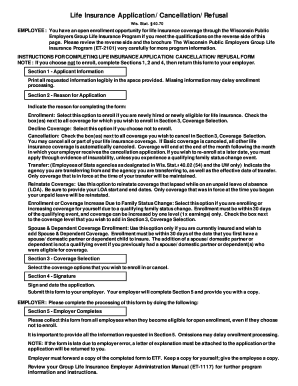

WI ETF ET-7282 2020 free printable template

Show details

Wisconsin Department of Employee Trust Funds PO Box 7931 Madison WI 537077931Direct Deposit Authorization18775335020 (toll-free) Fax 6082674549 ETF.WI.goose page 2 for important direct deposit information.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI ETF ET-7282

Edit your WI ETF ET-7282 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI ETF ET-7282 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WI ETF ET-7282 online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit WI ETF ET-7282. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI ETF ET-7282 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI ETF ET-7282

How to fill out WI ETF ET-7282

01

Begin by downloading the WI ETF ET-7282 form from the official state website.

02

Fill out the personal information section with your name, address, and contact details.

03

Provide your Social Security number or Employer Identification Number (EIN).

04

Indicate the reporting period for which you are filing.

05

Fill in the relevant financial information as required in the form, such as income, expenses, and any deductions.

06

Review the instructions for any additional documentation or information needed to accompany the form.

07

Sign and date the form to certify its accuracy.

08

Submit the completed form by the due date, either electronically or by mail, as instructed.

Who needs WI ETF ET-7282?

01

Individuals or businesses operating in Wisconsin who need to report pension-related information.

02

Tax professionals assisting clients with pension or retirement benefit reporting.

03

Anyone who has received distributions from a Wisconsin state pension or ETF plan.

Fill

form

: Try Risk Free

People Also Ask about

What age can you retire from an ETF in Wisconsin?

To be eligible for a WRS retirement benefit: You must be vested and be at least age 55 (or age 50 if you have protective category service). You must terminate all WRS-covered employment. You must not be on a leave of absence or in layoff status.

What are the hours for ETF?

Call Us. ETF Benefit Specialists are available from 7:00 a.m. to 5:00 p.m. (CST), Monday - Friday. Employer services are available from 7:45 a.m. - 4:30 p.m. (CST), Monday-Friday.

Are ETFs traded 24 hours?

Trading for stocks and ETFs closes at 4 p.m. ET, but unlike with mutual funds, you can continue trading stocks and ETFs in the after-hours market.

What are the trading hours for ETFs?

Standard Trading: Monday through Friday from 9:30 a.m.–4 p.m. EST. Pre-Market Trading: Monday through Friday from 8–9:30 a.m. EST.

What are the benefits of ETF?

ETFs have several advantages over traditional open-end funds. The 4 most prominent advantages are trading flexibility, portfolio diversification and risk management, lower costs, and tax benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send WI ETF ET-7282 to be eSigned by others?

When you're ready to share your WI ETF ET-7282, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit WI ETF ET-7282 online?

The editing procedure is simple with pdfFiller. Open your WI ETF ET-7282 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit WI ETF ET-7282 on an iOS device?

Create, edit, and share WI ETF ET-7282 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is WI ETF ET-7282?

WI ETF ET-7282 is a Wisconsin tax form used for reporting certain types of income or tax information related to employees and employers.

Who is required to file WI ETF ET-7282?

Employers who are subject to Wisconsin employment taxes and need to report specific information regarding their employees are required to file WI ETF ET-7282.

How to fill out WI ETF ET-7282?

To fill out WI ETF ET-7282, you should provide the required information such as employer details, employee details, and specific income details as outlined in the instructions provided with the form.

What is the purpose of WI ETF ET-7282?

The purpose of WI ETF ET-7282 is to ensure compliance with state tax laws by providing accurate reporting of employee-related income and taxes.

What information must be reported on WI ETF ET-7282?

The form must report information such as the employer's identification information, employee names, Social Security numbers, wages paid, and the corresponding tax withheld.

Fill out your WI ETF ET-7282 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI ETF ET-7282 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.