FL CR2EO91 2002-2026 free printable template

Show details

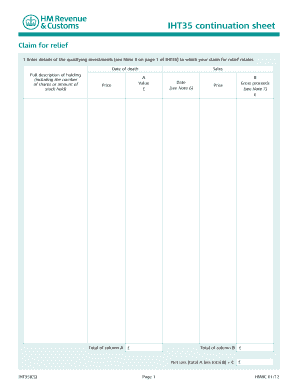

(THIS FORM IS TO BE USED FOR PURPOSES OF FILING A JUDGMENT LIEN WHICH WAS PREVIOUSLY ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL CR2EO91

Edit your FL CR2EO91 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL CR2EO91 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

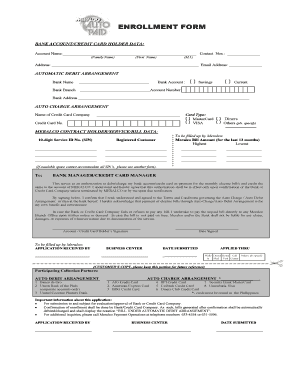

Editing FL CR2EO91 online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit FL CR2EO91. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

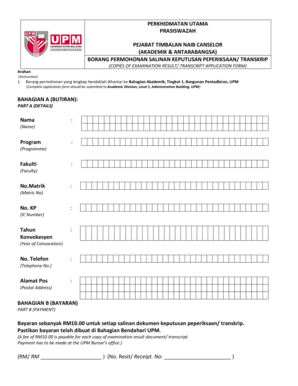

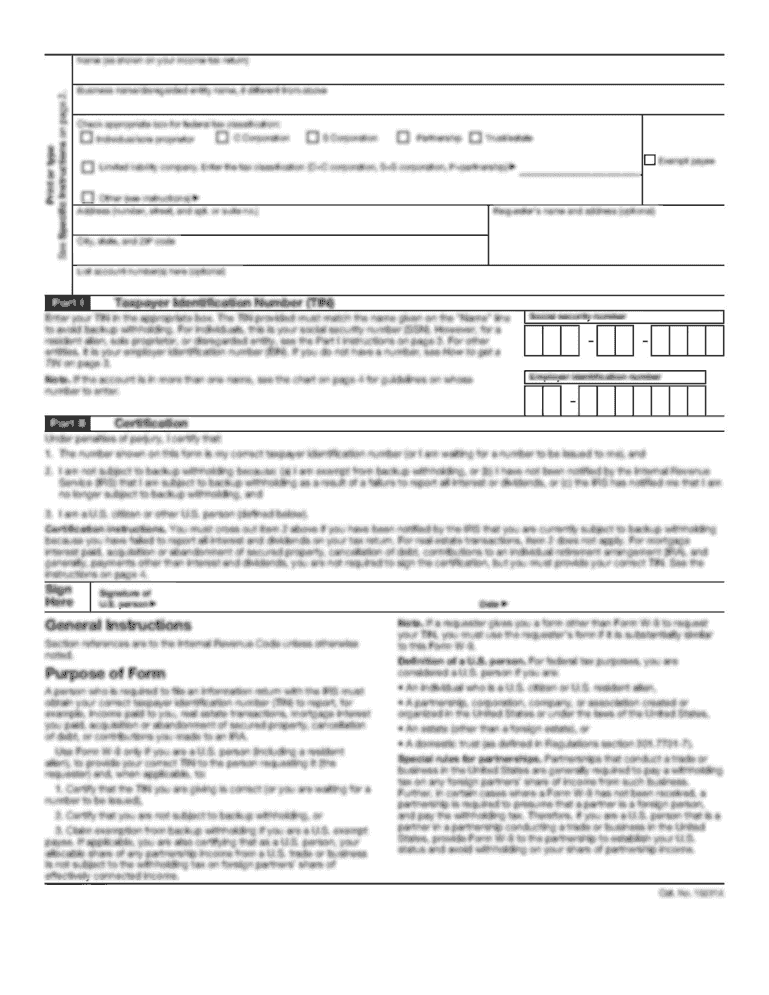

How to fill out FL CR2EO91

How to fill out FL CR2EO91

01

Gather all required personal and financial information.

