Get the free IRA Intake Form

Show details

Este formulario es utilizado para recopilar información sobre el titular de la cuenta IRA, contribuciones, beneficiarios, y para gestionar la transferencia de activos hacia o desde un custodio actual.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira intake form

Edit your ira intake form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira intake form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

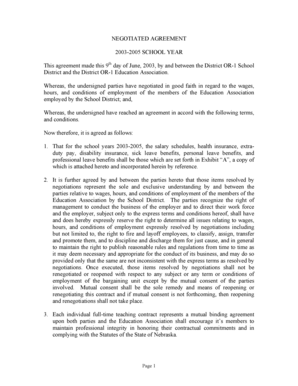

Editing ira intake form online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ira intake form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

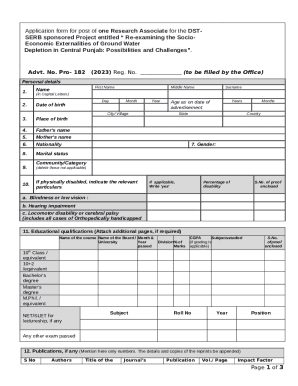

How to fill out ira intake form

How to fill out IRA Intake Form

01

Gather your personal information including your name, address, and Social Security number.

02

Provide details about your employment situation including the name of your employer and your position.

03

Indicate your contribution type (Traditional or Roth IRA).

04

Fill in your financial information, including your income, and any prior IRA contributions.

05

Sign and date the form to certify that all information is accurate.

Who needs IRA Intake Form?

01

Individuals looking to open an Individual Retirement Account (IRA) for retirement savings.

02

People wishing to switch between different IRA accounts or providers.

03

Anyone wanting to make contributions to their current IRA.

Fill

form

: Try Risk Free

People Also Ask about

What is the English word for IRA?

An IRA is a type of savings account where the money you put in and the interest you earn is not taxable until you retire. IRA is an abbreviation for `Individual Retirement Account. '

Is there a form for IRA contributions?

Intake and Interview Process — Form 13614-C. Use Form 13614-C, Intake and Interview Sheet to engage your taxpayer in preparing an accurate return.

At what age is IRA withdrawal tax free?

Contributions for all types of IRAs — Roth, traditional, SEP, and SIMPLE — are reported on Form 5498.

How do you write IRA in English?

IRA Business English → individual retirement account : You may establish an IRA even if you already have an employer-sponsored retirement plan.

How do you use IRA in a sentence?

Individual retirement arrangements (IRAs)

What is the English name of IRA?

Ira is a gender-neutral name of Hebrew origins. Found in both the Torah and Bible, the name translates to “watchful” and refers to one of King David's Mighty Warriors. This makes for a badass name to inspire baby to be as vigilant and observant as possible as they go through life.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRA Intake Form?

The IRA Intake Form is a document used to gather essential information about an individual intending to establish an Individual Retirement Account (IRA). It is typically required by financial institutions to set up the account.

Who is required to file IRA Intake Form?

Individuals who wish to open an IRA account are required to fill out the IRA Intake Form. This includes those looking to contribute to a traditional IRA, Roth IRA, or other types of IRAs.

How to fill out IRA Intake Form?

To fill out the IRA Intake Form, individuals need to provide personal information such as their name, address, Social Security number, date of birth, and beneficiary details. They may also need to indicate their IRA type and contribution amounts.

What is the purpose of IRA Intake Form?

The purpose of the IRA Intake Form is to collect necessary information to open an IRA account, ensuring compliance with regulatory requirements and establishing the account holder's eligibility.

What information must be reported on IRA Intake Form?

The information that must be reported on the IRA Intake Form includes personal identification details, type of IRA account, contribution amounts, beneficiary information, and any other required disclosures stipulated by the financial institution.

Fill out your ira intake form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Intake Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.