Canada SC ISP-5054-USA 2012 free printable template

Show details

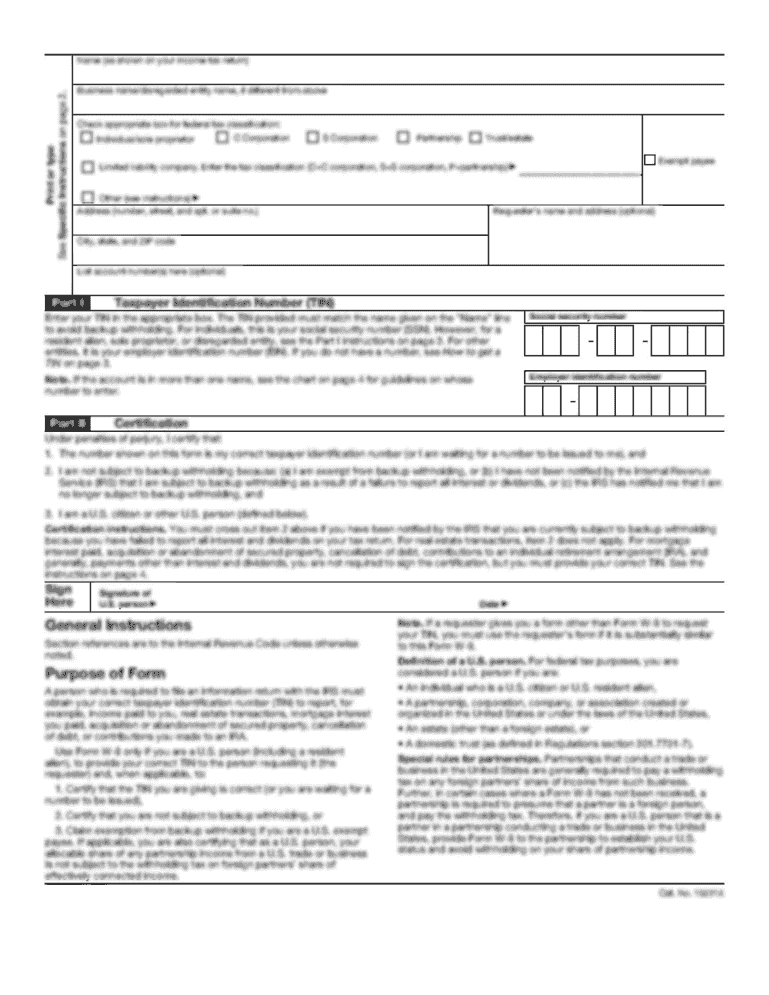

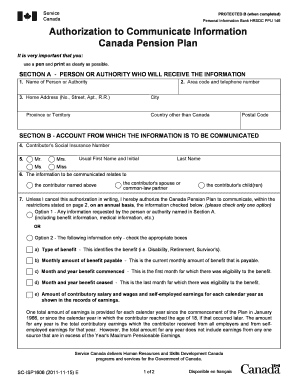

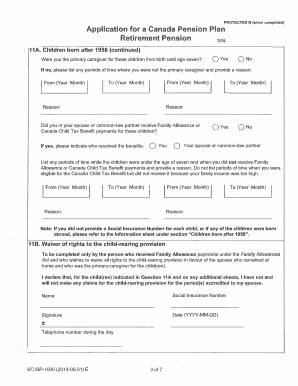

Service Canada PROTECTED B (when completed) CDN USA 1 Application for Canadian Old Age, Retirement and Survivors benefits under the Agreement on Social Security between Canada and the United States

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada SC ISP-5054-USA

Edit your Canada SC ISP-5054-USA form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada SC ISP-5054-USA form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada SC ISP-5054-USA online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada SC ISP-5054-USA. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada SC ISP-5054-USA Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada SC ISP-5054-USA

How to fill out Canada SC ISP-5054-USA

01

Obtain the Canada SC ISP-5054-USA form from the official website.

02

Ensure you have your personal identification details ready, such as your name, address, and contact information.

03

Fill in all required fields accurately, including any relevant immigration or immigration-related information.

04

Review the form for any errors or omissions before finalizing.

05

Attach any requested documentation or evidence required by the form.

06

Submit the completed form through the designated submission process, either online or by mail.

Who needs Canada SC ISP-5054-USA?

01

Individuals applying for immigration or residency in Canada who need to provide specific personal and immigration information.

02

Those who are required to confirm their status or provide evidence of their eligibility as part of a visa application or immigration process.

Fill

form

: Try Risk Free

People Also Ask about

Can I collect CPP if I live in the US?

Because CPP is a "member contributed plan" it will always be yours, regardless of where you live in the world. If you paid in at least 1 CPP contribution, you are entitled to a benefit.

Is the Canadian pension plan taxable in the US?

By provision of the income tax treaty between the U.S. and Canada, benefits paid under the Canada Pension Plan (CPP), Quebec Pension Plan (QPP), and Old Age Security (OAS) program to a U.S. resident are taxable, if at all, only in the United States.

Can CPP be claimed outside Canada?

Canadian Government Income Security Programs As a non-resident of Canada, you may be entitled to apply for Canada Pension Plan (CPP) payments and Old Age Security Pension (OAS) payments. Canada also has agreements with a number of other countries that offer comparable pension programs.

What is the tax treatment of Canadian Social Security benefits in the US?

If a resident of the United States receives Social Security from Canada, it will only be taxable in the United States as if it was being received as U.S. Social Security — except that if it would have been exempt in Canada then it will be exempt from U.S. tax as well.

How to apply for CPP from USA?

You can apply for Canadian benefits (OAS, CPP or QPP) at any U.S. Social Security office by completing application form CDN-USA 1 (for OAS and CPP benefits) or QUE/USA-1 (for QPP benefits). Contact any Canadian or Quebec Social Security office.

Is the old age pension taxable in Canada?

Old Age Security (OAS) pension and benefits It is considered taxable income and is subject to a recovery tax if your individual net annual income is higher than the net world income threshold set for the year ($79,845 for 2021).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit Canada SC ISP-5054-USA online?

With pdfFiller, it's easy to make changes. Open your Canada SC ISP-5054-USA in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I sign the Canada SC ISP-5054-USA electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your Canada SC ISP-5054-USA in seconds.

How can I fill out Canada SC ISP-5054-USA on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your Canada SC ISP-5054-USA. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is Canada SC ISP-5054-USA?

Canada SC ISP-5054-USA is a specific form used by certain individuals or entities to report information related to their financial activities or status in Canada, particularly in relation to U.S. tax laws.

Who is required to file Canada SC ISP-5054-USA?

Individuals and businesses that have certain financial interests or obligations in both Canada and the USA may be required to file Canada SC ISP-5054-USA.

How to fill out Canada SC ISP-5054-USA?

To fill out Canada SC ISP-5054-USA, individuals should carefully complete the form by providing all required information, including identification details, financial information, and any other relevant data as specified in the instructions for the form.

What is the purpose of Canada SC ISP-5054-USA?

The purpose of Canada SC ISP-5054-USA is to ensure compliance with tax regulations and to provide information to the Canadian government about financial interests and activities related to U.S. tax obligations.

What information must be reported on Canada SC ISP-5054-USA?

The information that must be reported on Canada SC ISP-5054-USA includes personal identification details, financial account information, and any relevant data that pertains to the individual's or entity's financial activities between Canada and the USA.

Fill out your Canada SC ISP-5054-USA online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada SC ISP-5054-USA is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.