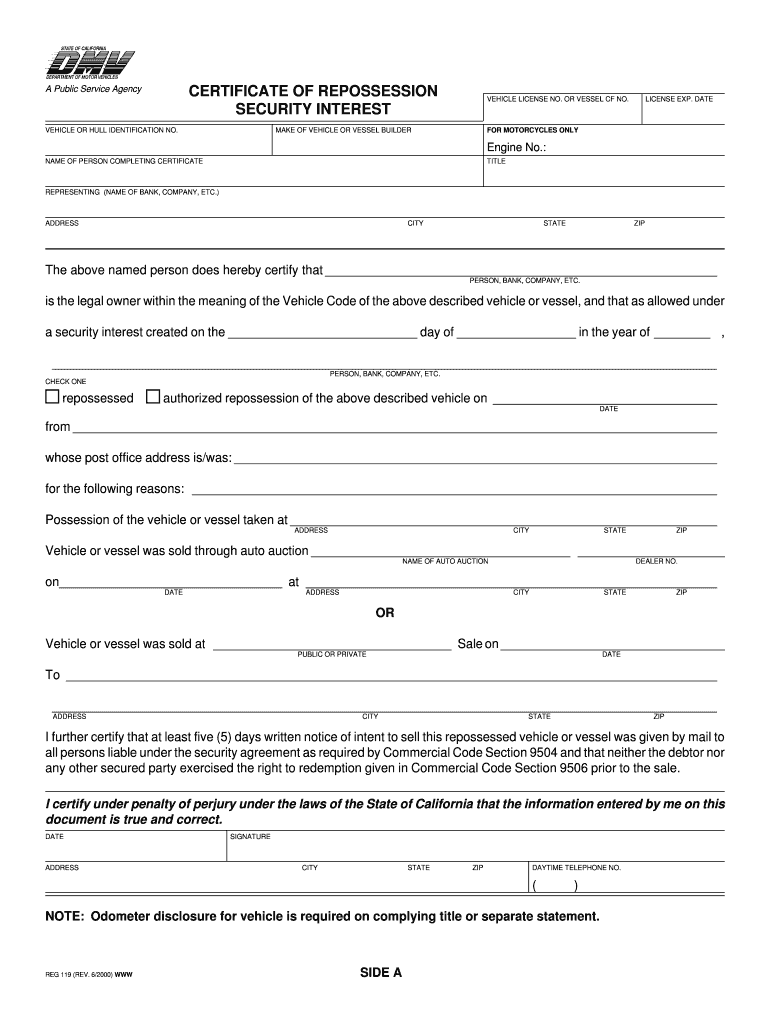

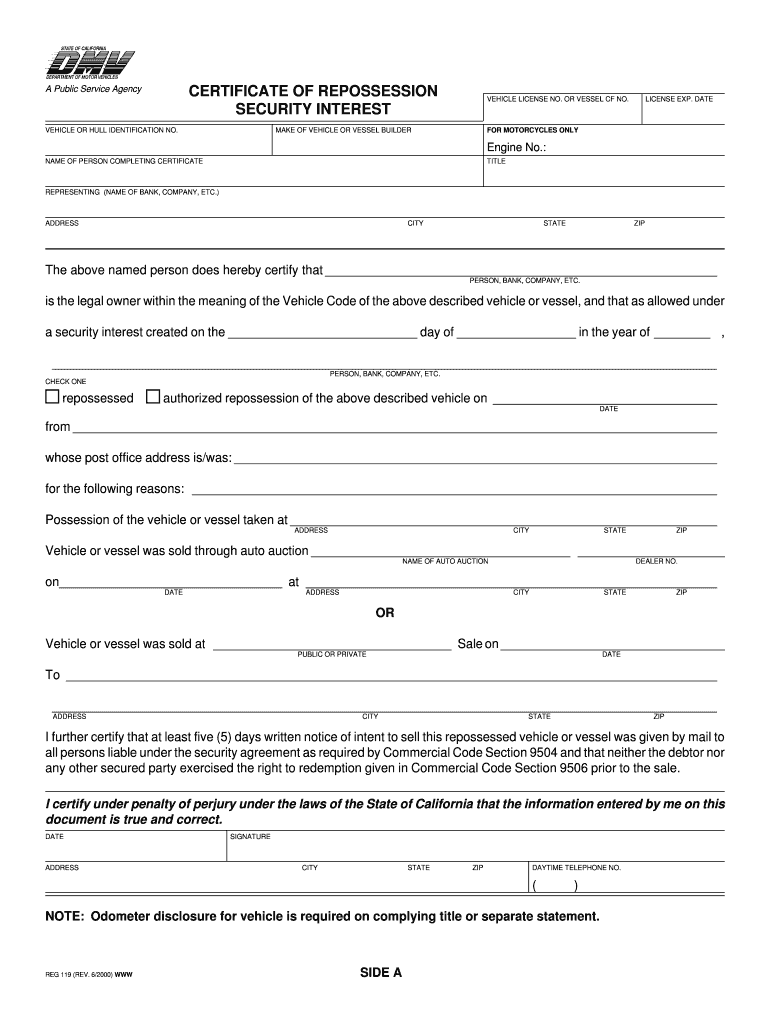

Get the free CERTIFICATE OF REPOSSESSION

Show details

This document certifies the repossession of a vehicle or vessel by a public service agency, detailing the legal owner, reasons for repossession, and compliance with applicable laws.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of repossession

Edit your certificate of repossession form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of repossession form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit certificate of repossession online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit certificate of repossession. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificate of repossession

How to fill out CERTIFICATE OF REPOSSESSION

01

Obtain the CERTIFICATE OF REPOSSESSION form from the appropriate authority or online.

02

Fill in the section for your personal information such as name, address, and contact details.

03

Provide details about the original loan agreement, including the date of agreement, account number, and loan amount.

04

Describe the repossessed item, including make, model, and any serial numbers.

05

Include the date of repossession and the location where the repossession took place.

06

Ensure both you (the creditor) and the borrower (debtor) sign the document where indicated.

07

Submit the completed certificate to the relevant authorities or retain it for your records.

Who needs CERTIFICATE OF REPOSSESSION?

01

Creditors who have repossessed property from debtors.

02

Financial institutions that need to document the repossession of collateral.

03

Individuals or businesses involved in leasing agreements where repossession is necessary.

Fill

form

: Try Risk Free

People Also Ask about

What happens if the repo man never finds your car?

The Repossession Process in California If you default — usually defined in the contract as missing even one payment — the lender technically has the legal right to repossess the car without going to court. They don't need your permission, and they don't have to give you notice ahead of time.

Do they send a letter before repossession?

If your car loan lender repossesses your car in California, you're not entitled to any notice before the repossession. However, the car lender must provide you with certain notices after taking the vehicle, including: a notice of the seizure. an inventory of the personal property in the vehicle, and.

How do you write a repossession letter?

