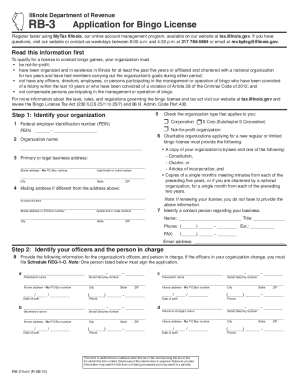

IL DoR RB-3 1995 free printable template

Show details

This form is authorized as outlined by the Bingo License and Tax Act. Disclosure of this information is REQUIRED. Failure to provide information could result in this form not being processed. This form has been approved by the Forms Management Center. IL-492-1359 Step 3 continued Tell us about your bingo event 6 What day of the week will bingo be played 9 Estimate the number of people who will play bingo weekly. Use your mouse or Tab key to move through the fields. Use your mouse or space bar...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL DoR RB-3

Edit your IL DoR RB-3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL DoR RB-3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IL DoR RB-3 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IL DoR RB-3. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL DoR RB-3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL DoR RB-3

How to fill out IL DoR RB-3

01

Obtain the IL DoR RB-3 form from the Illinois Department of Revenue website or local office.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information, including your name, address, and Social Security number.

04

Provide details about your business, including the business name and registration number.

05

Indicate the type of tax credits you are applying for if applicable.

06

Attach any required documentation that supports your claim.

07

Review your entire form for accuracy and completeness.

08

Sign and date the form at the designated area.

09

Submit the completed form to the appropriate address provided in the instructions.

Who needs IL DoR RB-3?

01

Individuals or entities who operate a business in Illinois and are applying for tax rebates or credits.

02

Taxpayers seeking to appeal or adjust prior tax calculations.

03

Business owners looking to report certain tax liabilities.

Instructions and Help about IL DoR RB-3

Fill

form

: Try Risk Free

People Also Ask about

What makes bingo gambling?

Counted as Gambling When bingo has players engaging in a cash or monetary exchange, it is something the state and federal law counts as gambling. However, since 2011, this form of gaming is no longer illegal by federal law. If playing bingo online, there are ten states that consider the game illegal.

Is bingo considered gambling in Illinois?

While Illinois gambling laws allow betting on horse racing and riverboat s, most other types of gambling are prohibited in the state. Contests of skill (rather than mere chance) are allowed, as are charitable games, bingo, and raffles.

Is playing bingo considered gambling?

Bingo Is a Form of Social Gambling Most states consider bingo a form of gambling in a social setting, especially when players receive a cash prize or engage in monetary exchanges. However, despite the exchange of money, bingo is often a legal activity at the state level.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute IL DoR RB-3 online?

Filling out and eSigning IL DoR RB-3 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit IL DoR RB-3 online?

The editing procedure is simple with pdfFiller. Open your IL DoR RB-3 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit IL DoR RB-3 straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing IL DoR RB-3.

What is IL DoR RB-3?

IL DoR RB-3 is a tax form used by the Illinois Department of Revenue to report certain business-related information.

Who is required to file IL DoR RB-3?

Businesses operating in Illinois that meet specific criteria related to their income or transactions are required to file IL DoR RB-3.

How to fill out IL DoR RB-3?

To fill out IL DoR RB-3, gather the necessary financial documents, enter your business information, report your income, and follow the instructions provided with the form to ensure all sections are completed accurately.

What is the purpose of IL DoR RB-3?

The purpose of IL DoR RB-3 is to collect information on business activities and ensure compliance with state tax regulations.

What information must be reported on IL DoR RB-3?

Information required on IL DoR RB-3 includes the business's name, address, federal Employer Identification Number (EIN), income details, and any applicable deductions or credits.

Fill out your IL DoR RB-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL DoR RB-3 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.