Get the free FORM F - albertacourts ab

Show details

This document outlines the procedures and required pleadings for a board hearing appealed from Queen's Bench, including referenced dates and final documents.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form f - albertacourts

Edit your form f - albertacourts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form f - albertacourts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form f - albertacourts online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form f - albertacourts. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

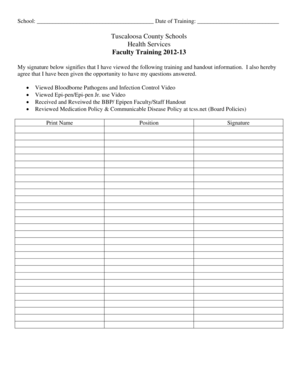

How to fill out form f - albertacourts

How to fill out FORM F

01

Obtain FORM F from the appropriate authority or website.

02

Read the instructions carefully before starting to fill out the form.

03

Enter your personal details in the designated sections (name, address, contact information).

04

Provide any required identification information, such as social security number or ID number.

05

Fill out the relevant sections pertaining to the purpose of the form.

06

Review all information for accuracy and completeness before submission.

07

Sign and date the form where indicated.

08

Submit the completed form according to the instructions provided, either online or by mail.

Who needs FORM F?

01

Individuals who are applying for a specific service or benefit that requires FORM F.

02

Organizations or entities that need to report certain data or compliance information.

03

Anyone required by law or regulation to submit FORM F for verification or registration purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is a form F filing?

A Form F filing is an endorsement to your policy that conforms it to each state's financial responsibility laws.

What is a Form F?

A Form F filing is an endorsement to your policy that conforms it to each state's financial responsibility laws.

What is IRS form F?

Profit or Loss From Farming. Use Schedule F (Form 1040) to report farm income and expenses. File it with Form 1040, 1040-SR, 1040-SS, 1040-NR, 1041, or 1065. Your farming activity may subject you to state and local taxes and other require- ments such as business licenses and fees.

What to write in Form f?

Sole proprietor farming businesses use IRS Schedule F, Profit or Loss from Farming to report income and expenses of the farming business. • Schedule F can be used by partnerships, Corporations, Trusts and Estates to report farming activities.

What is a Form F filing?

Statement Name of employee in full. Sex. Religion. Whether unmarried/ married/ widow/ widower. Department/ Branch/ Section where employed. Post held with Ticket or Serial No., if any. Date of appointment. Permanent address.

What is the purpose of form f?

Form F is a mandatory register that employers must maintain ing to labor laws. It records leave with wages for employees. It includes Earned Leave and Sick Leave sections. The register must be preserved for three years and presented to inspectors upon request.

What is a form F washer?

Form F washers are similar to the standard form A standard flat washer, but have a slightly larger outside diameter. The dimensions for these washers can be found here. Galvanised coatings prevent oxidation of the protected metal to create a longer lasting finish.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM F?

FORM F is a regulatory document used for reporting foreign exchange transactions and investments made by residents in overseas markets.

Who is required to file FORM F?

Residents who engage in foreign investments or make payments for foreign services are required to file FORM F.

How to fill out FORM F?

FORM F should be filled out with accurate details about the transaction, including the nature of the investment, amount invested, and relevant parties involved.

What is the purpose of FORM F?

The purpose of FORM F is to monitor and regulate foreign exchange outflows and to ensure compliance with governmental policies regarding foreign investments.

What information must be reported on FORM F?

The FORM F must report information such as the nature of the transaction, amount, currency used, the entity involved in the transaction, and purpose of the investment.

Fill out your form f - albertacourts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form F - Albertacourts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.