Get the free Application for Extension for Filing Partnership, Estate, or Trust Tax Return

Show details

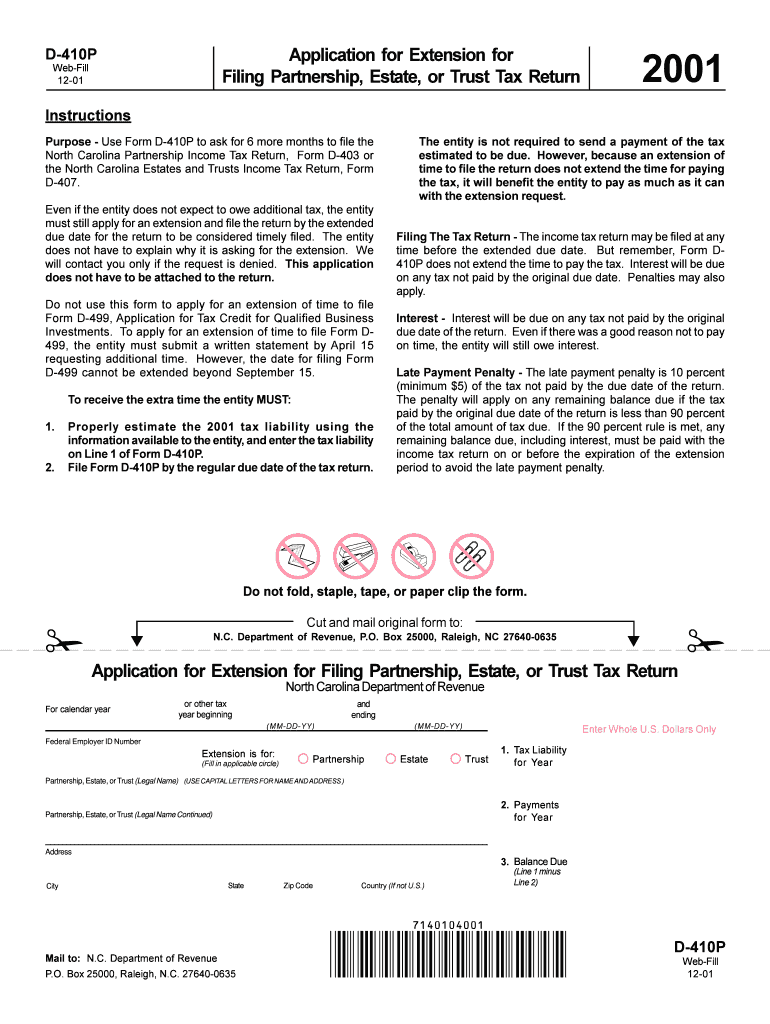

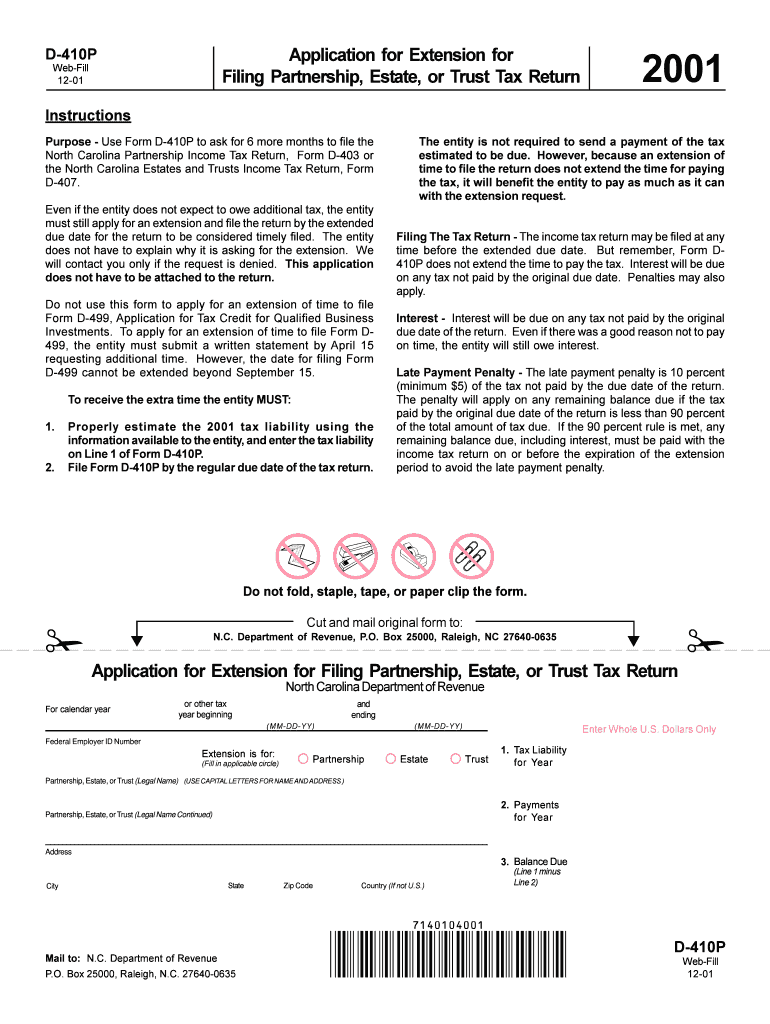

Use Form D-410P to ask for 6 more months to file the North Carolina Partnership Income Tax Return or the North Carolina Estates and Trusts Income Tax Return.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for extension for

