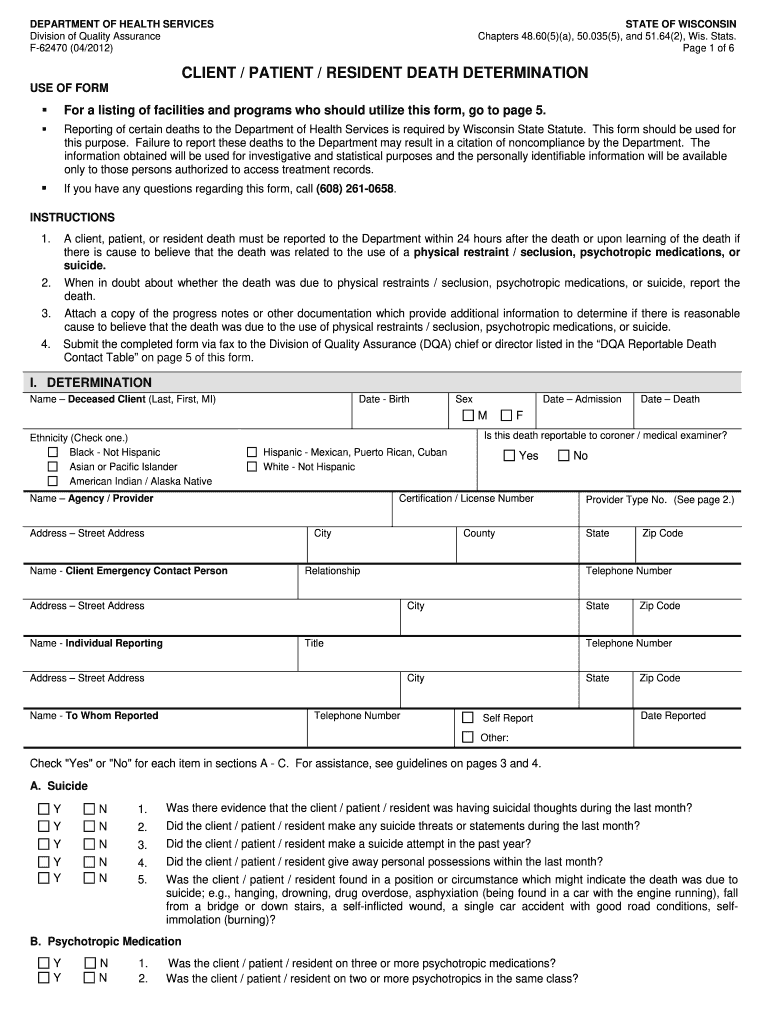

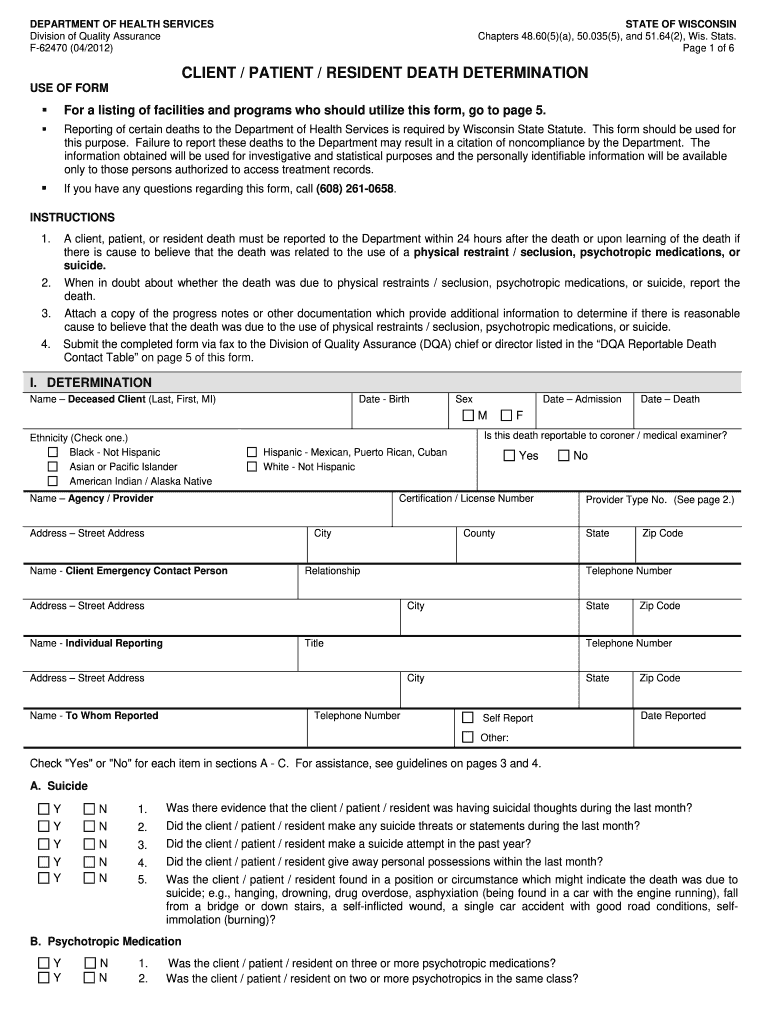

Get the free state of wisconsin f 62470 fillable - dhs wisconsin

Get, Create, Make and Sign state of wisconsin f

How to edit state of wisconsin f online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state of wisconsin f

How to fill out state of Wisconsin F:

Who needs State of Wisconsin F:

Instructions and Help about state of wisconsin f

Hello everyone welcome back to the Wisconsin Greg show just thought I'd check in here and let you know how I'm doing here and what's going on here in Wisconsin and pretty much nothing but rain and wet and cold it's about I think it's around 55 degrees today been nothing not too warm lately lots of rain off and on I got the corn aisle planted and the corn is just coming through the ground I noticed today the soybeans I did not get a chance to get planted yet hopefully, hopefully soon it won't be this week the way the weather forecast is looking there's their got showers and thunderstorms all through the whole week, and it's raining right now it rained yesterday we had a couple pretty big downpours, but there was a lot of nice weather in between, so people did get to celebrate their Memorial Day all the people in the United States that celebrated Memorial Day I hope you had a great day and then enjoyed your time off work and stuff, but I just thought I'd check in here and show you what's going on here was going to show you some geese here but car just pulled in here and scared them all away hopefully that car leave, and I can show you the geese there's a bunch of little geese here baby geese and mothers and their parents and stuff with the babies but they just kind of got scared and went in the water because a car pulled in here but anyways we're still plugging along it seems like we're in Oregon the way weather is here in Wisconsin usually it's never this bit I don't remember all the time