Get the free ARIZONA FORM 120S

Show details

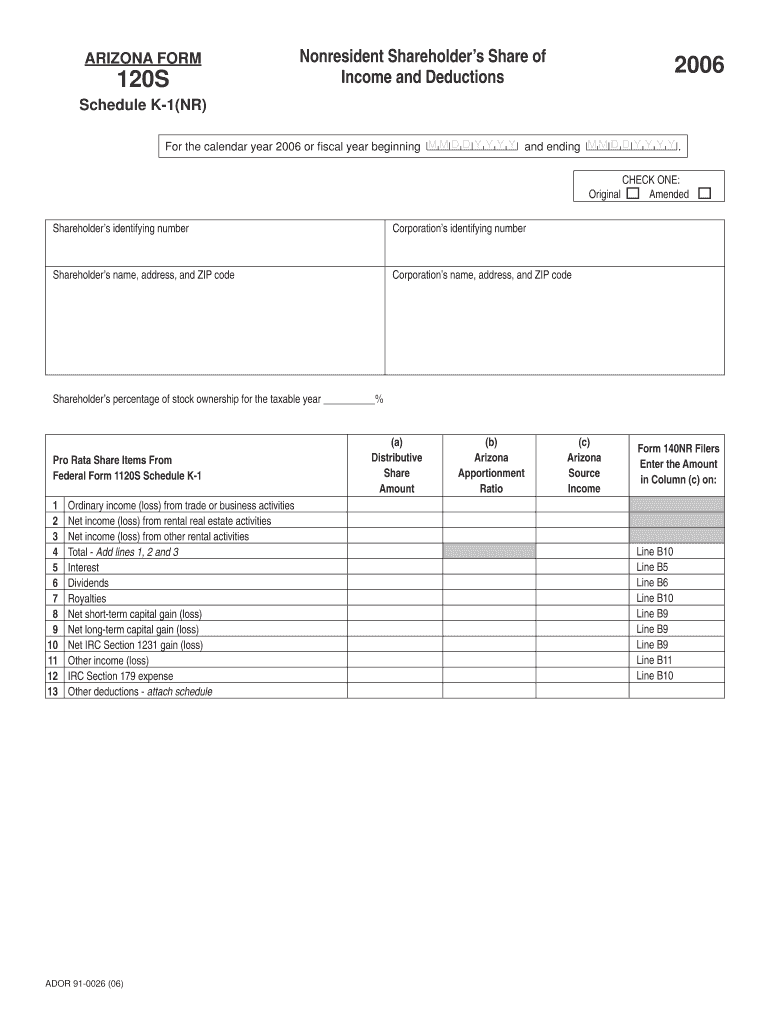

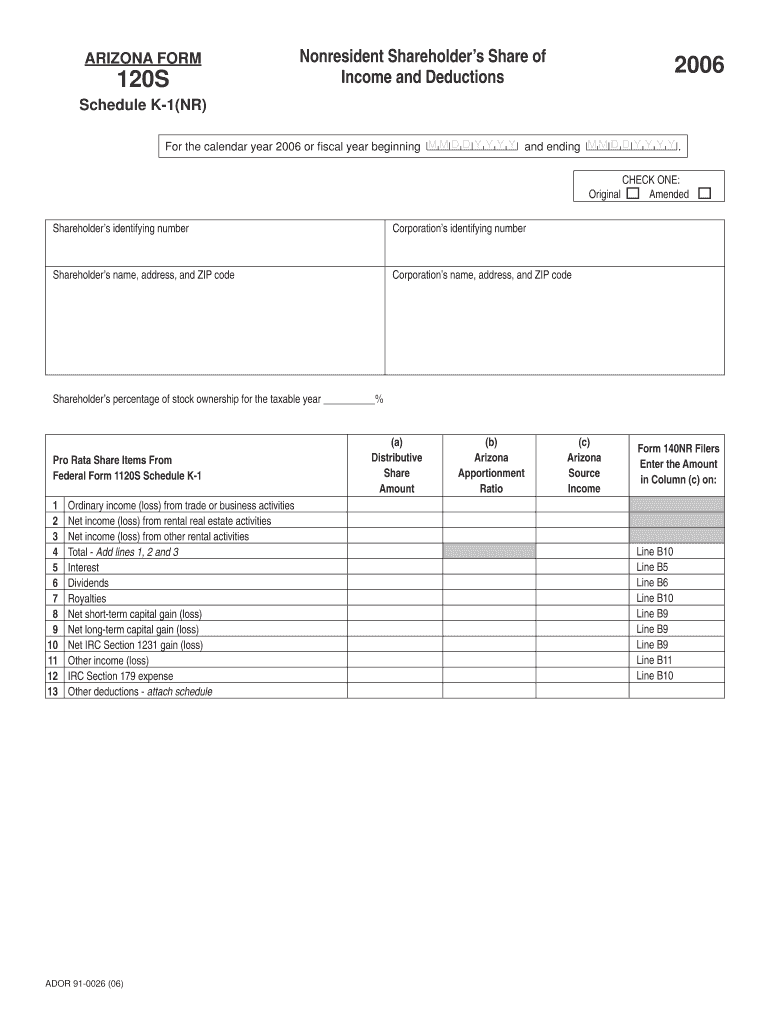

This document is a Schedule K-1(NR) for nonresident shareholders to report their share of income and deductions for the year 2006, including instructions for individuals and fiduciaries regarding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign arizona form 120s

