Get the free Relocation Expense Reimbursement

Show details

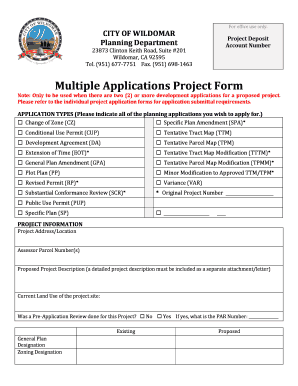

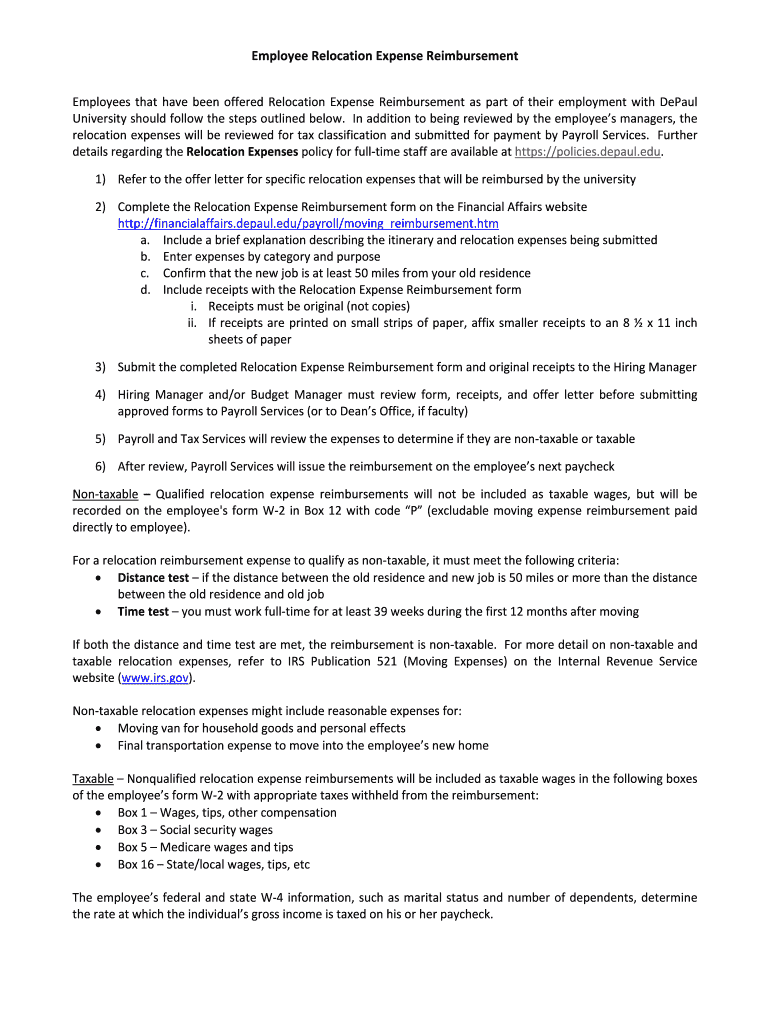

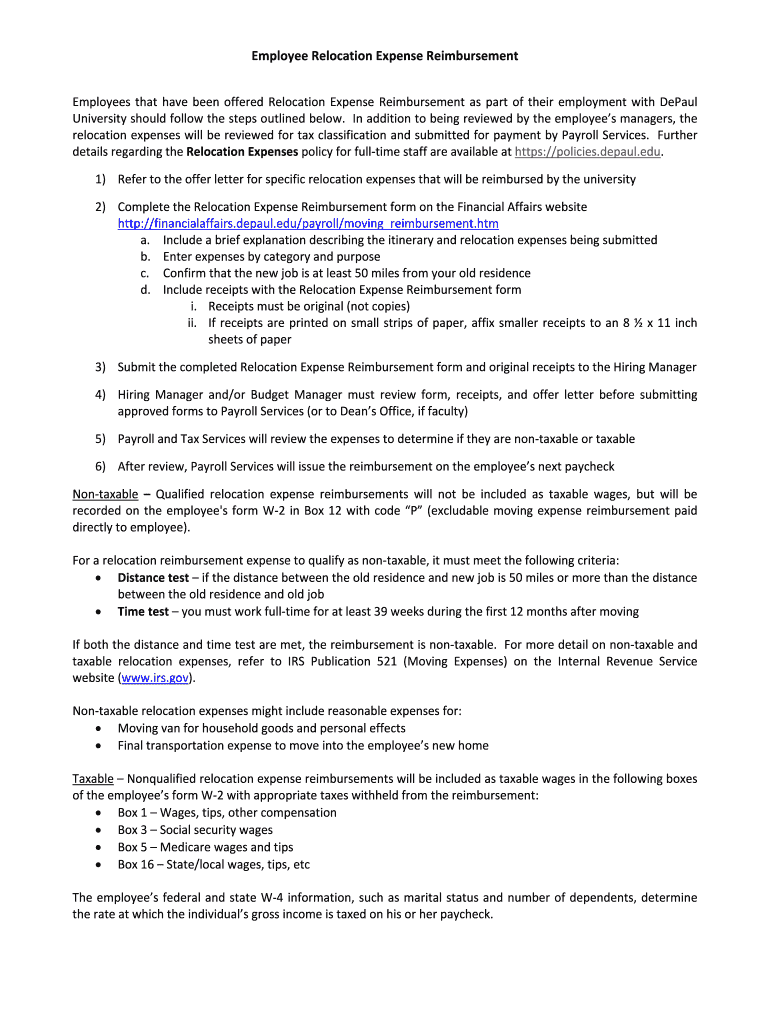

Guidelines for employees at DePaul University regarding the process for submitting relocation expenses for reimbursement, including necessary documentation and the tax implications of such reimbursements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign relocation expense reimbursement

Edit your relocation expense reimbursement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your relocation expense reimbursement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit relocation expense reimbursement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit relocation expense reimbursement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out relocation expense reimbursement

How to fill out Relocation Expense Reimbursement

01

Gather all relevant receipts and documentation for your relocation expenses.

02

Obtain the Relocation Expense Reimbursement form from your HR department or the company’s website.

03

Fill out your personal information at the top of the form, including your name, employee ID, and contact information.

04

Enter the dates of your relocation and the details of your new address.

05

List each relocation expense on the form, including moving costs, transportation, temporary housing, and any other eligible expenses.

06

Attach copies of the receipts and documentation for each expense listed.

07

Double-check your entries for accuracy and completeness.

08

Submit the filled-out form along with the attachments to the appropriate department or individual as specified by your company.

Who needs Relocation Expense Reimbursement?

01

Newly hired employees relocating for their job.

02

Current employees who are being transferred to a new location.

03

Employees who have been asked to relocate as part of a company initiative or project.

04

Any employee who incurs eligible expenses related to moving for work purposes.

Fill

form

: Try Risk Free

People Also Ask about

Is it worth claiming moving expenses on taxes?

Most people can't deduct these moving expenses on their taxes, even if they are moving for work. The only way you can deduct moving expenses on your taxes is if you are an active-duty member of the U.S. military moving because of a military order resulting in a permanent change of station.

How do you record moving expenses?

Here's an overview of the tax form: Line 1 – In this line, you'll report your storage and shipping expenses for moving your possessions. Line 2 – You'll record traveling, lodging, and gas expenses. Line 4 – Any reimbursements you receive from your employer when moving house should be reported here.

