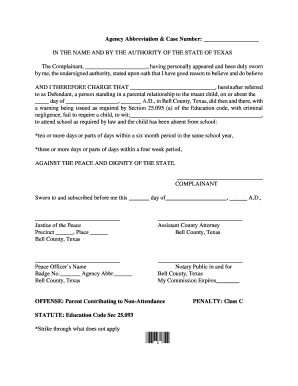

Get the free Rent-to-Own Application Form

Show details

A form for applicants seeking to enroll in a rent-to-own program, gathering personal, rental, employment, and credit information needed for consideration.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rent-to-own application form

Edit your rent-to-own application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rent-to-own application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rent-to-own application form online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rent-to-own application form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rent-to-own application form

How to fill out Rent-to-Own Application Form

01

Gather necessary documents such as proof of income, identification, and credit history.

02

Obtain the Rent-to-Own Application Form from the landlord or property management.

03

Fill out personal information including name, address, and contact details.

04

Provide details about your employment history and income sources.

05

List references that can vouch for your character or financial responsibility.

06

Complete any additional sections about desired property and rental preferences.

07

Review the application for accuracy and completeness.

08

Submit the application along with any required fees or deposits.

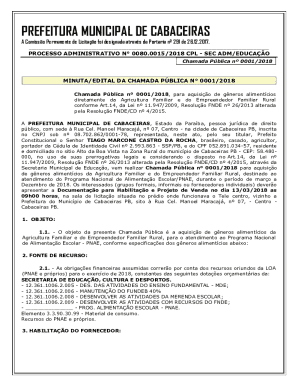

Who needs Rent-to-Own Application Form?

01

Individuals or families looking for housing options without an immediate purchase.

02

People with less than perfect credit who want a chance to buy a home later.

03

Tenants interested in potentially owning the property they are renting in the future.

04

Prospective buyers who seek flexibility in transitioning from renting to owning.

Fill

form

: Try Risk Free

People Also Ask about

Why would a landlord want to do rent-to-own?

Advantages to Landlords The landlord avoids having to pay the agent commission associated with selling a home. Since these fees typically run six per cent of the home's selling price, that is a sizable saving. The landlord assumes very little risk in rent-to-own lease agreements.

Is rent-to-own a smart idea?

In sum: Rent to own is a good idea because it helps you save money to purchase a home. You could potentially save money on the home by using Rent Credits or Premium Payment Matching. Additionally, you will have built up equity in the home and a larger down payment, which is likely to bring down your interest rate.

What credit score is needed to rent-to-own a house?

Rent-to-own company Divvy requires a minimum credit score of 550. Dream America's minimum score is 500. However, both programs have requirements around income, debt and rental payment history. Just keep in mind that mortgage lenders typically have higher credit score requirements.

Is rent-to-own ever a good idea?

Rent-to-own could be a good option if your credit score is so low that you either can't qualify for a mortgage or you can only qualify for one with high interest rates. You can take the steps necessary to improve your credit score while leasing the home you'll eventually buy.

Is rent-to-own ever legit?

It is legitimate, however they still require large deposits up front, and if you don't meet the requirements of the contract you forfeit everything you have paid. I knew a guy who had 12 homes, that he ran as Rent to Own with 1 year lease, followed buy the buyout.

How to start the process of rent-to-own?

Once a seller has agreed to a rent-to-own agreement the steps you'll take include: Find a rent-to-own opportunity. Agree to a purchase price. Determine the rental term's length. Define maintenance roles. Negotiate rent payments. Sign the contract. Shop for a mortgage lender. Keep Records.

Do I need a lawyer for a rent-to-own contract?

Because rent-to-own agreements are complex — after all, you're signing a lease as well as a document that might lay out all the terms of a home purchase — it's a good idea to have a local real estate attorney look over the agreement before signing.

Why is rent-to-own a bad idea to utilize?

Cons Explained Potential financial loss: If you change your mind or you are unable to purchase the home when the time comes, you could be out a significant amount of money. At minimum, you will lose your option fee. If you signed a lease-purchase contract, you could face more financial fallout.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Rent-to-Own Application Form?

The Rent-to-Own Application Form is a document used by potential tenants or buyers to express interest in renting a property with the option to purchase it later.

Who is required to file Rent-to-Own Application Form?

Individuals interested in entering a Rent-to-Own agreement must file the Rent-to-Own Application Form.

How to fill out Rent-to-Own Application Form?

To fill out the Rent-to-Own Application Form, provide personal information, employment details, rental history, income information, and any other required documentation.

What is the purpose of Rent-to-Own Application Form?

The purpose of the Rent-to-Own Application Form is to assess a potential tenant's qualifications and suitability for a Rent-to-Own agreement.

What information must be reported on Rent-to-Own Application Form?

The Rent-to-Own Application Form typically requires reporting personal identification details, employment information, income, credit history, and references.

Fill out your rent-to-own application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rent-To-Own Application Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.