Get the free Form 14134

Show details

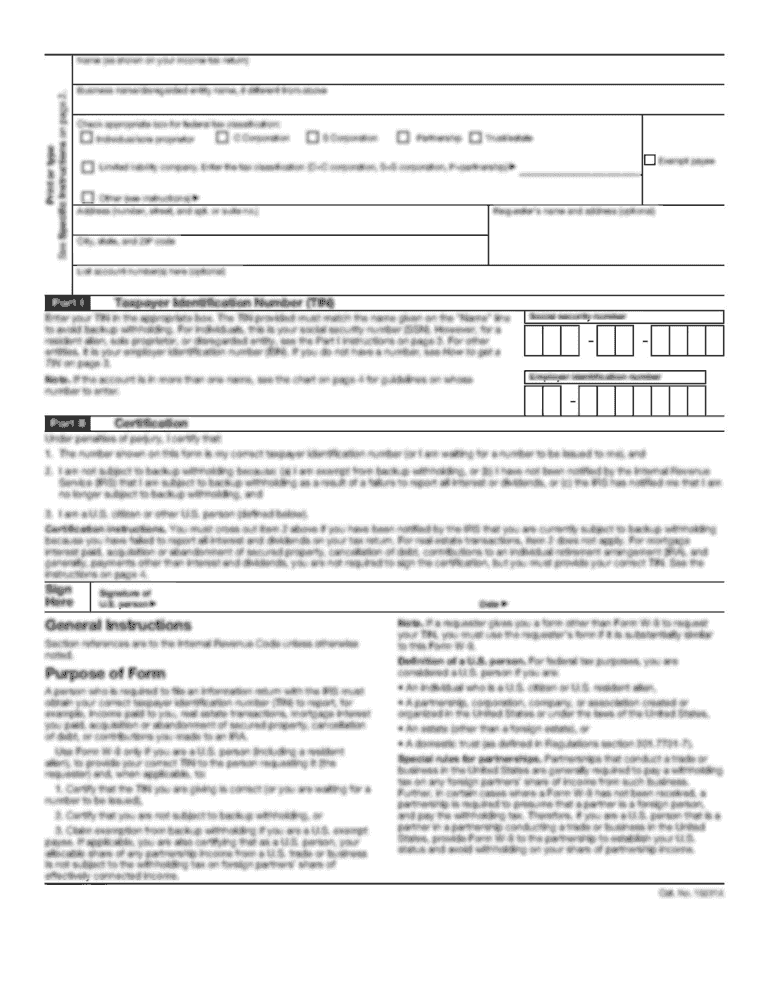

This form is used to apply for a Certificate of Subordination of Federal Tax Lien under Internal Revenue Code sections 6325(d)(1) and 6325(d)(2), allowing a creditor to prioritize their claim on a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 14134

Edit your form 14134 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 14134 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 14134 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 14134. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 14134

How to fill out Form 14134

01

Begin by downloading Form 14134 from the official website.

02

Read the instructions provided at the beginning of the form.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide information related to the request or application you are submitting.

05

Attach any required supporting documents as stated in the instructions.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form according to the submission guidelines provided.

Who needs Form 14134?

01

Individuals or organizations who are applying for a specific service or benefit that requires Form 14134.

Fill

form

: Try Risk Free

People Also Ask about

Where to send form 14134?

2. Mail the completed Form 14134 and the appropriate attachments to: IRS Advisory Consolidated Receipts 7940 Kentucky Drive, Stop 2850F Florence, KY 41042 (Refer to Publication 4235, Collection Advisory Group Addresses, for additional contact information.)

Why would someone have a federal tax lien?

A federal tax lien is the government's legal claim against your property when you neglect or fail to pay a tax debt. The lien protects the government's interest in all your property, including real estate, personal property and financial assets.

How long does it take for the IRS to remove a lien?

Paying your tax debt in full is the best way to get rid of a federal tax lien. The IRS releases your lien within 30 days after you have paid your tax debt. In certain situations, the IRS may withdraw a Notice of Federal Tax Lien even when you still owe the tax debt.

What happens when a tax warrant is issued?

If the taxpayer fails to respond or pay the owed amount, the tax authority may proceed with issuing a tax warrant. Public Record: Once issued, a tax warrant may be filed as a public record, alerting creditors and other interested parties of the government's claim against the taxpayer's property.

How do I request a lien discharge from the IRS?

To request IRS consider discharge, complete Form 14135, Application for Certificate of Discharge of Property from Federal Tax Lien.

What does a federal tax lien do to your credit?

Does a property tax lien affect your credit score? No — and neither does an income tax lien. Federal and state tax liens no longer appear on your credit report and neither affect your credit score.

How bad is a federal tax lien?

How a lien affects you. Assets — A lien attaches to all of your assets (such as property, securities, vehicles) and to future assets acquired during the duration of the lien. Credit — Once the IRS files a Notice of Federal Tax Lien, it may limit your ability to get credit.

What is form 14134?

Complete Form 14134, Application for Certificate of Subordination of Federal Tax Lien, attached with this publication.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 14134?

Form 14134 is a tax form used for reporting certain financial transactions and information to the Internal Revenue Service (IRS).

Who is required to file Form 14134?

Individuals or businesses that engage in specific financial activities as outlined by the IRS are required to file Form 14134.

How to fill out Form 14134?

To fill out Form 14134, gather required information, follow the instructions provided by the IRS, complete each section accurately, and submit it by the deadline.

What is the purpose of Form 14134?

The purpose of Form 14134 is to ensure transparency and proper reporting of certain financial transactions for tax compliance.

What information must be reported on Form 14134?

Information that must be reported on Form 14134 includes details about the financial transactions, involved parties, and the amount of money exchanged.

Fill out your form 14134 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 14134 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.