Get the free Commercial General Liability Application

Show details

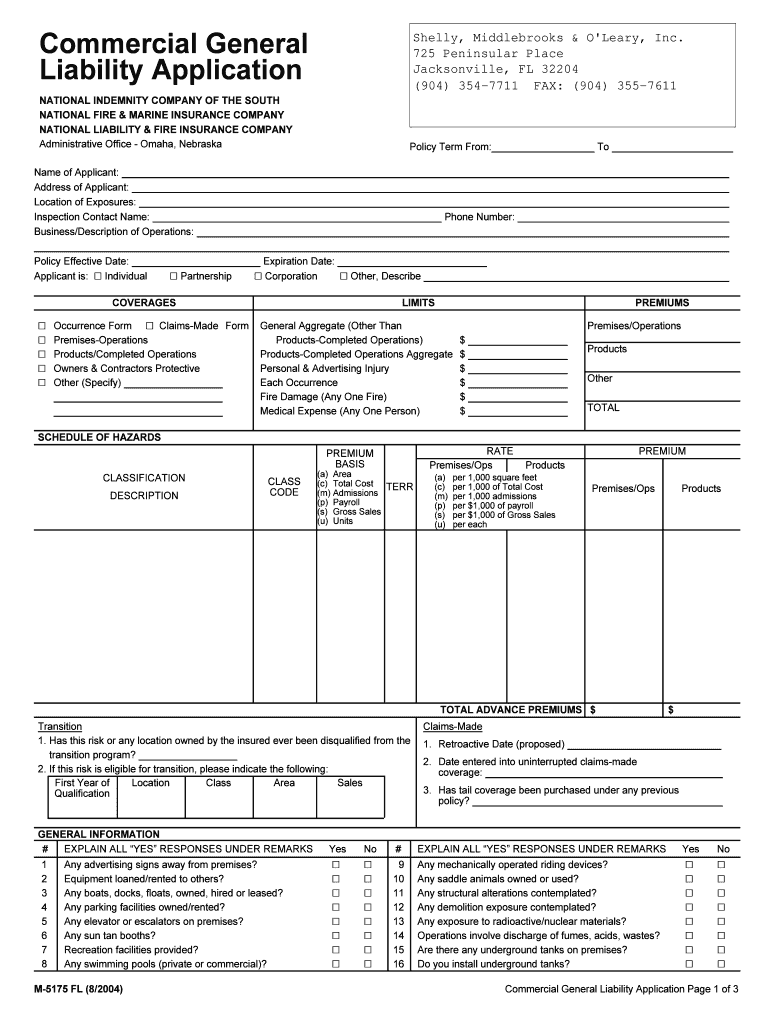

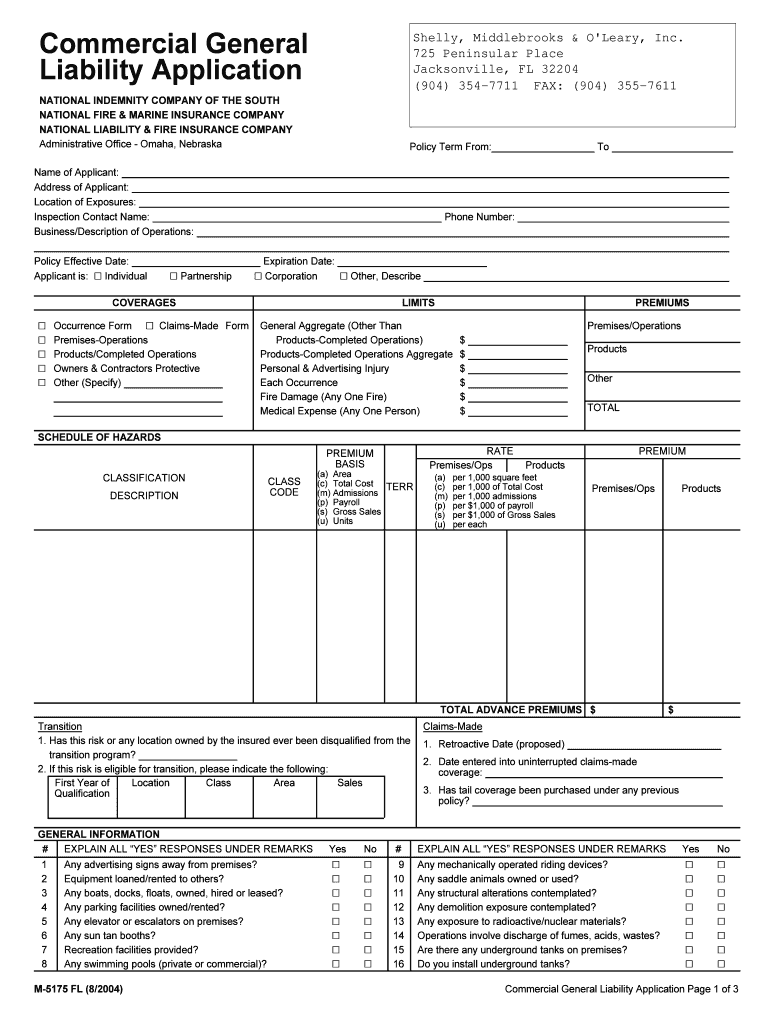

This document is an application for a Commercial General Liability insurance policy, detailing information about the applicant's business operations, coverage requirements, limits, and additional

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial general liability application

Edit your commercial general liability application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial general liability application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing commercial general liability application online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit commercial general liability application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial general liability application

How to fill out Commercial General Liability Application

01

Begin by gathering all necessary business information, including your business name, address, and contact information.

02

Identify and describe your business activities, including the products or services offered.

03

Provide details on your business structure (sole proprietorship, partnership, corporation, etc.).

04

List all locations where your business operates, including any additional properties.

05

Indicate the number of employees and their roles within the company.

06

Provide information on any subcontractors used and their work relationship with your business.

07

Fill out the estimated annual revenue and payroll information for your business.

08

Answer any additional questions related to your business operations, claims history, and risk management practices.

09

Review the application for accuracy and completeness before submission.

10

Submit the application to the insurer or broker along with any required supporting documents.

Who needs Commercial General Liability Application?

01

Businesses of all sizes that engage in operations which could lead to claims of bodily injury or property damage.

02

Contractors and service providers who may interact with clients or third parties.

03

Retailers and wholesalers that sell products.

04

Any organization that wishes to protect itself against potential liability lawsuits.

Fill

form

: Try Risk Free

People Also Ask about

What is covered under commercial general liability?

CGL insurance covers a broad spectrum of risks, including bodily injury, property damage, personal and advertising injury, and more. This wide-ranging protection helps businesses manage unforeseen risks effectively.

What is excluded from a commercial general liability policy?

Commercial general liability insurance excludes coverage for illegal actions or criminal acts. For example, if you get caught selling illegal substances out of your storefront, your insurance company wouldn't cover your legal fees.

What is included in commercial general liability?

Commercial General Liability (CGL) insurance protects business owners against claims of liability for bodily injury, property damage, and personal and advertising injury (slander and false advertising).

What is an example of a GL claim?

