Get the free FORM 415

Show details

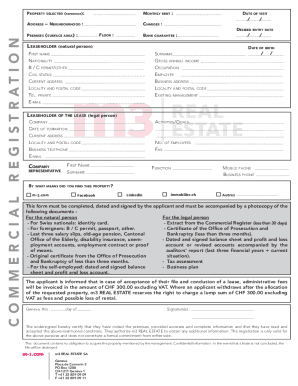

This document certifies the tax clearance status of a dealer under the Maharashtra Value Added Tax Act, 2002, stating any dues or obligations as of the date of the certificate.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 415

Edit your form 415 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 415 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 415 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 415. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 415

How to fill out FORM 415

01

Obtain FORM 415 from the official website or relevant authority.

02

Fill out your personal information at the top of the form, including name, address, and contact details.

03

Carefully read the instructions provided with the form to ensure you understand what information is required.

04

Proceed to fill out each section of the form as per the guidelines.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form where required.

07

Submit the completed form by the specified method (mail or electronic submission).

Who needs FORM 415?

01

Individuals or entities required to report certain information to the relevant authorities.

02

Taxpayers who need to declare specific financial details under regulations.

03

Organizations that must comply with filing requirements for government reporting.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to hear back from TSA after applying?

Most applicants receive approval notification in 3-5 days, though some applications can take up to 60 days. Considering this, applicants are encouraged to renew at least 60 days prior to expiry. TSA will notify members with eligibility results.

How long does TSA take to approve hazmat?

How Long Does the Process Take? The average TSA background check for Hazmat takes about 30 to 60 days. Some applications may be processed quicker, especially if your records are clean and all documents are in order. However, delays can happen.

How long does a Form 415 take?

TSA estimates each form will take approximately three minutes to complete. This collection would result in an annual reporting burden of 45,625 hours.

What is a 415 form?

Information on Filing a Petition to Terminate Sex Offender Registration (CR-415-INFO) Explains the steps to take to have a court consider whether to terminate a sex offender registration requirement. Get form CR-415-INFO.

How long does TSA Form 415 take?

TSA Full Form: Transportation Security Administration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM 415?

FORM 415 is a regulatory filing form used by certain entities to report specific financial and operational information to the relevant regulatory authority.

Who is required to file FORM 415?

Entities that meet certain thresholds set by regulatory authorities, such as public companies or businesses involved in specific industries, are required to file FORM 415.

How to fill out FORM 415?

To fill out FORM 415, entities need to provide accurate financial data and operational details as per the guidelines provided by the regulating body. It's important to follow the format and requirements specified in the instructions accompanying the form.

What is the purpose of FORM 415?

The purpose of FORM 415 is to ensure transparency and compliance with regulatory standards by collecting essential information from entities about their financial performance and operations.

What information must be reported on FORM 415?

FORM 415 typically requires reporting on financial statements, operational metrics, risk factors, management discussion, and other relevant data as required by the regulatory body.

Fill out your form 415 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 415 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.