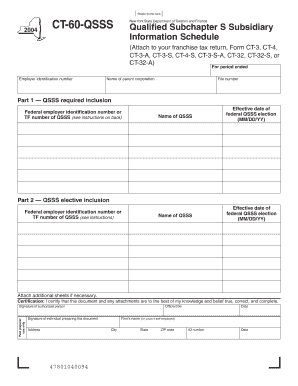

Get the free ROTH ira APPLICATION

Show details

This document serves as an application for opening a Roth Individual Retirement Account (IRA), including sections for account information, investment selections, residency, and beneficiary designations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign roth ira application

Edit your roth ira application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your roth ira application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit roth ira application online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit roth ira application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out roth ira application

How to fill out ROTH ira APPLICATION

01

Gather necessary documents such as Social Security number, identification, and income details.

02

Choose a financial institution or brokerage that offers a Roth IRA.

03

Obtain the Roth IRA application form from the selected institution's website or office.

04

Fill out personal information including name, address, and date of birth.

05

Provide your Social Security number for identification purposes.

06

Specify your contribution amount and select investment options if applicable.

07

Review the application for completeness and accuracy.

08

Sign and date the application form.

09

Submit the application, along with any required initial deposit, to the financial institution.

Who needs ROTH ira APPLICATION?

01

Individuals seeking to save retirement funds with tax-free growth.

02

Young professionals with a lower income tax rate who want to lock in a lower tax bracket for retirement.

03

Anyone looking for a flexible retirement savings option that allows for tax-free withdrawals in retirement.

04

People who want to diversify their retirement savings strategies beyond traditional IRAs.

Fill

form

: Try Risk Free

People Also Ask about

What disqualifies you from having a Roth IRA?

Income: To contribute to a Roth IRA, you must have compensation (i.e. wages, salary, tips, professional fees, bonuses). Your modified adjusted gross income must be less than: $160,000 - Married filing jointly. $10,000 - Married filing separately (and you lived with your spouse at any time during the year).

Do banks charge for Roth IRA?

Many financial institutions will not apply a fee to open a Roth IRA. However, these brokers or platforms often stipulate a minimum initial deposit that you must put into your account, even if you're not sure where you want to invest immediately. This deposit will vary depending on the institution.

What is the best place to start a Roth IRA?

Best Roth IRA accounts of May 2025: Charles Schwab. Wealthfront. Betterment. Fidelity Investments. Interactive Brokers. Fundrise. Schwab Intelligent Portfolios. Vanguard.

Is it smart to open a Roth IRA with your bank?

For individuals who anticipate that they will be in a higher tax bracket when they are older or have retired, Roth IRAs can provide a beneficial option, as the money is not taxable if you've met the time requirements, unlike withdrawals from a traditional 401(k) or traditional IRA.

How do I apply for a Roth IRA?

Ready to open a Roth IRA? Choosing the type of IRA account. Providing your personal, employment, and financial information. Selecting specific account features. Creating login credentials and providing contact information for your account. Verifying your identity. Indicating how you'll fund the account.

What is the best bank to open a Roth IRA?

Vanguard, Fidelity, and Schwab are good to go for ROTHs. Just remember to actually select what the roth is composed (index funds for example). Some people make the mistake of just opening and putting money in the roth ira but won't grow because it is not invested in anything.

Which bank is best open a Roth IRA with?

Vanguard, Fidelity, and Schwab are good to go for ROTHs. Just remember to actually select what the roth is composed (index funds for example). Some people make the mistake of just opening and putting money in the roth ira but won't grow because it is not invested in anything.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ROTH ira APPLICATION?

A ROTH IRA application is a form that individuals complete to open a ROTH IRA account, which allows them to contribute after-tax income and grow their investment income tax-free.

Who is required to file ROTH ira APPLICATION?

Anyone who wishes to open a ROTH IRA account must complete the ROTH IRA application, typically including individuals with earned income below certain thresholds.

How to fill out ROTH ira APPLICATION?

To fill out a ROTH IRA application, provide your personal information such as your name, address, Social Security number, employment details, and beneficiary information, and then sign and submit the application.

What is the purpose of ROTH ira APPLICATION?

The purpose of the ROTH IRA application is to establish an individual retirement account that allows you to save for retirement while enjoying tax-free growth and tax-free withdrawals in retirement.

What information must be reported on ROTH ira APPLICATION?

The ROTH IRA application typically requires personal details including your full name, address, Social Security number, date of birth, and information about your investment selections and beneficiaries.

Fill out your roth ira application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Roth Ira Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.