Get the free Application for Refund under the Ontario Tax Exemption for Commercialization - fin g...

Show details

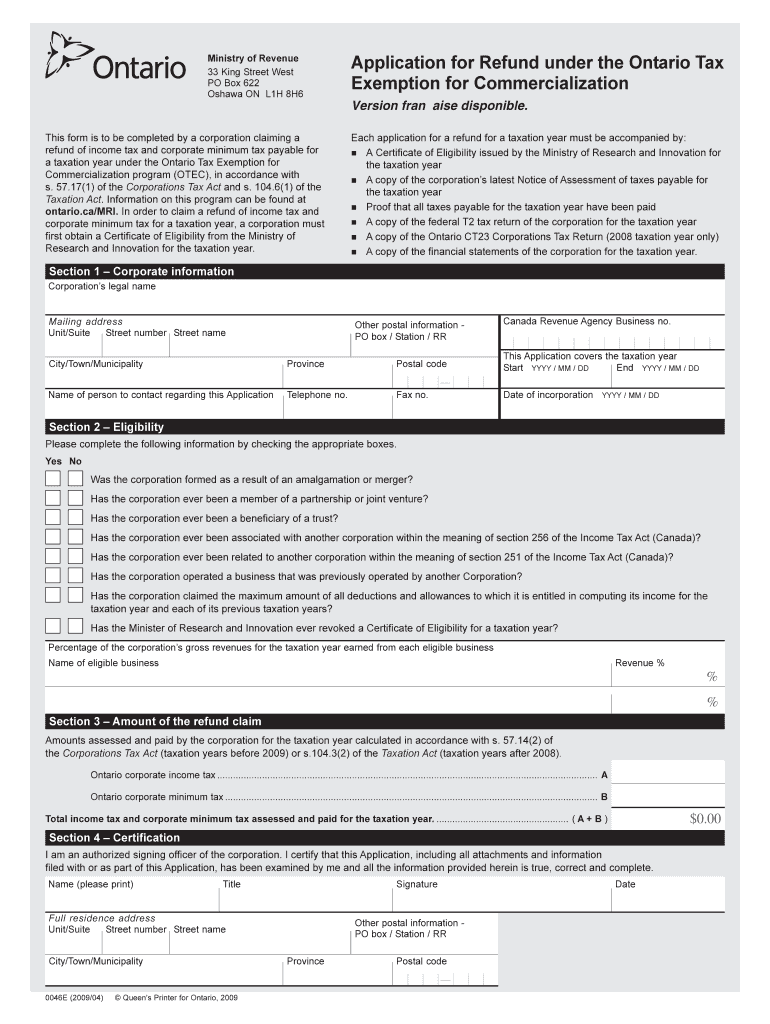

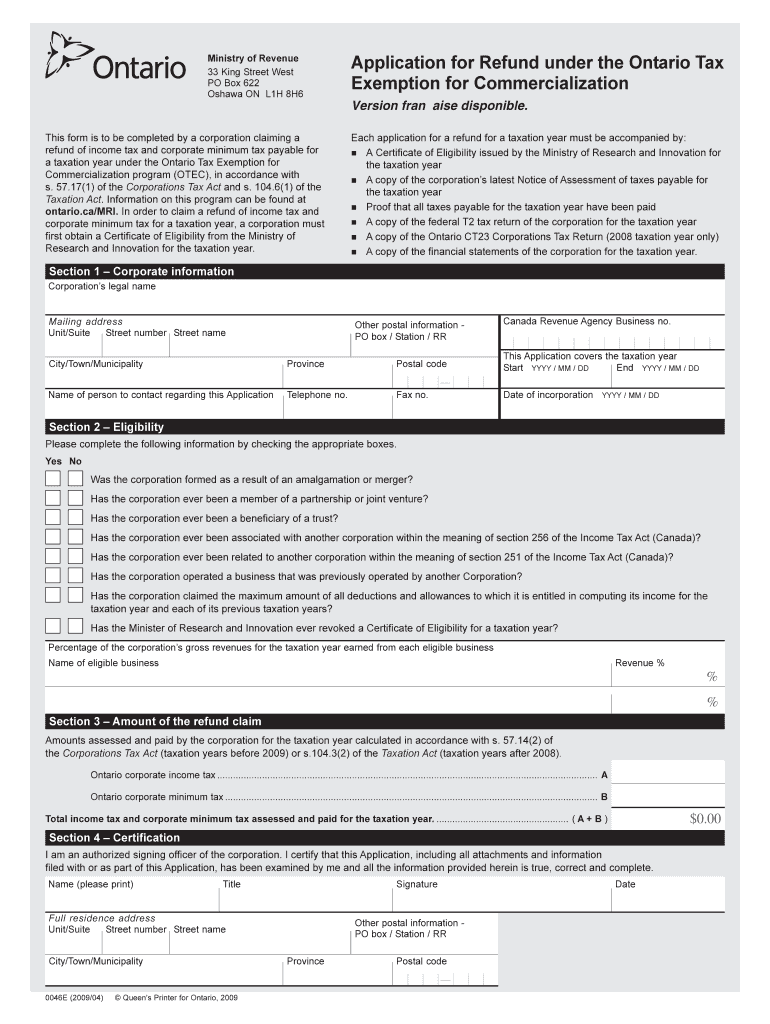

This form is to be completed by a corporation claiming a refund of income tax and corporate minimum tax payable for a taxation year under the Ontario Tax Exemption for Commercialization program (OTEC).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for refund under

