Get the free Annual Accounts

Show details

The document contains the annual financial accounts for CVBA Gaselwest covering the financial year from January 1, 2011 to December 31, 2011. It provides details on the company's financial performance,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual accounts

Edit your annual accounts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual accounts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annual accounts online

To use our professional PDF editor, follow these steps:

1

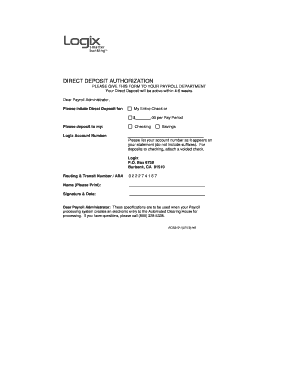

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit annual accounts. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual accounts

How to fill out Annual Accounts

01

Gather necessary financial documents, including income statements, balance sheets, and cash flow statements.

02

Start with the balance sheet: list all assets, liabilities, and equity.

03

Prepare the income statement: summarize revenues, expenses, and net income over the financial year.

04

Create the cash flow statement: detail cash inflows and outflows from operating, investing, and financing activities.

05

Review and adjust any estimates or provisions to ensure accuracy.

06

Compile notes to the accounts that explain any significant figures or accounting policies.

07

Ensure all financial statements comply with relevant accounting standards.

08

Consider having accounts audited or reviewed by a certified accountant for credibility.

09

File the completed Annual Accounts with the appropriate regulatory bodies before the deadline.

Who needs Annual Accounts?

01

All limited companies are required to prepare Annual Accounts for legal compliance.

02

Businesses seeking external funding or investment often need to provide Annual Accounts.

03

Tax authorities require Annual Accounts to determine tax obligations.

04

Stakeholders and creditors may need Annual Accounts to assess the financial health of a business.

05

Shareholders and potential investors utilize Annual Accounts for decision-making purposes.

Fill

form

: Try Risk Free

People Also Ask about

Is 2% annual return good?

Now, think about a real financial example: a 2 percent return. This may not sound impressive, but let's say you earned that 2 percent in a federally insured, high-yield savings account. In that case, it's a very good return since you didn't have to accept any risk whatsoever.

What is the annual income in English?

Annual income is the total money you earn during one financial year before deducting applicable taxes. A fiscal or financial year is April 1st to March 31st of the next year. A majority of the annual income calculation relies on fiscal year calculation.

What is included in annual accounts?

Annual accounts are financial reports that provide a comprehensive overview of a company's financial activity over a specific financial year. These accounts include a profit and loss statement, balance sheet, and other information about the company's financial position.

What is the annual return in English?

An annual rate of return is the profit or loss on an investment over a one-year period. There are many ways of calculating the annual rate of return. If the rate of return is calculated on a monthly basis, multiplying it by 12 expresses an annual rate of return.

What is annual in American English?

annual in American English for a year's time, work, etc.

What is the meaning of annual return?

Definition. An annual return measures the growth of an investment, on average, each year during a specific period. It is a commonly used method for comparing the performance of liquid investments.

What is annual in American English?

annual in American English for a year's time, work, etc.

What are examples of annual returns?

Annual Return Example If you invest ₹100,000 in January and it grows to ₹120,000 by December including ₹2,000 in dividends, your annual return is 22% [(120,000+2,000-100,000)/100,000 × 100], showing investment performance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Annual Accounts?

Annual Accounts are a financial report that summarizes a company's financial performance and position over the year. They typically include the balance sheet, income statement, and cash flow statement.

Who is required to file Annual Accounts?

Companies, partnerships, and certain other entities are required to file Annual Accounts, depending on local regulations and laws governing financial reporting.

How to fill out Annual Accounts?

To fill out Annual Accounts, gather all relevant financial data, including revenues, expenses, assets, and liabilities, and prepare the financial statements according to applicable accounting standards.

What is the purpose of Annual Accounts?

The purpose of Annual Accounts is to provide stakeholders with an overview of the company's financial health, facilitate transparency, and meet legal and regulatory requirements.

What information must be reported on Annual Accounts?

Annual Accounts must report financial information such as revenue, expenses, profit or loss, assets, liabilities, owner's equity, and notes on accounting policies and financial assumptions.

Fill out your annual accounts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Accounts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.