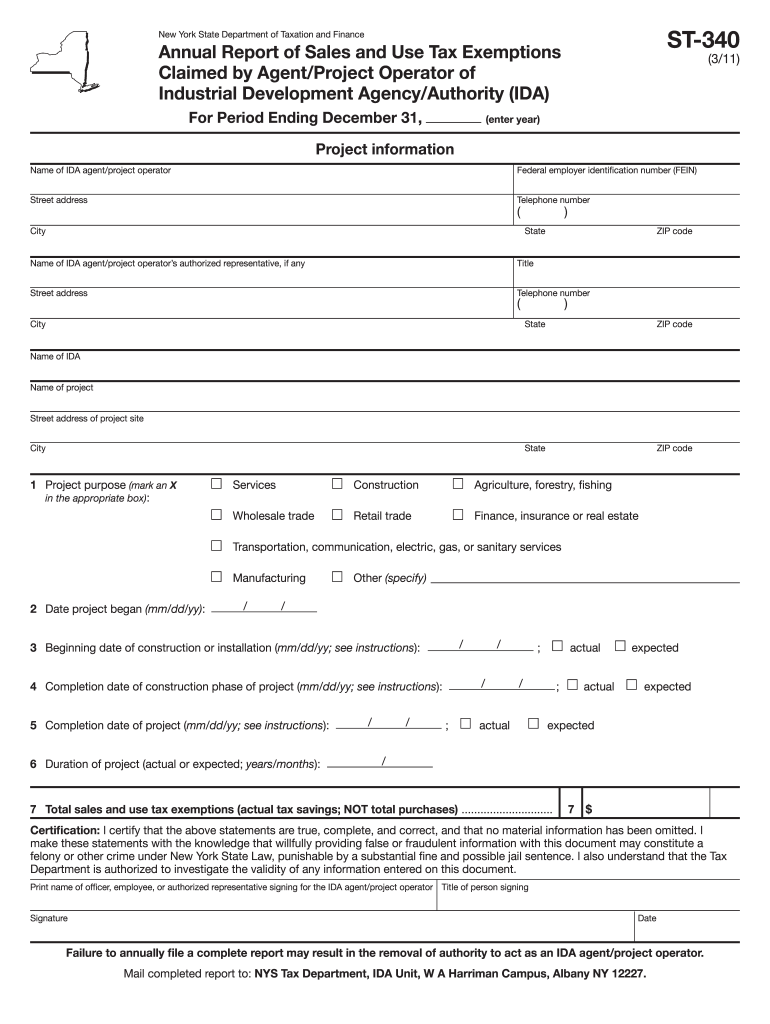

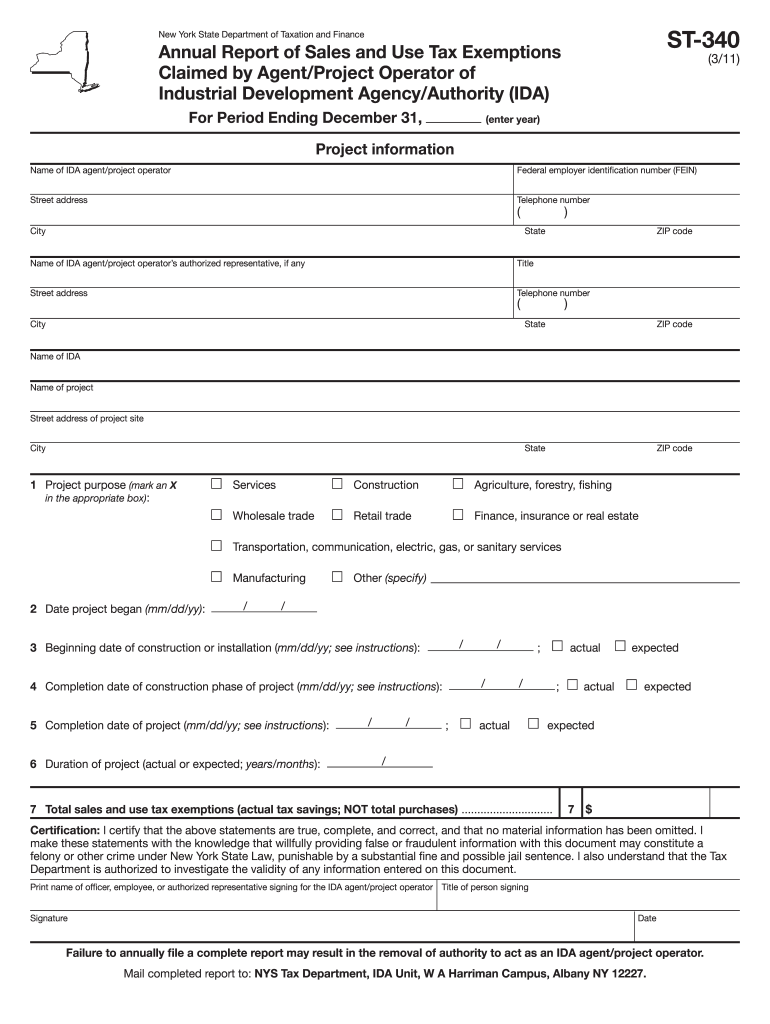

NY DTF ST-340 2011 free printable template

Show details

Only the agent/project operator s directly appointed by the IDA must file Form ST-340. Contractors subcontractors consultants or agents appointed by the agent/project operator s should not themselves file Form ST-340. See instructions below for additional information required. When is the report due You must file Form ST-340 on a calendar-year basis. However the agent/project operator s must include on Form ST-340 information obtained from such contractors subcontractors consultants and...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF ST-340