02

Start with the applicant's name and contact details at the top of the form.

03

Fill in the identification or account number if applicable.

04

Provide details about the entity or individual the form pertains to.

05

Complete any sections requiring financial data, ensuring accuracy.

06

Review the instructions specific to FL CR2EO91 for any additional documentation needed.

07

Sign and date the form at the bottom.

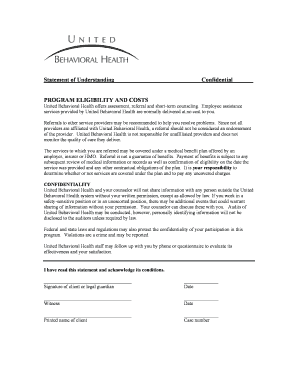

Who needs FL CR2EO91?

01

Individuals or entities required to report financial information.

02

Taxpayers who need to provide details for compliance.

03

Anyone involved in specific financial transactions as outlined by the form.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a Judgement lien certificate in Florida?

Judgment Lien File online with a credit card. OR. Complete the fillable PDF form using your computer. Print and sign it. Mail the document with payment to the Division of Corporations. OR. Print the PDF form. Complete it using blue or black ink. Sign it. Mail the document with payment to the Division of Corporations.

How do I get a Judgement lien removed from my house in Florida?

Florida statutes provide a procedure to remove judgment liens from homestead in advance of a sale or refinance. Florida Statute 222.01(2) provides a procedure to send a form notice to the judgment creditors claiming homestead exemption. The creditor 45 days after notice to contest the claim of homestead.

How do I get rid of a lien on my property in Florida?

If you want to remove a lien from your property, you need to do one of two things: 1) have the contractor record a release of the lien or 2) file an appeal to have the lien released.

How long does a lien judgment stay recorded on your property in Florida?

How long does a judgment lien last in Florida? A judgment lien in Florida will remain attached to the debtor's property (even if the property changes hands) for ten years (real estate lien) or five years (personal property lien).

How long is a judgment lien valid in Florida?

There is a time limit on judgment liens. The statute of limitations for collecting a debt in Florida is 20 years. A judgment lien on Florida property based on an underlying money judgment expires ten years after a certified copy of the judgment is recorded in the county where the property is situated.

How do I put a lien on someone's property who owes me money in Florida?

To attach a lien, the creditor must record the judgment with the county recorder in any Florida county where the debtor owns real estate now or may own real estate in future. For liens on personal property, the creditor files the judgment with the Florida Department of State.

How do I look up a Judgement in Florida?

One way to find court judgments in Florida is to visit the courthouse handling the particular case. Then, make an application requesting the records in writing from the clerk of the court, who issues the request form. Interested persons may find specific court locations on the Florida courts website.

What is the difference between a Judgement and a lien?

The easy definition is that a judgment is an official decision rendered by the court with regard to a civil matter. A judgment lien, sometimes referred to as an “abstract of judgment,” is an involuntary lien that is filed to give constructive notice and is to attach to the Judgment Debtor's property and/or assets.

How long can a judgment be enforced in Florida?

The Length of a Judgment A judgment is good for 10 years and Florida allows a creditor to “renew” a judgment before the expiration of the 10 years for an additional 10 years, thus giving a judgment almost unending life.

What happens to a judgment after 10 years in Florida?

If the creditor does not re-record the judgment ing to statutory procedures, the Florida judgment lien automatically expires after ten years.

Are liens public record in Florida?

In Florida, liens are public records, and a visit to the local county or city records office should reveal all relevant information on a property within state limits.

Do judgments attach to property in Florida?

(1) A judgment, order, or decree becomes a lien on real property in any county when a certified copy of it is recorded in the official records or judgment lien record of the county, whichever is maintained at the time of recordation, provided that the judgment, order, or decree contains the address of the person who

What happens if a defendant does not pay a judgment in Florida?

After a judgment is entered against you, the judgment creditor can garnish your bank account and wages, require you to reveal all assets belonging to you, and place a lien on any non-homestead property.

How long does a judgment lien last in Florida?

How long does a judgment lien last in Florida? A judgment lien in Florida will remain attached to the debtor's property (even if the property changes hands) for ten years (real estate lien) or five years (personal property lien).

