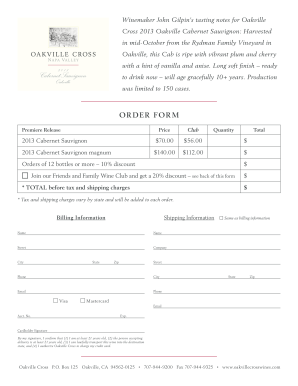

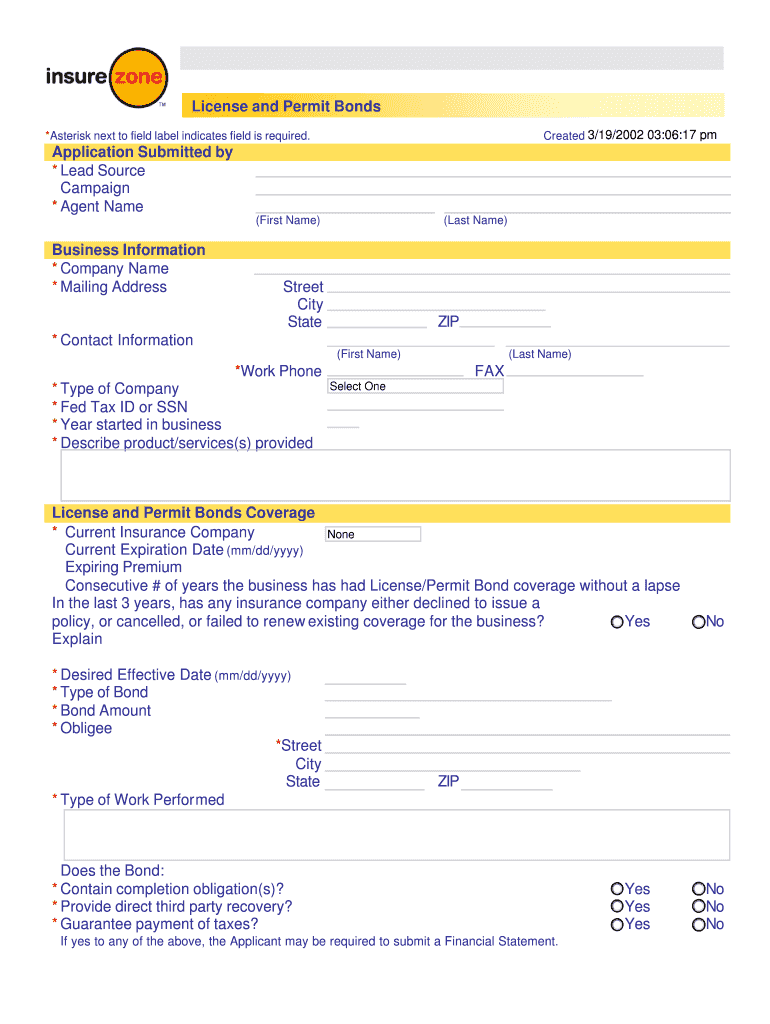

Get the free License and Permit Bonds

Show details

This document serves as an application for obtaining license and permit bonds, requiring various business information, insurance details, and acknowledgments regarding fraudulent claims.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign license and permit bonds

Edit your license and permit bonds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your license and permit bonds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit license and permit bonds online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit license and permit bonds. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out license and permit bonds

How to fill out License and Permit Bonds

01

Gather necessary information: Collect all required personal and business information, including your name, business name, and address.

02

Determine the bond amount: Identify the specific amount required for the license or permit you are applying for.

03

Choose a surety bond company: Research and select a reputable surety bond provider.

04

Complete the application: Fill out the bond application accurately with all requested details.

05

Submit supporting documents: Provide any additional documents required by the surety, such as financial statements or business licenses.

06

Pay the premium: Pay the required premium fee to secure the bond.

07

Review the bond: Once issued, carefully review the bond for accuracy before submission.

08

File the bond: Submit the bond to the relevant licensing authority as part of your application process.

Who needs License and Permit Bonds?

01

Individuals or businesses applying for various licenses or permits, such as contractors, vendors, and service providers.

02

Anyone required by state or local law to obtain a license or permit to legally operate in their industry.

Fill

form

: Try Risk Free

People Also Ask about

How much does a $40,000 surety bond cost?

Surety Bond Cost Table Surety Bond AmountYearly Premium Excellent Credit (675 and above)Average Credit (600-675) $40,000 $400 - $1,200 $1,200 - $2,000 $50,000 $500 - $1,500 $1,500 - $2,500 $75,000 $750 - $2,250 $2,250 - $3,7507 more rows

How much does a 40000 surety bond cost?

Surety Bond Cost Table Surety Bond AmountYearly Premium Excellent Credit (675 and above)Bad Credit (599 and below) $40,000 $400 - $1,200 $2,000 - $4,000 $50,000 $500 - $1,500 $2,500 - $5,000 $75,000 $750 - $2,250 $3,750 - $7,5007 more rows

What does it mean to be licensed and bonded?

The license proves that you are indeed qualified to perform the work you are performing and the bond provides financial protection for your company.

How much does a $4000 surety bond cost?

The cost of a surety bond is calculated as a small percentage of the total bond coverage amount — typically 0.5–10%.

How to calculate a surety bond?

Surety bond premiums are mainly calculated based on the applicant's credit score and usually vary between 0.5%-10% of the total bond amount. Other influencing factors include: Industry Experience: More experience can lead to lower premiums. Financial Strength: Strong financials and liquid assets can reduce costs.

What are the four types of bonds in construction?

The 4 Main Types of Construction Bonds Explained Bid Bond. Agreement to Bond (a.k.a. Surety's Consent or Consent of Surety) Performance Bond. Labour and Material Payment Bond.

What is an L&P bond?

License and Permit Bonds Governmental authorities require a licensee or permitee to post a bond as a condition of the business licensing or permit process. L&P bonds guarantee the bond principal will perform ing to the applicable statute, code or ordinance.

How much is a 50000 surety bond?

Therefore, for many applicants, a $50,000 surety bond will cost between $1,500 and $2,500 — usually paid as an annual premium. Get a quick estimate of your bond cost with our Surety Bond Cost Calculator below or apply online for free to receive an exact quote.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is License and Permit Bonds?

License and Permit Bonds are a type of surety bond required by government entities as part of the licensing process for businesses or individuals. They ensure that the bondholder will comply with laws and regulations applicable to their business.

Who is required to file License and Permit Bonds?

Businesses and individuals who are seeking a specific license or permit from a governmental authority are typically required to file License and Permit Bonds. This includes contractors, auto dealers, and various professional service providers.

How to fill out License and Permit Bonds?

To fill out License and Permit Bonds, the applicant must complete the bond form with accurate information such as their business name, address, the type of bond required, and sometimes additional personal information. It's important to ensure that all details comply with the requirements set by the licensing authority.

What is the purpose of License and Permit Bonds?

The purpose of License and Permit Bonds is to protect the public by ensuring that businesses adhere to regulations, laws, and ethical standards. They provide a financial guarantee that the bondholder will fulfill their obligations as outlined in the bond.

What information must be reported on License and Permit Bonds?

License and Permit Bonds typically require the following information to be reported: the principal's name, the surety company, the type of bond, the bond amount, and specifics about the regulations or conditions that the bond covers.

Fill out your license and permit bonds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

License And Permit Bonds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.