Edit your application for refund under form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for refund under form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for refund under online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for refund under. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for refund under

How to fill out Application for Refund under the Ontario Tax Exemption for Commercialization

01

Obtain the Application for Refund form from the Ontario Ministry of Finance website.

02

Fill out the applicant's information including name, address, and contact details.

03

Provide a detailed description of the goods or services for which the refund is requested.

04

Include the relevant tax exemption eligibility criteria you meet.

05

Attach copies of all supporting documentation, such as invoices and proof of payment.

06

Confirm that you have not claimed the same tax exemption elsewhere.

07

Sign and date the application form.

08

Submit the completed application to the designated office as indicated in the form instructions.

Who needs Application for Refund under the Ontario Tax Exemption for Commercialization?

01

Businesses and individuals who have paid sales tax on goods and services that are eligible for tax exemption under the Ontario Tax Exemption for Commercialization.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax exemption in Ontario?

In Ontario, certain products and services are exempt from the 13% Harmonized Sales Tax (HST). This section will discuss the general exemptions, which include basic groceries, prescription drugs, medical devices, books, children's goods, feminine hygiene products, and agricultural products.

What is the meaning of exemption in income tax?

A tax exemption is the right to have some or all of one's income exempt from country's taxation. The majority of taxpayers are eligible for a number of exemptions that can be used to lower their taxable income, while some people and organisations are fully free from paying taxes.

How do I get a tax exemption certificate in USA?

Generally, to obtain a sales tax exemption certificate, an exempt institution must first have a valid sales tax account. That account number is put on a form certificate issued by that state and the certificate can be used to purchase goods tax-free.

What does it mean to claim tax exemption?

An exemption is a dollar amount that can be deducted from an individual's total income, thereby reducing. the taxable income. Taxpayers may be able to claim two kinds of exemptions: • Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse)

Do you get a refund if you exempt?

When you file exempt with your employer for federal tax withholding, you do not make any tax payments during the year. Without paying tax, you do not qualify for a tax refund unless you qualify to claim a refundable tax credit, like the Earned Income Tax Credit.

Who qualifies for Ontario tax reduction?

If you were a resident of Canada at the beginning of the year and a resident of Ontario on December 31, 2024, you may be able to claim an Ontario tax reduction. Only one person can claim the reduction for a dependent child born in 2006 or later (line 75) or a dependant with a mental or physical impairment (line 76).

Is a tax exemption a refund?

When you file exempt with your employer for federal tax withholding, you do not make any tax payments during the year. Without paying tax, you do not qualify for a tax refund unless you qualify to claim a refundable tax credit, like the Earned Income Tax Credit.

Does tax deduction mean refund?

A tax deduction is a benefit that reduces your adjusted gross income (income minus certain adjustments), lowering your tax and potentially increasing your refund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Refund under the Ontario Tax Exemption for Commercialization?

The Application for Refund under the Ontario Tax Exemption for Commercialization is a formal request submitted by businesses to recover certain taxes paid on eligible expenditures that qualify for tax exemption during the commercialization phase of their products or services.

Who is required to file Application for Refund under the Ontario Tax Exemption for Commercialization?

Businesses and entities that have incurred eligible costs during the commercialization of their products or services in Ontario are required to file the Application for Refund to recover the taxes they have paid.

How to fill out Application for Refund under the Ontario Tax Exemption for Commercialization?

To fill out the Application for Refund, businesses must provide detailed information about their eligible expenditures, including documentation of costs incurred, a description of the commercialization activities, and any other requisite information as specified by the Ontario tax authorities.

What is the purpose of Application for Refund under the Ontario Tax Exemption for Commercialization?

The purpose of the Application for Refund is to allow businesses to recover taxes paid on eligible commercialization expenses, thus supporting innovation and growth within Ontario's economy by reducing the financial burden on emerging enterprises.

What information must be reported on Application for Refund under the Ontario Tax Exemption for Commercialization?

The Application for Refund must report information including the business name and contact details, a detailed list of eligible expenditures, the total tax paid, supporting documentation and receipts, and a description of the commercialization efforts related to the expenditures.

Fill out your application for refund under online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Refund Under is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.