Get the free FORM E - IMMEDIATE REPORTING & AMENDMENT FORM

Show details

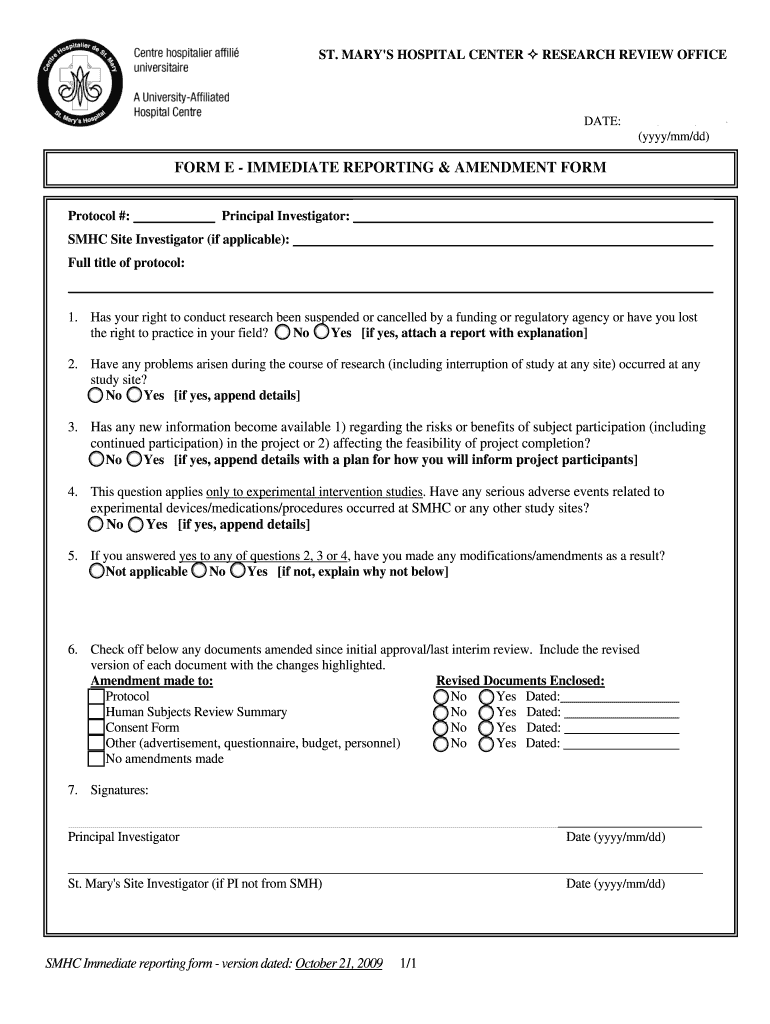

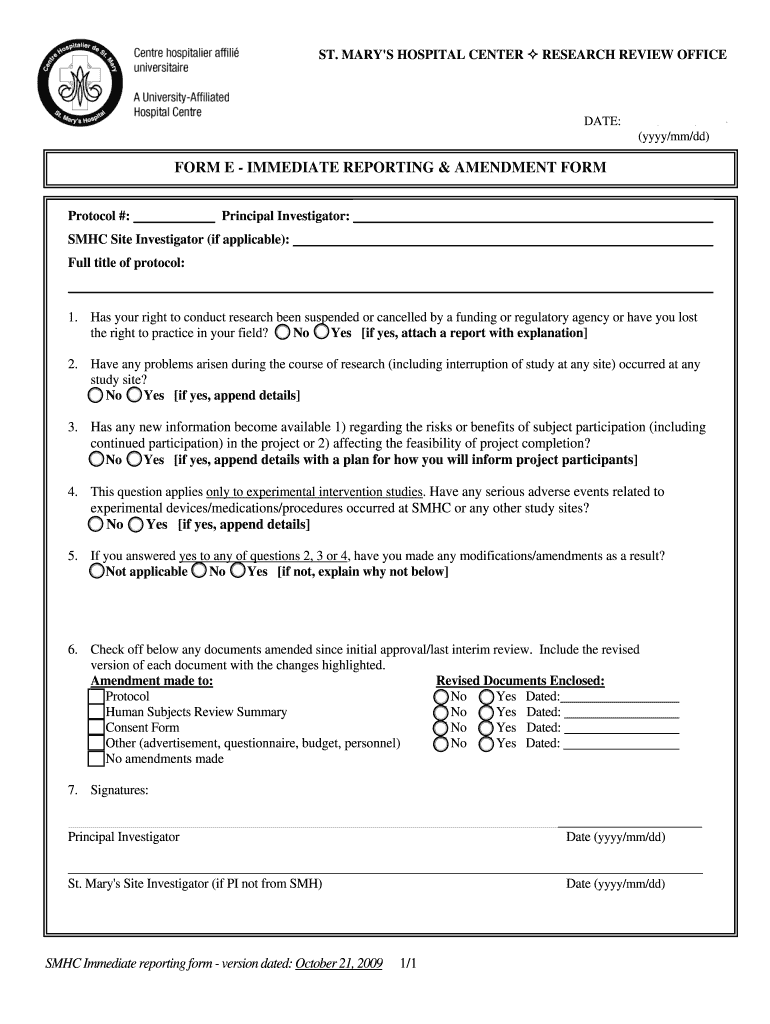

Complete this form to report any new information, incidents and/or changes related to your study of which the Research Ethics Committee must be made aware and approve before next interim review.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form e - immediate

