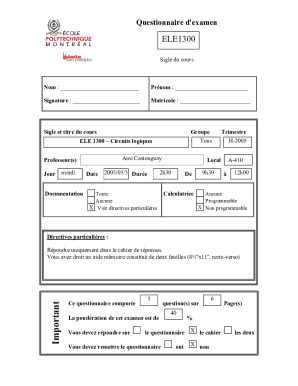

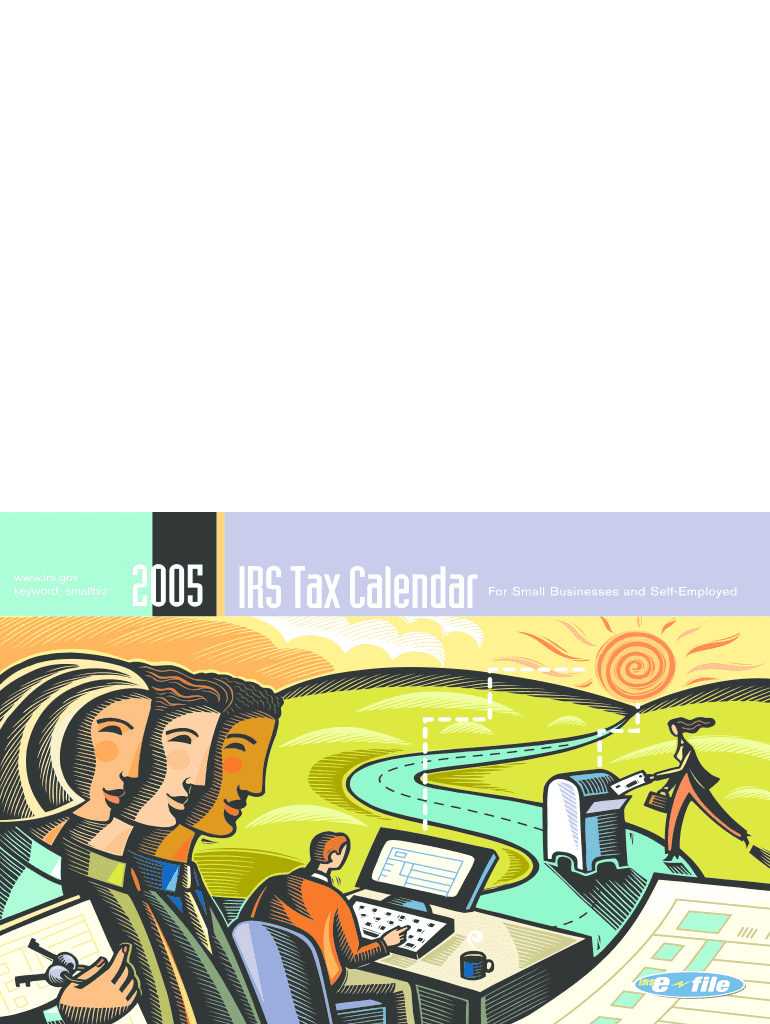

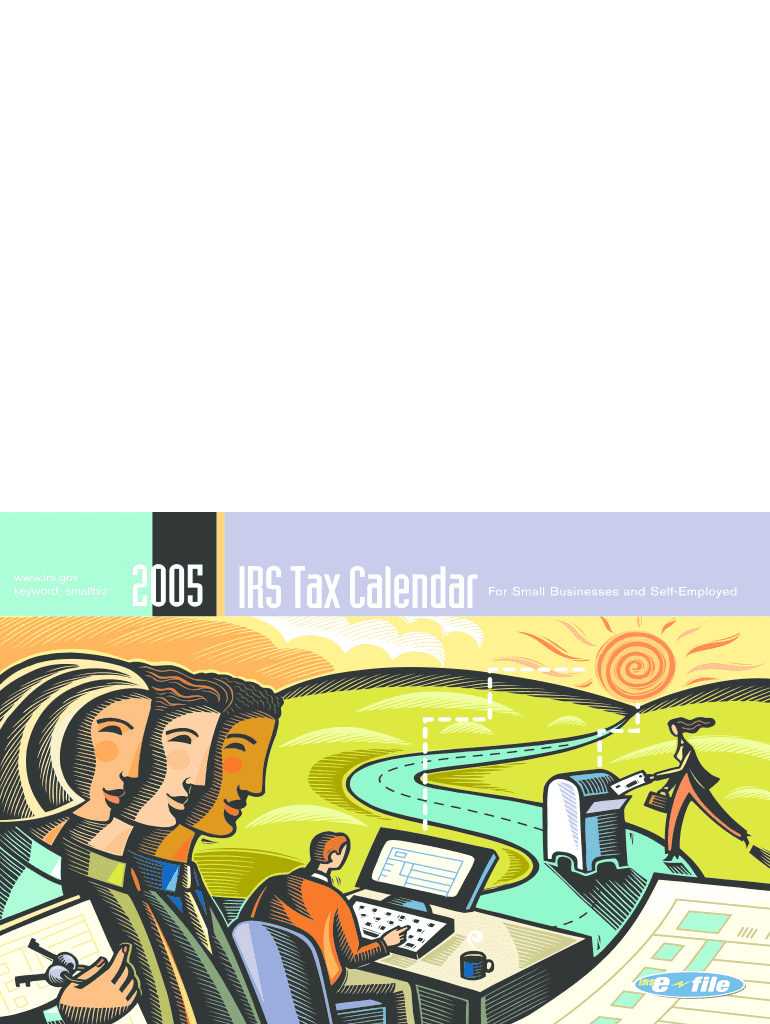

Get the free 2005 IRSTaxCalendar

Show details

This calendar provides comprehensive tax-related information specifically for small businesses and self-employed individuals, including important filing dates, forms, and general guidelines.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2005 irstaxcalendar

Edit your 2005 irstaxcalendar form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2005 irstaxcalendar form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2005 irstaxcalendar online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2005 irstaxcalendar. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2005 irstaxcalendar

How to fill out 2005 IRSTaxCalendar

01

Obtain a copy of the 2005 IRS Tax Calendar.

02

Identify key tax deadlines for the year, including filing dates and payment deadlines.

03

Mark important dates on the calendar for easy reference.

04

Include any personal tax appointments or reminders.

05

Check the calendar regularly to ensure compliance with tax obligations.

Who needs 2005 IRSTaxCalendar?

01

Individuals who need to file their taxes for the year 2005.

02

Tax professionals assisting clients in tax preparation.

03

Business owners who must keep track of tax-related deadlines.

04

Anyone planning to make estimated tax payments.

Fill

form

: Try Risk Free

People Also Ask about

When was there a 90% tax rate?

The top individual marginal income tax rate tended to increase over time through the early 1960s, with some additional bumps during war years. The top income tax rate reached above 90% from 1944 through 1963, peaking in 1944, when top taxpayers paid an income tax rate of 94% on their taxable income.

How did the 91% tax rate work?

That meant that the federal government took 91 cents of every dollar over $200,000. When you added it all up, someone in 1955 who made $1 million a year paid over $800,000 in taxes.

What were the tax brackets in 2005?

Schedule: Single If taxable income is over--But not over--The tax is: $0 $7,300 10% of the amount over $0 $7,300 $29,700 $730 plus 15% of the amount over 7,300 $29,700 $71,950 $4,090.00 plus 25% of the amount over 29,700 $71,950 $150,150 $14,652.50 plus 28% of the amount over 71,9502 more rows

What is the tax year calendar?

Calendar Tax Year: This is a period of 12 consecutive months beginning January 1 and ending December 31; or. Fiscal Tax Year: This is a period of 12 consecutive months ending on the last day of any month except December.

