Get the free China VAT and Business Tax Reform 2009

Show details

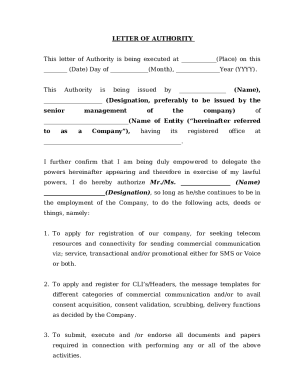

This document is a registration form for a seminar discussing the VAT and Business Tax reforms in China, providing insights and practical advice for businesses.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign china vat and business

Edit your china vat and business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your china vat and business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing china vat and business online

To use the professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit china vat and business. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out china vat and business

How to fill out China VAT and Business Tax Reform 2009

01

Gather necessary documents such as invoices, receipts, and financial statements.

02

Determine your taxable income and calculate the VAT payable based on your sales.

03

Fill out the VAT declaration form accurately, including your business information and period of reporting.

04

List all sales transactions and apply the appropriate VAT rates.

05

Include any allowable deductions or exemptions in your declaration.

06

Review the completed form for accuracy before submission.

07

Submit the VAT form to the local tax authority by the specified deadline.

Who needs China VAT and Business Tax Reform 2009?

01

All businesses operating in China that are subject to VAT.

02

Companies engaged in the sale of goods, provision of services, or import of goods.

03

Businesses seeking to comply with Chinese tax regulations and requirements.

Fill

form

: Try Risk Free

People Also Ask about

Is China VAT recoverable?

? New VAT Refund Policy Under the new regime, foreign tourists shopping at authorized tax-free enterprises can now receive instant input VAT refunds for qualifying goods at the time of purchase, rather than waiting to claim reimbursement upon exiting China.

What is the VAT rebate in China?

China's new instant VAT refund system enables foreign tourists to receive instant tax rebates at the point of purchase, aiming to boost domestic consumption and streamline the retail-tourism experience.

How does VAT work in China?

The Chinese government applies it on the sale of goods and services. VAT isn't paid by businesses — instead, it's charged to consumers in the price of goods, and collected by businesses, making it an indirect tax. Businesses are then responsible for reporting it to the government.

What is the tax reform in China?

Reform Local Tax Structure Specifically, the market trade tax, the livestock transaction tax, the bonus tax, the wages and salaries adjustment tax, and the oil consumption special tax will be abolished; the salt tax will be merged into the resource tax, and the special consumption tax into the excise tax.

What is the VAT regime in China?

China's Value-Added Tax (VAT) Law was passed on 25 December 2024 and will take effect on 1 January 2026. The law maintains the current three-tier tax rate system (13%, 9%, and 6%) while introducing significant policy changes and improvements in international alignment.

What is the VAT reform in China?

China's Value-Added Tax (VAT) Law was passed on 25 December 2024 and will take effect on 1 January 2026. The law maintains the current three-tier tax rate system (13%, 9%, and 6%) while introducing significant policy changes and improvements in international alignment.

What is the VAT rule in China?

The People's Republic of China (PRC) VAT Law largely retains the existing tax system framework and the current three-tier tax rate structure: 13% for general goods sales and imports. 9% for services like transportation, post, telecommunications, water, gas, publication of books, etc. 6% mainly for modern services.

Is China approves value added tax law taking effect in 2026?

On 25 December 2024, China's legislature passed the Value-Added Tax Law of the People's Republic of China ("VAT Law"), which will come into effect on 1 January 2026 and replace the Interim Value-Added Tax Regulations of the People's Republic of China ("Interim Regulations"), which have been in force for 31 years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is China VAT and Business Tax Reform 2009?

The China VAT and Business Tax Reform 2009 refers to significant changes introduced by the Chinese government to streamline the tax system, primarily transitioning from Business Tax (BT) to Value-Added Tax (VAT) for certain sectors to encourage economic growth, improve compliance, and reduce tax burdens.

Who is required to file China VAT and Business Tax Reform 2009?

Businesses engaged in taxable activities, particularly those in sectors affected by the reform such as transportation, construction, and certain service industries, are required to file under the China VAT and Business Tax Reform 2009.

How to fill out China VAT and Business Tax Reform 2009?

To fill out the China VAT and Business Tax form, businesses must provide relevant financial data including sales details, input VAT deductions, and tax calculations as specified in the guidelines provided by the tax authorities.

What is the purpose of China VAT and Business Tax Reform 2009?

The purpose of the reform is to simplify the tax system, enhance tax compliance, reduce inefficiencies associated with the old Business Tax system, and ultimately stimulate economic activity by alleviating the tax burden on businesses.

What information must be reported on China VAT and Business Tax Reform 2009?

Businesses must report information including total sales revenue, taxable income, the applicable VAT rates, input VAT amounts, and any deductions or exemptions applicable under the reform.

Fill out your china vat and business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

China Vat And Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.