Dear [Borrower Name]: You are hereby notified that your [description of motor vehicle, year, make, model and VIN #], was lawfully repossessed on [Date] because you defaulted on your loan with [Credit Union Name]. The vehicle is being held at [location address of vehicle]. be sold at public sale.

How do I write a voluntary repossession letter?

Identify yourself and your vehicle. Be sure to include an account number so that your lender can match your letter to your records. Explain that you're unable to make payments and intend to surrender the car. Provide contact information so that your lender can reach you.

Can I remove a repossession from my credit report?

You can also use websites like Carfax, Auto Trader, Buy It Now, eBay and CarsDirect. All these websites provide information about repossessed cars.

Can you look up car repossession?

A repossession affidavit is a legal statement filed with the Department of Motor Vehicles when you repossess a car from a customer. This document provides details about the repossession such as why and how the vehicle was repossessed. It also informs government authorities that the vehicle has been repossessed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CERTIFICATE OF REPOSSESSION?

A Certificate of Repossession is a legal document issued to confirm that a lender has taken possession of property after a borrower has defaulted on a loan or obligation.

Who is required to file CERTIFICATE OF REPOSSESSION?

Typically, lenders or repossession agents who take possession of the property are required to file a Certificate of Repossession.

How to fill out CERTIFICATE OF REPOSSESSION?

To fill out a Certificate of Repossession, include details such as the borrower's information, a description of the repossessed property, the reason for repossession, and the lender's information. Ensure all required signatures are included.

What is the purpose of CERTIFICATE OF REPOSSESSION?

The purpose of a Certificate of Repossession is to formally document the transfer of ownership of the repossessed property back to the lender and to notify relevant parties of the repossession.

What information must be reported on CERTIFICATE OF REPOSSESSION?

Information that must be reported includes the names and addresses of the borrower and lender, a detailed description of the property, the date of repossession, and any applicable loan or account numbers.

Fill out your certificate of repossession online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Repossession is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.