Get the free Letters of Credit

Show details

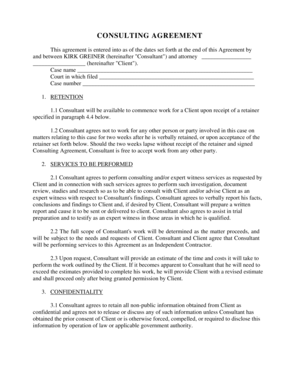

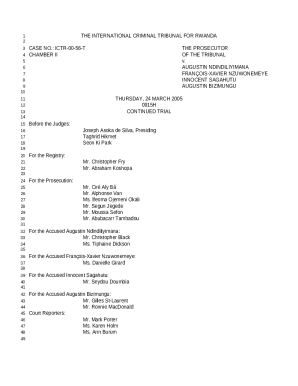

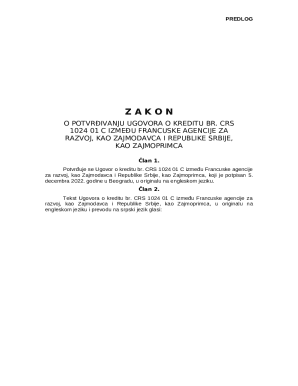

This document outlines a course on Letters of Credit in international trade finance, detailing payment methods, trade documents, terms, and best practices for handling letters of credit.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign letters of credit

Edit your letters of credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your letters of credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing letters of credit online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit letters of credit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out letters of credit

How to fill out Letters of Credit

01

Obtain a Letter of Credit application from your bank.

02

Fill in the required details, including the buyer's and seller's information.

03

Specify the amount and currency of the credit.

04

Define the terms and conditions for the payment.

05

Include the expiration date of the Letter of Credit.

06

Indicate the shipping and delivery instructions.

07

Submit the application to your bank along with any required documentation.

08

Pay any applicable fees to issue the Letter of Credit.

Who needs Letters of Credit?

01

Importers who want to ensure payment to exporters.

02

Exporters who need a guarantee of payment.

03

Banks providing financial services in international trade.

04

Freight forwarders and logistical companies involved in shipping.

05

Buyers and sellers in high-value transactions requiring security.

Fill

form

: Try Risk Free

People Also Ask about

What are the rules for letter of credit?

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

What are the different types of letters of credit?

There are different kinds of letters of credit. These include Confirmed LC, Usance Credit, Traveller's LC, Revocable LC, Transferable Credit, Stand by LC, Commercial Letter, and Revolving LC.

What happens if LC is not paid?

A letter of credit is essentially a financial contract between a bank, a bank's customer and a beneficiary. Generally issued by an importer's bank, the letter of credit guarantees the beneficiary will be paid once the conditions of the letter of credit have been met.

What is the difference between a revocable and irrevocable letter of credit?

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees. Irrevocable letters of credit provide more security than revocable ones.

What are the four different types of credit?

Generally, irrevocable and confirmed LCs are more secure and preferable for sellers, while revocable and unconfirmed LCs are more flexible and cheaper for buyers. Types are given as a list Acceptance Credit/ Time Credit. Revocable Letter of Credit. Irrevocable Letter of Credit.

What is an LC and how does it work?

As a rule, Letters of Credit require strict compliance – meaning both parties must stick to all the formal terms of the contract or risk being found in breach of contract. Under UCP 600, documents must be in strict compliance with the terms of the contract, so any inaccuracies may risk jeopardising the transactions.

What are 4 types of letter of credit?

A Letter of Credit (LC) is a document that guarantees the buyer's payment to the sellers. It is issued by a bank and ensures timely and full payment to the seller. If the buyer is unable to make such a payment, the bank covers the full or the remaining amount on behalf of the buyer.

What are the examples of letter of credit?

Gather the Necessary Information Identify the issuing bank and the beneficiary. Ensure that the terms of the letter of credit are within the issuing bank's credit limits. Confirm the credit amount, currency, and expiration date. Identify the goods or services to be provided.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Letters of Credit?

A Letter of Credit is a financial document issued by a bank or financial institution that guarantees payment to a seller upon the fulfillment of specified conditions, usually related to the delivery of goods or services.

Who is required to file Letters of Credit?

Typically, the buyer of goods or services is required to file a Letter of Credit with the issuing bank. The seller may also need to provide documentation to ensure that payment is made once the conditions of the Letter of Credit are met.

How to fill out Letters of Credit?

To fill out a Letter of Credit, the applicant must provide necessary information such as the buyer's and seller's details, the amount to be covered, description of goods or services, terms of delivery, and any specific conditions that must be met for payment.

What is the purpose of Letters of Credit?

The purpose of a Letter of Credit is to facilitate international trade by providing a guarantee of payment to the seller, thereby reducing the risk for both the buyer and the seller in a transaction.

What information must be reported on Letters of Credit?

Information that must be reported on Letters of Credit includes the parties involved (issuer, beneficiary, and applicant), amount of credit, expiry date, terms and conditions for payment, and the required documents to claim the payment.

Fill out your letters of credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Letters Of Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.