Edit your NY DTF ST-340 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF ST-340 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF ST-340 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY DTF ST-340. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF ST-340 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF ST-340

How to fill out NY DTF ST-340

01

Obtain the NY DTF ST-340 form from the New York Department of Taxation and Finance website or local office.

02

Provide your name, address, and identification number at the top of the form.

03

Specify the type of exemption you are claiming in the appropriate section.

04

Fill out the applicable details regarding the taxable items or services.

05

Sign and date the form to certify the information provided is correct.

06

Submit the completed form to the appropriate tax authority as indicated in the instructions.

Who needs NY DTF ST-340?

01

Individuals or businesses purchasing goods or services in New York that may be exempt from sales tax.

02

Non-profit organizations that qualify for tax-exempt status under New York law.

03

Government entities making exempt purchases.

Instructions and Help about NY DTF ST-340

Fill

form

: Try Risk Free

People Also Ask about

What is the exempt form for NYS sales tax?

If you have a valid Certificate of Authority, you may use Form ST-121 to purchase, rent, or lease tangible personal property or services exempt from tax to the extent indicated in these instructions. Complete all required entries on the form and give it to the seller.

Do New York State resale certificates expire?

Expiration of a New York Resale certificate While a resale certificate itself doesn't expire, a certificate of authority is valid for a maximum of three years and is “renewable at the discretion of the Department of Taxation and Finance."

Does a exemption certificate expire?

Resale certificates in Iowa are valid for up to three years from the original issue.

Do New York sales tax exemption certificates expire?

You must keep the exemption certificate for at least three years from the due date of the sales tax return on which the last sale using the exemption certificate was reported.

How long are NY tax exempt certificates valid?

You must keep the exemption certificate for at least three years from the due date of the sales tax return on which the last sale using the exemption certificate was reported. For more information, see Tax Bulletin Record-keeping Requirements for Sales Tax Vendors (TB ST-770).

What is the number for NYS sales tax certificate of authority?

Duplicate Certificate of Authority If you are already registered for sales tax with the Tax Department but need a duplicate copy of your Certificate of Authority because the original was misplaced or destroyed, you can call us at (518) 485-2889.

What items are exempt from sales tax in New York?

Use Tax - applies if you buy tangible personal property and services outside the state and use it within New York State. Clothing and footwear under $110 are exempt from New York City and NY State Sales Tax. Purchases above $110 are subject to a 4.5% NYC Sales Tax and a 4% NY State Sales Tax.

What is the difference between a tax exemption and a deduction?

Tax deductions are specific items that can be deducted from your income. These items are generally expenses or payments made towards certain investments. Tax exemptions are specific items that are excluded from taxation. These items are generally allowances or other amounts earned as income.

What is an example of an exemption?

Children are exemptions, or deductions, on tax forms; the more children you have the less taxes you pay. Some non-profits are tax-exempt; their exemption means they pay no taxes at all. Exemptions also spare people from fighting in wars and doing some jobs.

What items are exempt from sales tax in New Jersey?

The current Sales Tax rate is 6.625% and the specially designated Urban Enterprise Zones rate is one half the Sales Tax rate. Certain items are exempt from sales tax, such as food, clothing, drugs, and manufacturing/processing machinery and equipment. A resale exemption also exists.

How do I become tax exempt in NY?

Exemptions from Withholding You must be under age 18, or over age 65, or a full-time student under age 25 and. You did not have a New York income tax liability for the previous year; and. You do not expect to have a New York income tax liability for this year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NY DTF ST-340 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your NY DTF ST-340 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out the NY DTF ST-340 form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign NY DTF ST-340. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit NY DTF ST-340 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share NY DTF ST-340 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is NY DTF ST-340?

NY DTF ST-340 is a tax form used by individuals and businesses in New York State to apply for a sales tax exemption on certain purchases.

Who is required to file NY DTF ST-340?

Entities such as non-profit organizations, government agencies, and certain businesses that make qualifying purchases without sales tax are required to file NY DTF ST-340.

How to fill out NY DTF ST-340?

To fill out NY DTF ST-340, you need to provide identifying information such as your name, address, and the reason for the exemption, along with the details of the items being purchased.

What is the purpose of NY DTF ST-340?

The purpose of NY DTF ST-340 is to formally document requests for sales tax exemptions and ensure compliance with state tax regulations.

What information must be reported on NY DTF ST-340?

The form requires reporting information such as the purchaser's details, type of organization, reason for the exemption, and a description of the goods or services being purchased.

Fill out your NY DTF ST-340 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF ST-340 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.