Edit your arizona form 120s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arizona form 120s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing arizona form 120s online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit arizona form 120s. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out arizona form 120s

How to fill out ARIZONA FORM 120S

01

Obtain Arizona Form 120S from the Arizona Department of Revenue website or your accountant.

02

Fill out the header section with your name, address, and tax identification number.

03

Indicate your filing status and the type of entity you are reporting for.

04

Complete the income section by reporting all sources of income, including sales and services.

05

Calculate deductions and credits appropriate for your business activities as per the instructions provided.

06

Fill out the tax computation section to determine the tax owed.

07

Review the form carefully for accuracy and completeness.

08

Sign and date the form before submitting it.

09

Make a copy for your records before mailing it to the Arizona Department of Revenue.

Who needs ARIZONA FORM 120S?

01

Arizona Form 120S is needed by S corporations operating in Arizona.

02

Businesses that are electing S corporation status for tax purposes must file this form.

03

Any entity earning income within Arizona that is categorized as an S corporation.

Fill

form

: Try Risk Free

People Also Ask about

Does Arizona have an S corp tax?

Arizona corporate income tax Arizona imposes a corporate income tax on C corporations and Limited Liability Companies (LLCs) with C corp elections. The corporate income tax rate is 4.9% of your taxable income. S corporations, partnerships, standard LLCs, and sole proprietorships don't pay corporate income tax.

Do I need to file Arizona state tax return?

Income Tax Filing Requirements In the state of Arizona, full-year resident or part-year resident individuals must file a tax return if they are: Single or married filing separately and gross income (GI) is greater than $14,600; Head of household and GI is greater than $21,900; or.

Do I have to file a tax return for my S corp?

You must file California S Corporation Franchise or Income Tax Return (Form 100S) if the corporation is: Incorporated in California. Doing business in California. Registered to do business in California with the Secretary of State (SOS)

What is an Arizona 120S form?

Arizona Form 120S S Corporation Income Tax Return. This file contains the 2021 Arizona S Corporation Income Tax Return guidelines and instructions. It provides essential information for corporations filing under Subchapter S of the IRC. Ideal for S Corporations needing to comply with Arizona tax requirements.

Do I have to file an Arizona corporate tax return?

Corporate Income Tax Filing Requirements Every corporation subject to the Arizona Income Tax Act of 1978 must file an Arizona corporate income tax return.

What is the penalty for filing form 120S late in Arizona?

The late filing penalty is 4.5% (. 045) of the amount of tax required to be shown on the return. The penalty period is each month or fraction of a month between the due date of the return and the date the taxpayer filed the return. The maximum penalty is 25% of the tax found to be remaining due.

Do I need to file an Arizona S Corp return?

But what about Arizona income taxes? Arizona will treat an S corp the same way the federal government does; you don't need to make a separate election for the state. However, corporations taxed as S corps must file Arizona Form 120S at tax time.

What is the Arizona amended tax form?

Form 140X (2023): Arizona Individual Amended Income Tax Return. The Arizona Form 140X allows individuals to correct errors or omissions made on their original Arizona income tax return (Forms 140, 140A, 140EZ, 140PY, or 140NR).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ARIZONA FORM 120S?

ARIZONA FORM 120S is a tax return form used by S corporations doing business in Arizona to report income, deductions, and credits.

Who is required to file ARIZONA FORM 120S?

S corporations that are conducting business within Arizona and wish to report income for state tax purposes are required to file ARIZONA FORM 120S.

How to fill out ARIZONA FORM 120S?

To fill out ARIZONA FORM 120S, gather necessary financial documents, report your income and expenses, complete all sections of the form, and ensure all calculations are accurate before submitting.

What is the purpose of ARIZONA FORM 120S?

The purpose of ARIZONA FORM 120S is to assess the state income tax liability of S corporations and to ensure compliance with Arizona tax laws.

What information must be reported on ARIZONA FORM 120S?

ARIZONA FORM 120S requires the reporting of business income, deductions, credits, and relevant tax details, including shareholder information and income allocations.

Fill out your arizona form 120s online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arizona Form 120s is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.