Get the free Form W-4P (2004)

Show details

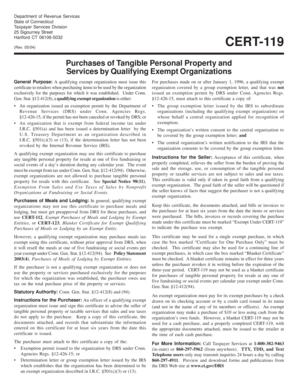

This document provides a worksheet for estimating itemized deductions including home mortgage interest and charitable contributions for the year 2004.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form w-4p 2004

Edit your form w-4p 2004 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form w-4p 2004 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form w-4p 2004 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form w-4p 2004. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form w-4p 2004

How to fill out Form W-4P (2004)

01

Obtain a copy of Form W-4P (2004) from the IRS website or your employer.

02

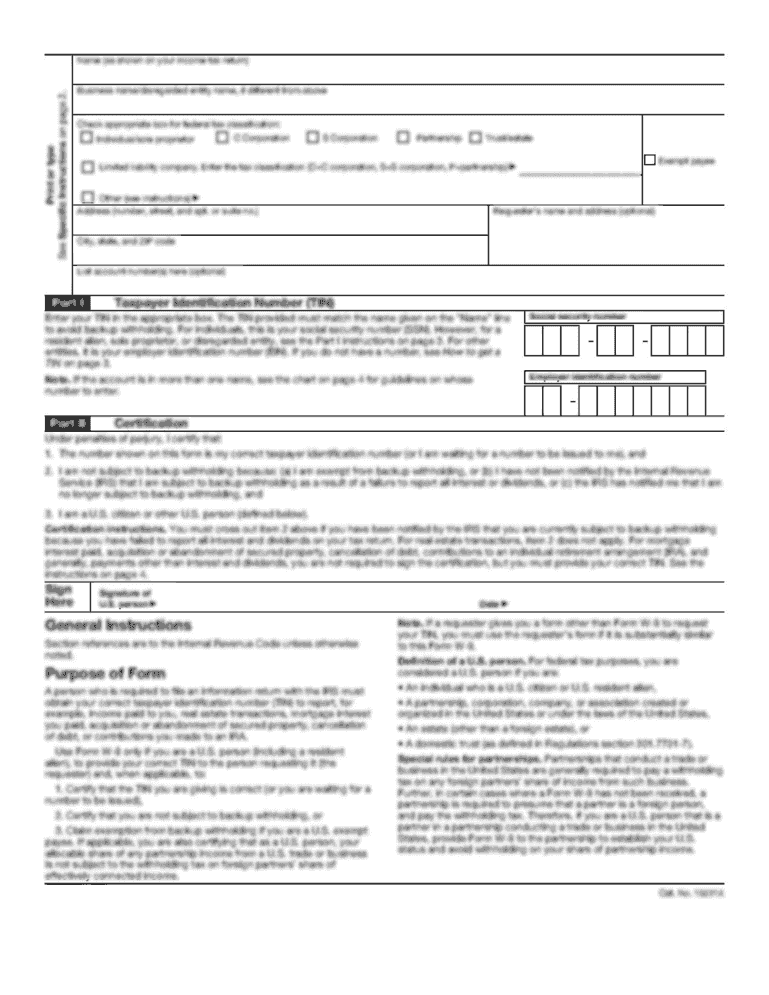

Provide your name, address, and Social Security number in the designated fields.

03

Indicate your filing status by checking the appropriate box (single, married, etc.).

04

Enter the total number of allowances you are claiming, based on the worksheet provided in the form.

05

If you want extra withholding, specify the additional amount you wish to have withheld from each payment.

06

Sign and date the form at the bottom.

07

Submit the completed form to the payer of the pension or annuity.

Who needs Form W-4P (2004)?

01

Individuals who receive pension or annuity payments.

02

People who wish to have federal income tax withheld from these payments.

Fill

form

: Try Risk Free

People Also Ask about

What percentage of federal pension is taxable?

In my experience – your contributions usually amount to about 2% to 5% of your annual pension income for FERS and about 5% to 10% for CSRS.So that means that about 90% to 98% of your FERS or CSRS pension will be taxable. So most of your FERS or CSRS retirement pension will be taxable.

How can I avoid federal tax on my pension?

You can defer taxes on a lump-sum pension payment by rolling it into a traditional IRA. This allows the funds to grow tax-deferred, and you only pay taxes when you withdraw money from the IRA. However, if you cash out the lump sum without rolling it into another retirement account, the entire amount will be taxable.

Are federal taxes taken out of pension checks?

Generally, pension and annuity payments are subject to Federal income tax withholding. The withholding rules apply to the taxable part of payments or distributions from an employer pension, annuity, profit-sharing, stock bonus, or other deferred compensation plan.

How much federal tax will I pay on my pension?

Lump-Sum Benefits A mandatory 20% federal tax withholding rate is applied to certain lump-sum paid benefits, such as the Basic Death Benefit, Retired Death Benefit, Option 1 balance, and Temporary Annuity balance.

Is form W-4P mandatory?

The revised Form W-4P (Withholding Certificate for Periodic Pension or Annuity Payments) revised in 2021 include substantial changes to the federal tax withholding elections available. Use of these forms was optional for tax year 2022; however, the IRS requires that the new forms be used beginning January 1, 2023. 5.

How much federal tax is taken out of a pension check?

Unless a payee chooses another withholding rate, the default withholding rate for a nonperiodic distribution (a payment other than a periodic payment) that is not an eligible rollover distribution, is 10% of the distribution.

How many allowances should I claim on my W-4P?

A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. You can also claim your children as dependents if you support them financially and they're not past the age of 19.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form W-4P (2004)?

Form W-4P (2004) is a tax form used by individuals to indicate their withholding preferences for periodic pension or annuity payments.

Who is required to file Form W-4P (2004)?

Individuals who receive pension or annuity payments and wish to specify how much federal income tax should be withheld from those payments are required to file Form W-4P (2004).

How to fill out Form W-4P (2004)?

To fill out Form W-4P (2004), provide personal information such as your name and Social Security number, indicate your marital status, and specify the amount of tax you want withheld from your payments. Follow the instructions provided on the form carefully.

What is the purpose of Form W-4P (2004)?

The purpose of Form W-4P (2004) is to inform the payer of the pension or annuity how much federal income tax to withhold from your payments, ensuring the withholding aligns with your tax situation.

What information must be reported on Form W-4P (2004)?

Information that must be reported on Form W-4P (2004) includes your name, address, Social Security number, marital status, and the amount you wish to withhold from your pension or annuity payments.

Fill out your form w-4p 2004 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form W-4p 2004 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.