?

Certificates of insurance (COIs) are documents containing all the essential details of an insurance policy in an easily digestible, standardized format. A COI is intended to prove a policy's status, provide quick access to its coverage details, reduce risk exposure, and protect against third-party liability.

What is the purpose of a certificate of coverage?

If a Social Security agreement assigns coverage of the employee's work to the United States, the Social Security Administration issues a U.S. Certificate of Coverage. The certificate serves as proof that the employee and employer are exempt from the payment of Social Security taxes to the foreign country.

What is certificate of insurance in insurance?

A Certificate of Insurance is a proof of valid insurance policy and is compulsory as per the Motor Vehicles Act.

What is a certificate of insurance in Canada?

A certificate of insurance (COI) is a document issued by an insurance company/broker to verify the existence of insurance coverage under specific conditions granted to listed individuals.

How do I get an insurance certificate in Ontario?

In order to be certified and qualify for a potential insurance discount you must complete the Basic Beginner Driver Education Program: 20 Hours In-Class, pass the final test in the classroom and complete the home-link activities in the workbook. Moreover, complete 10 hours In-Car Training with a final score of 80%.

What is a Certificate of insurance Ontario?

This Certificate is proof of a contract of insurance between the Named Insured and the Insurer, subject in all respects to the Ontario Automobile Policy (OAP 1). In return for the premium charged and the statements contained in the Application, the contract provides the coverage outlined in this Certificate.

Should I ask for a certificate of insurance?

When Should I Obtain a Certificate of Insurance? Whenever you hire a contractor or book someone you've worked with in the past, you should get COIs for all relevant insurance policies as soon as possible—preferably before they do any work. You may also need to obtain a COI if you lease property or equipment.

Why do customers ask for certificate of insurance?

Your customer wants to ensure you have proper insurance coverage to protect against certain financial risks associated with the work. The certificate of insurance states the policy or policies you carry so your customer can see if you have sufficient coverage. If you don't, they may request that you get it.

How do you find certificate of insurance?

You can get a certificate of insurance from your insurance company or broker (if you used a broker). Typically the certificate of insurance would be emailed to you, or be available on your insurance provider's website via the customer portal (if they have one).

Why does a customer request a COI?

A certificate of insurance is often requested in the case of a project or job in which liability concerns and the possibility of great financial losses are very real. In such a case, your client or partner will request a COI from you to prove that certain liabilities will be covered by your insurance program.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada Certificate of Insurance - Toronto City for eSignature?

Once your Canada Certificate of Insurance - Toronto City is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I edit Canada Certificate of Insurance - Toronto City on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign Canada Certificate of Insurance - Toronto City. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I fill out Canada Certificate of Insurance - Toronto City on an Android device?

Use the pdfFiller mobile app and complete your Canada Certificate of Insurance - Toronto City and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is Canada Certificate of Insurance - Toronto City?

The Canada Certificate of Insurance - Toronto City is a document that verifies the insurance coverage of an individual or entity, specifically within the jurisdiction of Toronto, Canada.

Who is required to file Canada Certificate of Insurance - Toronto City?

Individuals or businesses that are required to demonstrate proof of insurance coverage for various permits, licenses, or contracts in Toronto are obligated to file the Canada Certificate of Insurance.

How to fill out Canada Certificate of Insurance - Toronto City?

To fill out the Canada Certificate of Insurance - Toronto City, you need to provide accurate information about the insured party, the insurance provider, the coverage limits, and any relevant policy numbers, ensuring that all sections are completed as specified by the city’s requirements.

What is the purpose of Canada Certificate of Insurance - Toronto City?

The purpose of the Canada Certificate of Insurance - Toronto City is to provide proof of insurance coverage to protect against liabilities, ensuring compliance with local regulations and safeguarding the city from potential financial losses.

What information must be reported on Canada Certificate of Insurance - Toronto City?

The information that must be reported on the Canada Certificate of Insurance - Toronto City includes the name of the insured, the insurance provider, policy numbers, types of coverage (e.g., general liability, property), coverage limits, and the effective date of the policy.

Fill out your Canada Certificate of Insurance - Toronto City online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada Certificate Of Insurance - Toronto City is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.