Edit your application for extension for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for extension for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for extension for online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for extension for. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for extension for

How to fill out Application for Extension for Filing Partnership, Estate, or Trust Tax Return

01

Obtain the Application for Extension for Filing Partnership, Estate, or Trust Tax Return form from the IRS website or a tax professional.

02

Fill in the entity's name, address, and Employer Identification Number (EIN) in the designated fields.

03

Indicate the type of return for which you are requesting an extension.

04

Provide the tax year for which the extension is being requested.

05

Estimate the taxes owed, if any, and include payment for that amount to avoid penalties.

06

Sign and date the application, ensuring that it is completed by an authorized person.

07

Submit the application to the appropriate IRS address by the due date of the original return.

Who needs Application for Extension for Filing Partnership, Estate, or Trust Tax Return?

01

Partnerships that require more time to file their tax returns.

02

Estates that are in the process of settling and need additional time for tax reporting.

03

Trusts that are unable to file their returns by the due date and require an extension.

Fill

form

: Try Risk Free

People Also Ask about

What happens if I file a partnership return late?

Partnership Late Filing – IRC 6698 — We charge a penalty when you file your partnership return late. The penalty is $220 for each person who was a partner at any time during the tax year, for each month or part of a month that the return was filed late, for up to 12 months.

Can you file an extension for K1?

If you can't file on time because you did not receive your K-1 timely, you will need to file an extension. This is done on Form 4868, Application for Automatic Extension of Time to File U.S. Income Tax Return. A properly filed extension request will extend the due date to file until October 15, 2023.

How do I file an extension for an estate tax return?

Use Form 4768 to: Apply for an automatic 6-month extension of time to file Form 706, Form 706-A, Form 706-NA, or Form 706-QDT. Apply for a discretionary (additional) extension of time to file Form 706 (Part II of Form 4768).

What is the difference between form 7004 and form 4868?

Choosing the Right Extension Form with TaxZerone Tax Return Type: Form 7004 covers business-related returns, while Form 4868 is strictly for individual income tax returns.

Can you file a 1065 extension late?

Late filing of Form 1065 The following penalties are incurred if the return is filed after the regular or extended due date of the return: $205 for each member of the partnership for each month or partial month that the return is late for up to 12 months.

How do I file an extension for a partnership return?

To file for an LLC extension, file Form 7004: Application for Automatic Extension of Time to File Certain Business Income Tax Information, and Other Returns. When you request partnership extension, your LLC will get an automatic five-month extension to file Form 1065.

How do I file an extension for a trust tax return?

California does not require filing written extensions. If the fiduciary cannot file Form 541, California Fiduciary Income Tax Return, or Form 541-QFT, California Income Tax Return for Qualified Funeral Trusts, by the due date, the fiduciary is granted an automatic six-month extension.

Can you file an extension for a partnership return?

When you request partnership extension, your LLC will get an automatic five-month extension to file Form 1065. For a partnership, Form 1065 is submitted instead of Form 1120S. Form 4868 is filed by individuals who need to request extension and for single-member LLCs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Extension for Filing Partnership, Estate, or Trust Tax Return?

The Application for Extension for Filing Partnership, Estate, or Trust Tax Return is a form that allows partnerships, estates, and trusts to request an extension of time to file their respective tax returns.

Who is required to file Application for Extension for Filing Partnership, Estate, or Trust Tax Return?

Partnerships, estates, and trusts that need additional time to complete their tax returns are required to file this application.

How to fill out Application for Extension for Filing Partnership, Estate, or Trust Tax Return?

To fill out the application, provide basic information such as the name of the partnership, estate, or trust, the employer identification number (EIN), the address, and the requested extension period. Follow the specific instructions provided on the form.

What is the purpose of Application for Extension for Filing Partnership, Estate, or Trust Tax Return?

The purpose of the application is to grant a taxpayer additional time to file their tax return without incurring penalties for late submission.

What information must be reported on Application for Extension for Filing Partnership, Estate, or Trust Tax Return?

The application must report the name of the entity, the EIN, the address, the type of return being filed, and the period for which the extension is requested.

Fill out your application for extension for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Extension For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.