What happens if I can't pay a Judgement in Florida?

You can't go to jail for failing to pay a debt or a judgment. However, if you do not pay a debt, or if a judgment is entered against you, this information can be reported to credit bureaus and made a part of your credit history. This information can be reported for up to seven years on your credit reports.

How do I enforce a judgment lien in Florida?

Return to the Clerk of the Court that originally issued your judgment and ask for a Writ of Execution. Deliver the Writ to the sheriff's department for the county where the debtor's property is located. Provide the sheriff's department with: A deposit to cover their fees and costs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send FL CR2EO91 to be eSigned by others?

When you're ready to share your FL CR2EO91, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find FL CR2EO91?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the FL CR2EO91 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit FL CR2EO91 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share FL CR2EO91 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

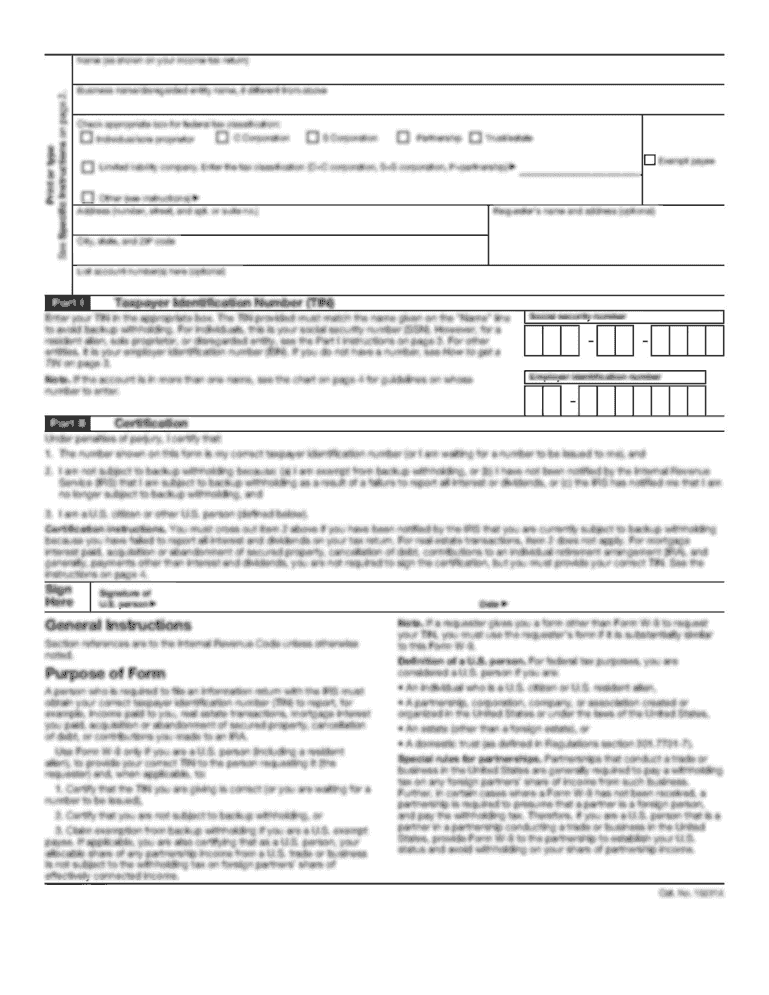

What is FL CR2EO91?

FL CR2EO91 is a form used for reporting certain financial information to the Florida Department of Revenue.

Who is required to file FL CR2EO91?

Entities or individuals who have specific financial obligations or meet certain criteria set by the Florida Department of Revenue must file FL CR2EO91.

How to fill out FL CR2EO91?

To fill out FL CR2EO91, follow the instructions provided with the form, ensuring that all required fields are completed accurately and that any necessary documentation is attached.

What is the purpose of FL CR2EO91?

The purpose of FL CR2EO91 is to ensure compliance with state tax regulations by collecting necessary financial information from filers.

What information must be reported on FL CR2EO91?

The information that must be reported on FL CR2EO91 typically includes details about income, expenses, and other financial data relevant to the tax obligations of the filer.

Fill out your FL CR2EO91 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL CR2EO91 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.