Get the free Rental Income Guide - fightbacktoday

Show details

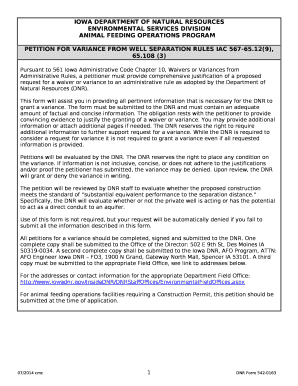

This guide provides information for individuals who received rental income from real estate or other properties. It helps calculate gross rental income, deductible expenses, and net rental income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rental income guide

Edit your rental income guide form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rental income guide form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rental income guide online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit rental income guide. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rental income guide

How to fill out Rental Income Guide

01

Gather all necessary documents related to your rental properties, including lease agreements, rental income statements, and expense receipts.

02

Begin filling out the Rental Income Guide by entering your personal information, such as your name and contact details.

03

List each property you rent out, including the address and details about the tenants.

04

Document the rental income received for each property over the specified time period.

05

Record any expenses associated with the properties, such as maintenance costs, property management fees, and taxes.

06

Review the guide for accuracy and ensure all fields are completed.

07

Submit the completed Rental Income Guide according to the guidelines provided.

Who needs Rental Income Guide?

01

Landlords who rent out residential or commercial properties.

02

Real estate investors looking to document their rental income for tax purposes.

03

People seeking to apply for loans or financial assistance that require proof of rental income.

04

Individuals preparing for tax season who need to report their rental earnings.

Fill

form

: Try Risk Free

People Also Ask about

What is the 14 day rule for rental income?

Annual Rental Income → Calculate the annual rental income of the property from all tenants. Operating Expenses → Calculate the sum of all fees and expenses incurred from operating the property. Annual Rental Income ÷ Operating Expenses → Divide the property's annual rental income by the sum of all operating expenses.

How do I avoid 20% down payment on investment property?

While conventional wisdom suggests that a significant down payment is necessary, the financing options below can help you acquire investment properties with a much lower upfront cost: Seller Financing. Home Equity. FHA and VA Loans. House Hacking. Portfolio and Hard Money Lenders. Partnerships. Lease Options.

What is the 50% rule in rental property?

The 2% rule is a popular guideline that real estate investors use to evaluate the potential profitability of an investment property. Simply put, the 2% rule states that a rental property should generate monthly rent that is at least 2% of the total purchase price.

How do you calculate the 50% rule?

Calculating the 50% rule for real estate transactions is simple, there's no complicated formula involved. You'd simply estimate the gross rent the property is likely to generate either monthly or annually, then divide by two.

What is the 50 percent rule for rental properties?

The rule suggests that about half of the property's rental income should cover expenses, and the other half is an estimate of the property's net operating income (NOI). The 50% rule is a starting point and not a strict formula. Different property types, locations, and market conditions can affect actual expenses.

Is there a way to avoid paying taxes on rental income?

Minimizing or eradicating taxes on rental income involves employing strategies such as 1031 exchanges, utilizing self-directed IRAs, claiming depreciation and deductions, leveraging equity through borrowing, deferring sales, and potentially becoming a real estate agent.

What is the 2% rule for rental income?

Under the 14-day rule, you don't report any of the income you earn from a short-term rental, as long as you rent the property (or room) for no more than 14 days during the year, and you use the property yourself for 14 days or more during the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Rental Income Guide?

The Rental Income Guide is a document or resource that provides instructions and information for individuals who earn income from renting out property. It outlines how to report rental income for tax purposes.

Who is required to file Rental Income Guide?

Individuals or entities that earn income from renting out residential or commercial properties are required to file the Rental Income Guide to report their earnings to tax authorities.

How to fill out Rental Income Guide?

To fill out the Rental Income Guide, one must provide details such as the total rental income received, expenses related to the rental property, and any other relevant financial information as outlined in the guide. It's advisable to consult the specific instructions accompanying the form.

What is the purpose of Rental Income Guide?

The purpose of the Rental Income Guide is to ensure that rental property owners correctly report their rental income and associated expenses for tax calculation, thereby complying with tax regulations.

What information must be reported on Rental Income Guide?

The information that must be reported on the Rental Income Guide includes total rental income received, rental property expenses (such as maintenance, repairs, property management fees), and any losses incurred. Additionally, property details and ownership information are also required.

Fill out your rental income guide online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rental Income Guide is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.