WI ETF ET-7282 2013 free printable template

Show details

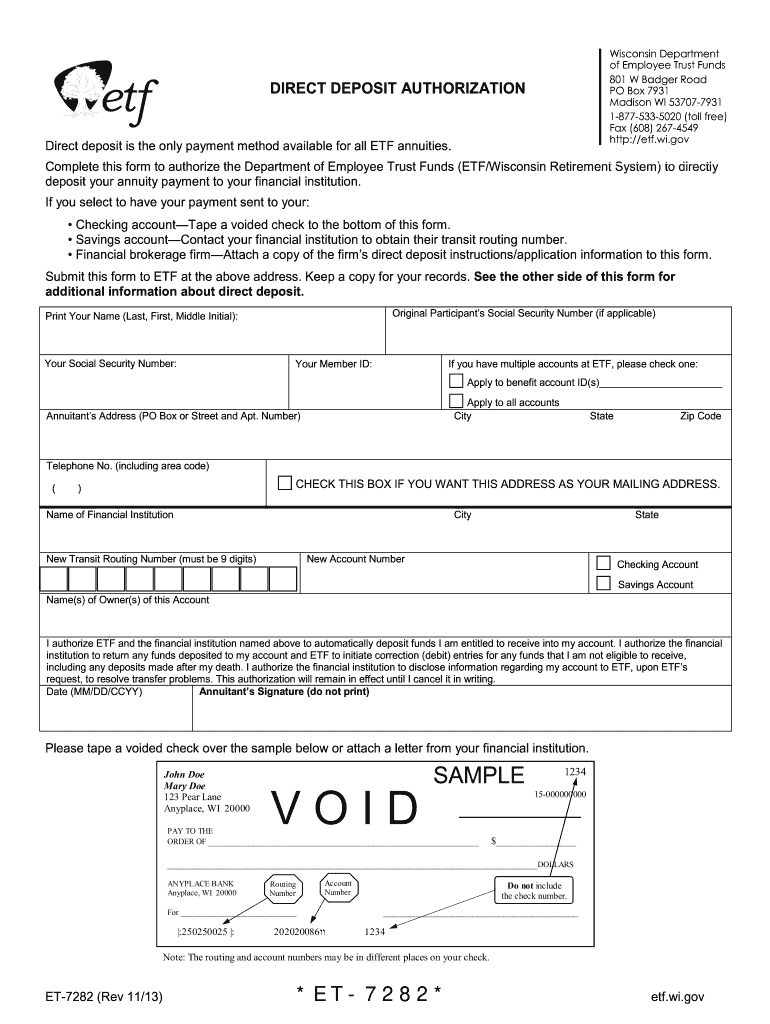

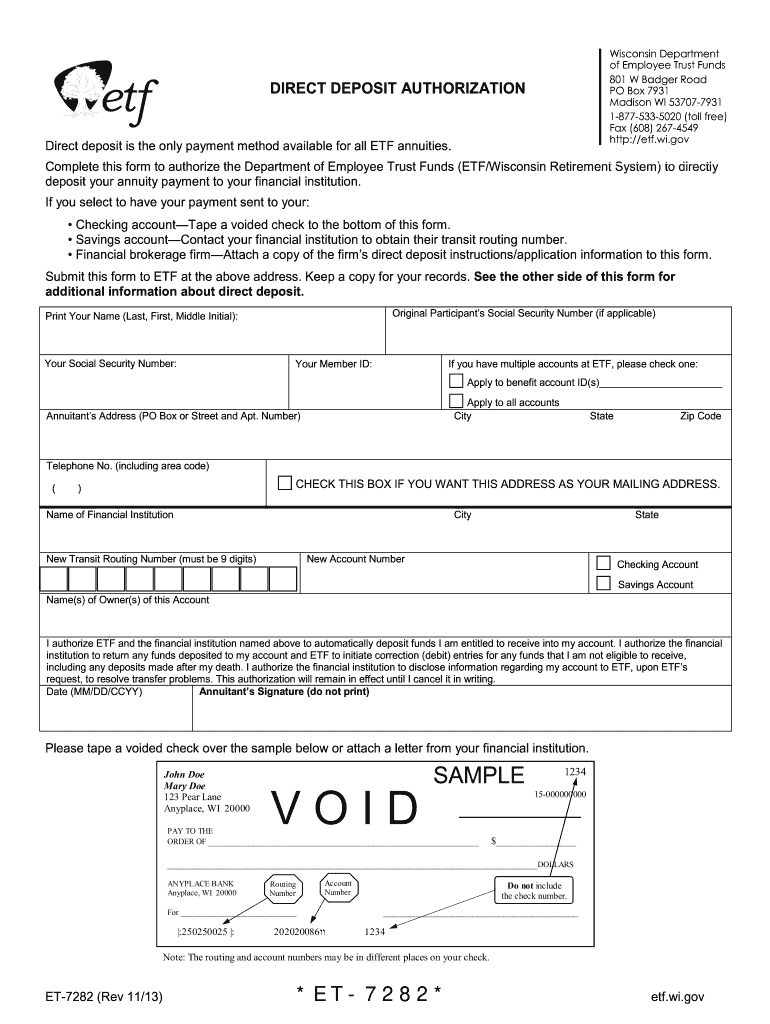

Department of Employee Trust Funds P. O. Box 7931 Madison, WI 53707-7931 DIRECT DEPOSIT AUTHORIZATION Direct deposit is the only payment method available for all ETF annuities. Complete this form

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI ETF ET-7282

Edit your WI ETF ET-7282 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI ETF ET-7282 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI ETF ET-7282 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit WI ETF ET-7282. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI ETF ET-7282 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI ETF ET-7282

How to fill out WI ETF ET-7282

01

Obtain the WI ETF ET-7282 form from the official Wisconsin Department of Revenue website or via your tax professional.

02

Fill in your personal information, including your name, address, and Social Security number at the top of the form.

03

Indicate the type of income you are reporting (e.g., wages, tips, etc.) in the specified sections.

04

Calculate the total income by adding up all sources of income listed on the form.

05

Report any deductions you may qualify for in the appropriate fields.

06

If applicable, include any tax credits you are eligible for.

07

Review all entered information for accuracy and completeness.

08

Sign and date the form before submission.

09

Submit the form via mail or electronically, following the instructions provided.

Who needs WI ETF ET-7282?

01

Individuals who earn income in Wisconsin and need to report it for tax purposes.

02

Residents of Wisconsin seeking to claim tax credits or deductions on their income.

03

Tax professionals assisting clients in preparing their state tax returns.

Fill

form

: Try Risk Free

People Also Ask about

What is the downside of ETF funds?

Market risk The single biggest risk in ETFs is market risk. Like a mutual fund or a closed-end fund, ETFs are only an investment vehicle—a wrapper for their underlying investment. So if you buy an S&P 500 ETF and the S&P 500 goes down 50%, nothing about how cheap, tax efficient, or transparent an ETF is will help you.

Why ETFs are good for beginners?

Exchange traded funds (ETFs) are ideal for beginner investors due to their many benefits such as low expense ratios, abundant liquidity, range of investment choices, diversification, low investment threshold, and so on.

Is ETF a good investment?