What is reimbursement of relocation expenses?

A relocation allowance is compensation intended to offset higher living costs in a new location. Reimbursement for expenses incurred for moves and transfers that must be included in an employee's gross income and are therefore taxable.

What are the IRS guidelines for moving expenses?

For tax years beginning after 2017, you can no longer deduct moving expenses unless you are a member of the Armed Forces on active duty and, due to a military order, you move because of a permanent change of station.

Is relocation reimbursement considered income?

To put it simply, any amount an employer pays a relocating employee to help cover moving expenses is added to the employee's W2 statement. Therefore, the employee will need to pay taxes on the total amount given, in addition to their annual salary.

How much is a typical relocation allowance?

For employer homeowners without a Buyer Value Option (BVO), the estimated cost of relocation for a typical U.S. domestic move is around $45,500. This estimate assumes standard services like household goods moves, temporary housing, and travel allowances, but it does not include the added expense of a home sale program.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Relocation Expense Reimbursement?

Relocation Expense Reimbursement is a financial compensation provided by employers to employees for expenses incurred during a job-related move from one location to another.

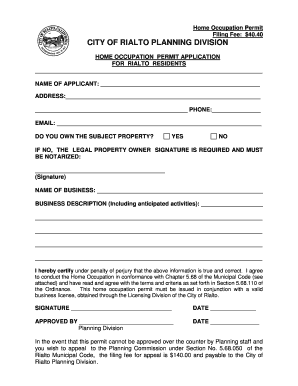

Who is required to file Relocation Expense Reimbursement?

Employees who have incurred eligible relocation expenses as part of a job transfer or assignment are required to file for Relocation Expense Reimbursement.

How to fill out Relocation Expense Reimbursement?

To fill out a Relocation Expense Reimbursement form, employees should provide details of their move, itemize eligible expenses, and attach necessary receipts and documentation.

What is the purpose of Relocation Expense Reimbursement?

The purpose of Relocation Expense Reimbursement is to assist employees in covering the costs associated with moving for a job, thereby reducing the financial burden during their transition.

What information must be reported on Relocation Expense Reimbursement?

Information that must be reported includes employee details, the new job location, a detailed list of incurred expenses, dates of the move, and supporting documentation such as receipts.

Fill out your relocation expense reimbursement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Relocation Expense Reimbursement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.