since I've been planting corn and soy beans that it's been this hard to get planted I remember one time planting pretty wet, but this has been pretty bad it just gets dried almost dry enough not quite and then arrange a few days ago I thought it was almost dry enough where I could plant I'm already got the planter all switched over and everything the soybeans, so I went out there with a field cultivator to kind of just test it out and stuff, and it's too wet on the ends he couldn't turn it would just rut it all up it looks dry on top because there's been some days we've had lots of wind and the top looks dry but as soon as you get out there underneath is not dry so anyways I'm going to flip this camera around here and see if I can show you them geese here you can see the babies out there in the water with their parents swimming they're up on land here a few minutes ago it is sprinkling right now kind of cute little guys when they're little they're all fuzzy, but one good thing about the rain is it's making the prices of the corn and soy beans that we do have for sale go up right now they have been drastically going up the last couple of days and that's a good because they've been a very, very low on price for a long time I still have all my corn and soy beans from last year I haven't sold any of them, yet they're still in storage, but hopefully it keeps going up here I'll be able to sell that stuff hopefully, but we'll see this is real common around here right...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my state of wisconsin f in Gmail?

How do I edit state of wisconsin f in Chrome?

Can I edit state of wisconsin f on an Android device?

What is state of wisconsin f?

Who is required to file state of wisconsin f?

How to fill out state of wisconsin f?

What is the purpose of state of wisconsin f?

What information must be reported on state of wisconsin f?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.