Get the free Form 5558

Show details

Use Form 5558 to apply for a one-time extension of time to file Form 5500, Form 5500-EZ, or Form 5330.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 5558

Edit your form 5558 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 5558 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 5558 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 5558. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 5558

How to fill out Form 5558

01

Start with the top of the form where you will enter your name and address.

02

Enter the type of plan for which you are filing the form (e.g., pension or profit-sharing).

03

Fill in the applicable IRS Employer Identification Number (EIN).

04

Specify the plan year dates in the appropriate sections.

05

Indicate the reason for the extension request, such as inability to file on time.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the designated areas.

08

Submit the form by mailing it to the designated IRS address.

Who needs Form 5558?

01

Employees or employers managing employee benefit plans who need to request an extension for filing Form 5500.

02

Plan administrators responsible for the compliance of pension and welfare benefit plans.

Fill

form

: Try Risk Free

People Also Ask about

Does form 5558 need to be filed electronically?

The IRS has released the 2025 Form 5558 to be used to request an extension in filing the Form 5500 that will report about the 2024 plan year. And now it can be filed electronically, as well as on paper.

What is the IRS Form 5500 used for?

The employer maintaining the plan or the plan administrator of a Pension or Welfare benefit plan covered by ERISA. File Form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan.

What is the IRS form 5558 used for?

Use Form 5558 to apply for a one-time extension of time to file the Form 5500 series, and Form 8955-SSA. To avoid processing delays, the most recent version of this Form 5558 must be used. For example, this Form 5558 (Rev. January 2025) must be used instead of the January 2024 version or any other prior version.

Who counts as a participant for 5500?

Active participants (i.e., any individuals who are currently in employment covered by the plan and who are earning or retaining credited service under the plan). This includes any individuals who are eligible to elect to have the employer make payments under a Code section 401(k) qualified cash or deferred arrangement.

What type of return is a 5500?

Page 1 of 1 The 5500 series of tax forms are prepared by retirement plans. They report the business activity, investments, expenditures and earnings of the plan for the year.

What is a 5500 used for?

Form 5500 is filed with the DOL and contains information about a 401(k) plan's financial condition, plan qualifications, and operation. The form aims to provide the IRS and DOL with information about the plan's operation and compliance with government regulations.

What happens if you don't file form 5500?

It's normally a year after it was due and includes a substantial penalty. Late filed returns are subject to penalties from both IRS and DOL, so it's very important to identify this mistake before we do. The IRS penalty for late filing of a 5500-series return is $25 per day, up to a maximum of $15,000.

Does form 5558 have to be signed?

If you are filing Form 5558 for an extension to file Form 5500 series return/report or Form 8955-SSA, a signature is not required.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

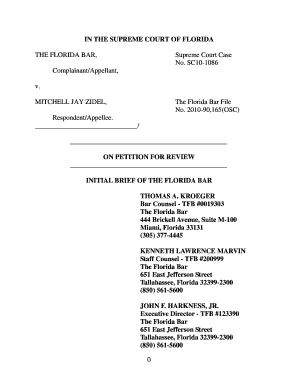

What is Form 5558?

Form 5558 is a form used by employers to request an extension of time to file certain employee benefit plan returns, specifically the Form 5500 series.

Who is required to file Form 5558?

Employers who need to request an extension for filing Form 5500, Form 5500-SF, or Form 5500-EZ for their qualified pension and welfare benefit plans are required to file Form 5558.

How to fill out Form 5558?

To fill out Form 5558, you need to provide information such as the name of the plan, the plan number, the employer's name, address, and Employer Identification Number (EIN), and indicate the type of extension being requested.

What is the purpose of Form 5558?

The purpose of Form 5558 is to allow employers additional time to file the required annual reports for employee benefit plans without incurring penalties for late filing.

What information must be reported on Form 5558?

Form 5558 must include the plan's name, plan number, EIN of the employer, the specific form for which an extension is being requested, the signature of the plan administrator or authorized representative, and any applicable fees.

Fill out your form 5558 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 5558 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.