Get the free Fact Sheet on the Returning Heroes and Wounded Warrior Tax Credits

Show details

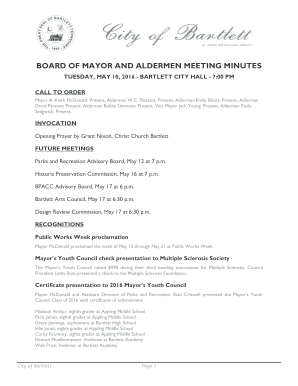

This document provides information about the Returning Heroes and Wounded Warrior Tax Credits as part of The Vow to Hire Heroes Act of 2011, outlining eligibility criteria, benefits for employers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fact sheet on form

Edit your fact sheet on form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fact sheet on form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fact sheet on form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fact sheet on form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fact sheet on form

How to fill out Fact Sheet on the Returning Heroes and Wounded Warrior Tax Credits

01

Obtain the Fact Sheet from the official tax website or IRS.

02

Fill in your personal information, including name, address, and Social Security number.

03

Indicate the qualified tax credits you are applying for: Returning Heroes Tax Credit or Wounded Warrior Tax Credit.

04

Provide details about your military service and employment history.

05

Specify the dates for which you are claiming the credits.

06

Ensure that you include all necessary supporting documentation such as proof of service or employment letters.

07

Review the Fact Sheet for accuracy and completeness before submission.

08

Submit the completed Fact Sheet to the appropriate tax authority as directed.

Who needs Fact Sheet on the Returning Heroes and Wounded Warrior Tax Credits?

01

Veterans and service members who have been hired by employers.

02

Employers looking to claim tax credits for hiring veterans.

03

Tax professionals assisting clients with tax credits for military service.

04

Individuals seeking to understand benefits available for returning service members.

Fill

form

: Try Risk Free

People Also Ask about

What is the Heroes tax program?

HEROES increases the CTC's refundability and maximum credit amount. Under current law (until the end of 2025), the CTC tops out at $2,000 per child, $1,400 of which is refundable. Under HEROES, the maximum credit would temporarily increase from $2,000 to $3,000 and be fully-refundable for the 2020 tax year.

Who can claim the American Opportunity Tax Credit?

A student eligible for the American Opportunity tax credit: has not completed the first four years of post-secondary education. enrolls in at least one academic semester during the applicable tax year. maintains at least half-time status in a program leading to a degree or other credential.

What is the Heroes Act loan forgiveness?

The HEROES Act authorizes the Secretary to "waive or modify" statutory or regulatory provisions applicable to federal student financial assistance programs under Title IV of the Higher Education Act (HEA) of 1965 to ensure that borrowers are not placed in a worse position financially in relation to their student loans

What is the Heroes Act tax credit?

Under HEROES, the maximum credit would temporarily increase from $2,000 to $3,000 and be fully-refundable for the 2020 tax year. It also creates a new younger child tax credit. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer's tax bill directly.

What does the Heroes Act cover?

The Heroes Act includes about $1.13 trillion of emergency supplemental appropriations to federal agencies, as well as economic assistance to governments at the state, local, tribal, and territorial levels.

Do veterans get a tax credit?

Income: U.S. military retirement payments (including Survivor Benefit Plan and Retired Serviceman's Family Protection Plan) and federally exempt military pay are tax-free. Property: Veterans and un-remarried surviving spouses can claim a refundable tax credit for their primary residence up to one acre.

How does the work opportunity tax credit work?

The Work Opportunity Tax Credit (WOTC) is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group .

Are donations to Wounded Warrior tax deductible?

Wounded Warrior Project® (WWP) was granted tax-exempt status by the Internal Revenue Service functioning as a charity under 501(c)(3) of the Internal Revenue Code. Donations to the organization are deductible as charitable contributions. The WWP Federal I.D. number for donations is #20-2370934.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fact Sheet on the Returning Heroes and Wounded Warrior Tax Credits?

The Fact Sheet on the Returning Heroes and Wounded Warrior Tax Credits provides information about tax incentives available to employers who hire qualified veterans, aimed at promoting employment opportunities for those who have served in the military.

Who is required to file Fact Sheet on the Returning Heroes and Wounded Warrior Tax Credits?

Employers who wish to claim the Returning Heroes and Wounded Warrior tax credits must file the Fact Sheet as part of their tax filings to provide documentation supporting their claims for hiring qualified veterans.

How to fill out Fact Sheet on the Returning Heroes and Wounded Warrior Tax Credits?

To fill out the Fact Sheet, employers need to provide specific information such as the names and Social Security numbers of the veterans hired, the dates of employment, and the details of the positions filled. This includes ensuring all eligibility criteria are met and documented.

What is the purpose of Fact Sheet on the Returning Heroes and Wounded Warrior Tax Credits?

The purpose of the Fact Sheet is to outline the eligibility requirements and provide necessary information for employers to claim tax credits for hiring veterans, ultimately encouraging the employment of those who have served in the armed forces.

What information must be reported on Fact Sheet on the Returning Heroes and Wounded Warrior Tax Credits?

The information that must be reported includes the veteran's name, Social Security number, the date of hire, the hours worked, as well as the specific tax credit amounts being claimed for the employment of each veteran.

Fill out your fact sheet on form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fact Sheet On Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.