Edit your form e - immediate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form e - immediate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form e - immediate online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form e - immediate. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form e - immediate

How to fill out FORM E - IMMEDIATE REPORTING & AMENDMENT FORM

01

Obtain FORM E - IMMEDIATE REPORTING & AMENDMENT FORM from the appropriate authority or online portal.

02

Start with filling out the personal information section, including your name, contact details, and address.

03

Identify the specific incident or amendment being reported; provide a brief description.

04

Include the date and time of the incident or amendment.

05

Specify any relevant reference numbers, if applicable.

06

Detail the circumstances surrounding the incident, including parties involved and any potential impacts.

07

If applicable, provide documentation or evidence to support your report, attaching copies as needed.

08

Review the entire form for accuracy and completeness.

09

Sign and date the form, indicating your confirmation and understanding of the information provided.

10

Submit the completed form to the designated authority, either in person or through the required electronic method.

Who needs FORM E - IMMEDIATE REPORTING & AMENDMENT FORM?

01

Individuals or organizations involved in incidents that require immediate reporting or amendments, including but not limited to accidents, compliance issues, and regulatory adjustments.

Fill

form

: Try Risk Free

People Also Ask about

Should I use Form 1040 or 1040SR?

The 1040-SR is only for persons over age 65. The Form 1040-SR uses the same schedules and instructions as the Form 1040. The only key difference with the Form 1040-SR is the text being larger. You would not be audited if you used 1040-SR at your age. Anyone over age 65 should do so.

Which tax form should I use?

Most U.S. taxpayers will use Form 1040 as their tax return. But there are other 1040 forms to consider: Form 1040-X: If you need to amend a previously filed return, use Form 1040-X. Form 1040-NR: If you're a nonresident alien with a business in the U.S., you may need to fill out Form 1040-NR.

What is the best tax form to use?

You can use the 1040 to report all types of income, deductions, and credits. You may have received a Form 1040A or 1040EZ in the mail because of the return you filed last year. If your situation has changed this year, it may be to your advantage to file a Form 1040 instead.

Should I use 1040EZ or 1040A?

IRS Form 1040A has been discontinued. There are now only two forms you can use to file your federal income tax return: IRS Form 1040 and 1040-SR. Form 1040A is a shorter version of Form 1040 and is more complex than Form 1040EZ, which has also been discontinued.

What form do I use to elect out of electronic filing?

Use Form 8948 to explain why a particular return is being filed on paper. to select the reason for not e-filing the return.

Is Form 1040 the same as W-2?

Form 1040 is different from a W-2. A W-2 is a wage and tax statement that an employee receives from a company they worked for during the tax year. The information listed on the W-2 is used to fill out Form 1040.

What IRS form is used to report inheritance?

Schedule K-1 (Form 1041), Beneficiary's Share of Income, Deductions, Credits, etc. Use Schedule K-1 to report a beneficiary's share of the estate's or trust's income, credits, deductions, etc., on your Form 1040, U.S. Individual Income Tax Return.

How do I file a Form D amendment?

Form D and Form D amendments must be filed with the SEC online using EDGAR (electronic gathering, analysis and retrieval) system. In order to do so, the issuer must obtain its own filer identification number (called a “Central Index Key” or “CIK” number) and access codes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM E - IMMEDIATE REPORTING & AMENDMENT FORM?

FORM E - IMMEDIATE REPORTING & AMENDMENT FORM is a regulatory document used to report significant events or changes in the status of a company or its officers that require prompt disclosure to the relevant authorities.

Who is required to file FORM E - IMMEDIATE REPORTING & AMENDMENT FORM?

Companies listed on a stock exchange, as well as their directors and key personnel, are required to file FORM E to ensure transparency and compliance with regulatory requirements.

How to fill out FORM E - IMMEDIATE REPORTING & AMENDMENT FORM?

To fill out FORM E, individuals must provide relevant details such as the nature of the event, the date it occurred, and any other necessary information as stipulated by the regulatory body. It's important to accurately complete each section to avoid penalties.

What is the purpose of FORM E - IMMEDIATE REPORTING & AMENDMENT FORM?

The purpose of FORM E is to ensure timely and transparent reporting of significant corporate events, thereby safeguarding the interests of stakeholders and maintaining market integrity.

What information must be reported on FORM E - IMMEDIATE REPORTING & AMENDMENT FORM?

FORM E requires reporting of information such as the nature of the event, details about the company or officers involved, the date of the occurrence, and any other pertinent facts that could influence stakeholder decisions.

Fill out your form e - immediate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form E - Immediate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.