Get the free FILING OF FINANCIAL STATEMENTS IN XBRL

Show details

This document outlines the training course for the revisions to FS Manager and includes details about training dates, eligibility, funding support, administrative details, and participant registration

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign filing of financial statements

Edit your filing of financial statements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your filing of financial statements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit filing of financial statements online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit filing of financial statements. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out filing of financial statements

How to fill out FILING OF FINANCIAL STATEMENTS IN XBRL

01

Gather all necessary financial data including balance sheets, income statements, and cash flow statements.

02

Ensure that all financial statements comply with the relevant accounting standards.

03

Convert the financial statements into XBRL (eXtensible Business Reporting Language) format using a tagging tool or software.

04

Validate the XBRL document using an XBRL validator to check for errors.

05

Prepare any additional documentation required for submission.

06

Submit the validated XBRL files through the designated filing platform or regulatory body.

07

Confirm receipt of the filing and retain a copy for your records.

Who needs FILING OF FINANCIAL STATEMENTS IN XBRL?

01

Publicly traded companies that must comply with financial reporting regulations.

02

Organizations that are required to submit financial data to government agencies.

03

Financial institutions that require standardized reporting for investment analysis.

04

Any company seeking to enhance transparency and accessibility of their financial information for stakeholders.

Fill

form

: Try Risk Free

People Also Ask about

How to file financial statements in XBRL format?

Step 1: Begin with the company's financial statements. Step 2: Map Company's every financial Element to a corresponding element in published taxonomy. Step 3: Create the instance document- It involves tagging the XBRL taxonomy elements with various accounting heads in the books of accounts of the company.

How is XBRL used in financial reporting?

XBRL makes it easy to compare information in multiple languages and from different countries, can enable automated analyses across many thousands of reports, and provides high-quality input for AI models. XBRL can connect companies directly with data users, providing verified information for precise analysis.

What are the benefits to a company from putting its financial statements into XBRL?

Benefits of XBRL Filing Automated data collection. Reliable and accurate. Time-saving process. Analytical process. Improved way of reporting. Safe in data handling. Cost-effective. Helps in better decision making.

What needs to be XBRL tagged?

The most common type of financial report tagged with XBRL is those submitted to regulators, including balance sheets, cash flow and profit and loss (income) statements.

How to extract financials from XBRL?

The extraction of values from these financial statements is essential for various analyses, audits, and further reporting. Steps for Extracting Values from Financial Statements. Identify Relevant Sections. Use Standardized Formats and Tags. Leverage Automation Tools. Manual Review and Verification. Reporting and Analysis.

Are financial statements tagged ing to the XBRL?

XBRL (eXtensible Business Reporting Language) is an XML-based language for the electronic communication of business and financial data. Each item on the financial statements is tagged with information about various attributes, such as calendar year, audited/unaudited status, currency, etc.

How to file financial statements in XBRL format?

Step 1: Begin with the company's financial statements. Step 2: Map Company's every financial Element to a corresponding element in published taxonomy. Step 3: Create the instance document- It involves tagging the XBRL taxonomy elements with various accounting heads in the books of accounts of the company.

How is XBRL used in financial reporting?

XBRL makes it easy to compare information in multiple languages and from different countries, can enable automated analyses across many thousands of reports, and provides high-quality input for AI models. XBRL can connect companies directly with data users, providing verified information for precise analysis.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

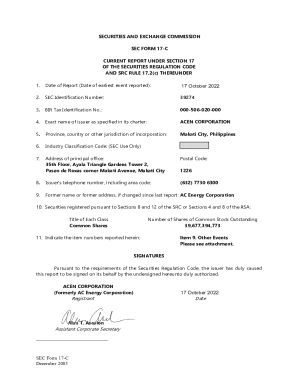

What is FILING OF FINANCIAL STATEMENTS IN XBRL?

Filing of financial statements in XBRL (eXtensible Business Reporting Language) refers to the process of preparing and submitting financial data in a structured digital format that can be easily analyzed and processed by computers.

Who is required to file FILING OF FINANCIAL STATEMENTS IN XBRL?

Typically, publicly traded companies and certain large private companies, as mandated by regulatory authorities, are required to file their financial statements in XBRL format.

How to fill out FILING OF FINANCIAL STATEMENTS IN XBRL?

To fill out the filing, companies must use XBRL-compatible software to tag their financial data with standard XBRL taxonomy elements, ensuring accuracy and compliance with regulatory requirements before submission.

What is the purpose of FILING OF FINANCIAL STATEMENTS IN XBRL?

The purpose of filing financial statements in XBRL is to enhance the transparency, comparability, and accessibility of financial data, thereby facilitating better analysis and decision-making by investors and regulators.

What information must be reported on FILING OF FINANCIAL STATEMENTS IN XBRL?

The information that must be reported includes balance sheets, income statements, cash flow statements, and various notes and disclosures, all tagged according to the relevant taxonomy.

Fill out your filing of financial statements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Filing Of Financial Statements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.