Get the free meghalaya value added tax rules, 2005

Show details

In accordance with the provision of Section 77 of the Meghalaya Value Added Tax Act 2003 under Rule 53.

We are not affiliated with any brand or entity on this form

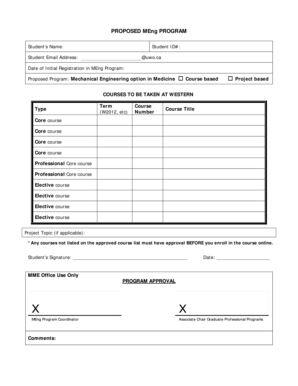

Get, Create, Make and Sign meghalaya value added tax rules, 2005

Edit your meghalaya value added tax rules, 2005 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your meghalaya value added tax rules, 2005 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit meghalaya value added tax online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit meghalaya value added tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out meghalaya value added tax rules, 2005

How to fill out meghalaya value added tax rules, 2005

01

Read and understand the Meghalaya Value Added Tax Rules, 2005.

02

Gather all necessary documents including your business registration certificate and sales invoices.

03

Determine your taxable turnover by assessing all sales made during the relevant period.

04

Calculate VAT payable by applying the appropriate VAT rates to your taxable turnover.

05

Complete the VAT return form as specified in the rules, ensuring all required information is accurately filled in.

06

Submit the completed VAT return form along with any payment due to the appropriate tax authority by the deadline.

07

Keep copies of all submitted documents and records for future reference and compliance.

Who needs meghalaya value added tax rules, 2005?

01

All registered businesses operating within Meghalaya that engage in the sale of goods or services.

02

Businesses that meet the turnover threshold for VAT registration as specified in the rules.

03

Vendors and suppliers who wish to ensure compliance with state tax regulations.

04

Accountants and tax practitioners advising clients on VAT matters in Meghalaya.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is meghalaya value added tax rules, 2005?

The Meghalaya Value Added Tax Rules, 2005 are regulations that govern the administration and implementation of the Value Added Tax (VAT) in the state of Meghalaya, India. These rules outline the procedures for registration, filing returns, and compliance for businesses subject to VAT.

Who is required to file meghalaya value added tax rules, 2005?

Businesses and individuals in Meghalaya engaged in the sale of goods that meet the specified turnover threshold are required to file under the Meghalaya Value Added Tax Rules, 2005. This includes traders, manufacturers, and service providers who are liable to pay VAT.

How to fill out meghalaya value added tax rules, 2005?

To fill out the Meghalaya Value Added Tax rules, 2005, taxpayers must complete the designated VAT return forms provided by the government, ensuring accurate reporting of sales, purchases, and tax liability. Required information usually includes the taxpayer's registration details, sales figures, and any allowable deductions.

What is the purpose of meghalaya value added tax rules, 2005?

The purpose of the Meghalaya Value Added Tax Rules, 2005 is to provide a clear framework for the collection of VAT in the state, ensure compliance among businesses, and streamline the assessment and enforcement of tax liabilities, thereby promoting fair taxation and revenue generation for the state.

What information must be reported on meghalaya value added tax rules, 2005?

The information that must be reported includes the taxpayer's identity details, total sales, total purchases, applicable VAT collected, VAT paid on purchases, and any adjustments or claims for input tax credit. Accurate record-keeping and reporting are essential for compliance.

Fill out your meghalaya value added tax rules, 2005 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Meghalaya Value Added Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.