Where did 90% of tax revenue come from between 1863 to 1913?

1867 - Heeding public opposition to the income tax, Congress cut the tax rate. From 1868 until 1913, 90 percent of all revenue came from taxes on liquor, beer, wine and tobacco. 1872 - Income tax repealed.

When did the US have a 90% tax rate?

The top individual marginal income tax rate tended to increase over time through the early 1960s, with some additional bumps during war years. The top income tax rate reached above 90% from 1944 through 1963, peaking in 1944, when top taxpayers paid an income tax rate of 94% on their taxable income.

What were the tax changes in 2005?

A new uniform definition of a qualifying child, special rules for car donations, higher standard mileage rates and expanded retirement savings incentives are among the changes individual taxpayers will find when they sit down to prepare their 2005 federal income tax return.

What was the US tax rate in 1970?

The tax was limited to an 87% effective rate. Vietnam War surcharges effectively increased this rate to 75.25% in 1968, 77% in 1969, and 71.75% in 1970. The tax was limited to a 60% effective rate in 1971, and 50% in 1972-1976. In 1974, a statutory rebate effectively reduced this rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2005 IRSTaxCalendar?

The 2005 IRSTaxCalendar is a schedule that outlines important tax-related dates and deadlines for the year 2005 as established by the Internal Revenue Service (IRS).

Who is required to file 2005 IRSTaxCalendar?

Individuals, businesses, and organizations that are subject to U.S. taxation and have tax obligations during the year 2005 are required to follow the 2005 IRSTaxCalendar.

How to fill out 2005 IRSTaxCalendar?

To fill out the 2005 IRSTaxCalendar, taxpayers should follow the guidance provided by the IRS, documenting deadlines for various tax-related activities such as filing returns and making payments. Accurate dates and taxpayer-specific information should be included.

What is the purpose of 2005 IRSTaxCalendar?

The purpose of the 2005 IRSTaxCalendar is to provide taxpayers with a clear timeline of tax-related deadlines and activities, helping them to stay compliant with federal tax regulations.

What information must be reported on 2005 IRSTaxCalendar?

The 2005 IRSTaxCalendar must report information such as filing deadlines, payment due dates, and other significant tax-related events that affect taxpayers within that year.

Fill out your 2005 irstaxcalendar online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2005 Irstaxcalendar is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.