ETFs are a low cost means to gain exposure to the stock market. They offer liquidity and real time settlement as they are listed on an exchange and trade like stocks. ETFs are a low risk option as they replicate a stock index, offering diversification as opposed to investing in few stocks of your choice.

What are the benefits of ETF?

ETFs have several advantages over traditional open-end funds. The 4 most prominent advantages are trading flexibility, portfolio diversification and risk management, lower costs, and tax benefits.

What is the Wisconsin retirement system?

The Wisconsin Retirement System was created to protect public employees and their beneficiaries against the financial hardships of old age and disability, to attract and retain a qualified public workforce, establish modest benefits and achieve administrative savings.

What are the pros and cons of an ETF?

The risks associated with owning ETFs are usually lower, but if an investor can take on the risk, then the dividend yields of stocks can be much higher. While you can pick the stock with the highest dividend yield, ETFs track a broader market, so the overall yield will average out to be lower.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my WI ETF ET-7282 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your WI ETF ET-7282 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I complete WI ETF ET-7282 online?

pdfFiller makes it easy to finish and sign WI ETF ET-7282 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out WI ETF ET-7282 on an Android device?

Use the pdfFiller Android app to finish your WI ETF ET-7282 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is WI ETF ET-7282?

WI ETF ET-7282 is a Wisconsin Department of Revenue form used for Employment Tax filings.

Who is required to file WI ETF ET-7282?

Employers in Wisconsin who withhold state income tax or have employees subject to state unemployment insurance are required to file WI ETF ET-7282.

How to fill out WI ETF ET-7282?

To fill out WI ETF ET-7282, enter the employer's details, report total wages paid, withholdings, and follow the instructions for any necessary attachments.

What is the purpose of WI ETF ET-7282?

The purpose of WI ETF ET-7282 is to report and reconcile employee withholding taxes and ensure compliance with Wisconsin tax laws.

What information must be reported on WI ETF ET-7282?

The information that must be reported includes total wages, amount of tax withheld, and any other relevant employment tax details.

Fill out your WI ETF ET-7282 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI ETF ET-7282 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.