The short answer: General liability can provide financial help if your business is involved in an accident involving: An injury to someone who is not an employee. Damage to property that doesn't belong to you. Accusations of advertising copyright infringement, libel or slander.

What are the 3 forms of commercial general liability?

What are the three forms of commercial general liability? Coverage A includes legal expenses related to bodily injury and property damage liability. Coverage B includes legal expenses related to personal and advertising injuries. Coverage C includes medical payments for non-employees who are harmed at or by your business.

How much is $1,000,000 general liability?

How much does 1 million general liability insurance cost? On average, small businesses can expect to pay between $796 and $1,230 per year for a $1 million policy. The monthly cost often ranges from $67 to $150, varying based on factors like business type, location, and risk factors.

Which coverage is not included in a commercial general liability policy?

Damage to Your Own Property: CGL insurance does not cover damage to property owned, used, or in the care of your business. Property insurance is required for these concerns.

What claims fall under general liability?

Injuries that happen on your property, such as those from slips or falls. Bodily injury or property damage to a third party caused by your work, products or your employees' activities. Liability of others assumed in specifically defined contracts. Libel, slander or business disparagement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Commercial General Liability Application?

A Commercial General Liability Application is a document used by businesses to apply for general liability insurance coverage, which protects them from various types of claims including bodily injury, property damage, and personal injury.

Who is required to file Commercial General Liability Application?

Business owners or entities seeking to obtain general liability insurance are required to file a Commercial General Liability Application.

How to fill out Commercial General Liability Application?

To fill out a Commercial General Liability Application, one must provide detailed information about the business, including its operations, financials, and risk exposure. This often involves answering specific questions regarding the nature of the business, employees, and types of services offered.

What is the purpose of Commercial General Liability Application?

The purpose of the Commercial General Liability Application is to assess the risks associated with a business and determine the appropriate coverage needed, as well as to provide an estimate of the premium costs for the insurance policy.

What information must be reported on Commercial General Liability Application?

Information that must be reported on a Commercial General Liability Application typically includes the business name, address, type of business, revenue, number of employees, details about the services provided, previous insurance claims, and any special risks associated with the operations.

Fill out your commercial general liability application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial General Liability Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.