Get the free Self Certification Form – 2010

Show details

This form is used to collect information on annual family income and race to determine eligibility for public services funded by federal Community Development Block Grant (CDBG) funds. Participants

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self certification form 2010

Edit your self certification form 2010 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self certification form 2010 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self certification form 2010 online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit self certification form 2010. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self certification form 2010

How to fill out Self Certification Form – 2010

01

Obtain the Self Certification Form – 2010 from the relevant authority or website.

02

Fill in your personal details such as name, address, and contact information at the designated sections.

03

Provide your tax identification number or social security number as required.

04

Indicate your income sources and amounts accurately.

05

Certify the accuracy of the information by signing and dating the form.

06

Submit the completed form to the designated office or authority.

Who needs Self Certification Form – 2010?

01

Individuals seeking to certify their income for financial assistance.

02

Taxpayers who need to establish their income status for tax purposes.

03

Applicants for loans or credits that require income verification.

04

Persons applying for government benefits or assistance programs.

Fill

form

: Try Risk Free

People Also Ask about

What is a valid self-certification?

The statement of self-certification should cover residency status in all cases and, where foreign tax residency is identified, affirmation by the Account Holder of their date of birth and the TIN provided.

What are self-certification forms?

Self-certification is when an employee provides a personal note explaining their reasons for being off work sick. Employees won't need a private certificate or doctor's note for this type of short-term absence. Instead, they'll need to say how they were ill and if they're well enough to do their usual job.

Do self certification forms expire?

Does the self-certification form have an expiration date? Once you have completed the self-certification form there is no need to resubmit the form at regular points in the future.

What does self-certification status mean?

Self-certification is the process where a commercial driver declares to their state's licensing agency what type of driving they will be doing. This helps the state determine which medical requirements apply to the driver.

What is a self-certification form for a student loan?

The Self-Certification Form includes the cost of attendance of the college, as well as an estimate of the financial aid the student is eligible to receive for the semester or academic year.

What is the CRS individual self-certification form?

This form is intended to request information consistent with local law requirements. Please fill in this form if you are an individual account holder, sole trader or sole proprietor. For joint or multiple account holders, use a separate form for each individual person.

How long is the CRS form valid for?

The CRS form will remain valid unless there is a change in circumstances which affects your tax residence status or where any information provided in the form becomes incorrect. Under this certification, you, as an account holder, must inform the Bank within 30 days of any such change in circumstances.

Can you download a self certification form?

Many employers have their own self-certification forms. If your employer doesn't have its own form your can download this Self Certification Form (PDF). Please print it, fill it in and hand it in to your employer. You do not need to see a Doctor.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

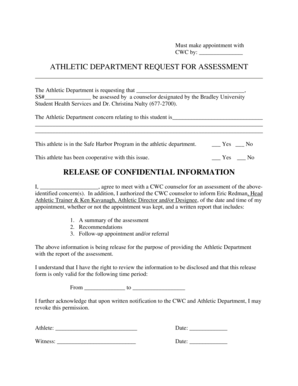

What is Self Certification Form – 2010?

The Self Certification Form – 2010 is a document used by individuals to certify certain information about their tax status or residency for various financial institutions or tax authorities.

Who is required to file Self Certification Form – 2010?

Individuals or entities that are required to provide confirmation of their tax residence or information related to their financial accounts typically need to file the Self Certification Form – 2010.

How to fill out Self Certification Form – 2010?

To fill out the Self Certification Form – 2010, individuals must provide personal identification details, tax residency information, and any relevant financial account details, followed by signing and dating the form.

What is the purpose of Self Certification Form – 2010?

The purpose of the Self Certification Form – 2010 is to ensure compliance with tax laws by collecting accurate information regarding a person's tax residency status or financial accounts.

What information must be reported on Self Certification Form – 2010?

The information that must be reported includes the individual's name, address, tax identification number, country of tax residence, and other relevant details concerning their financial accounts.

Fill out your self certification form 2010 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self Certification Form 2010 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.