Get the free Trading Account Related Details

Show details

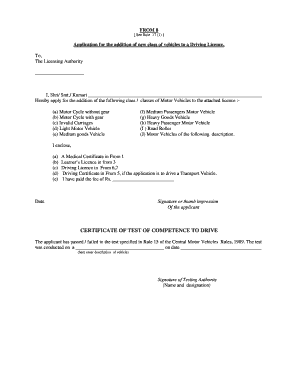

This document collects comprehensive information from clients opening a trading account, including bank account details, depository account information, trading preferences, past actions, dealings

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trading account related details

Edit your trading account related details form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trading account related details form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing trading account related details online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit trading account related details. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trading account related details

How to fill out Trading Account Related Details

01

Begin by gathering all necessary personal information, including your full name, address, and contact details.

02

Provide your Social Security Number or Tax Identification Number for identification purposes.

03

Specify your employment status and financial background, including your annual income and net worth.

04

Indicate your investment experience, detailing any prior trading or investment activities.

05

Complete the risk tolerance assessment to determine your preferred investment strategy.

06

Provide banking information for funding your trading account, including bank account numbers and routing numbers if required.

07

Review all information for accuracy and completeness before submission.

Who needs Trading Account Related Details?

01

Individuals looking to invest in stocks, bonds, or other securities.

02

Traders who want to engage in day trading or swing trading activities.

03

Financial advisors or consultants managing client investments.

04

Institutions or businesses entering into financial markets.

Fill

form

: Try Risk Free

People Also Ask about

Is a trading account a bank account?

A trading account is an investment account. Trading accounts typically refer to accounts used to trade securities. Trading accounts require personal identification information and have minimum margin requirements set by FINRA.

What is trading account in detail?

Summary. A trading account is an account with holdings such as cash or securities that are used for the purpose of buying and selling assets. Trading accounts operate under the Financial Industry Regulatory Authority (FINRA), where account activities are operated within a single day for five business days.

What is an example of a trading account?

A trading account can be any investment account containing securities, cash, or other holdings. A trading account can be any investment account containing securities, cash or other holdings. Most commonly, trading account refers to a day trader's primary account.

What is an example of a trading account?

An example of a trading account is an equity trading account opened with a stockbroker to buy and sell shares on the stock market. The trading account facilitates the execution of trades and tracks the investor's transactions.

What is trading details?

Trading refers to the buying and selling of financial assets in markets with the aim of making a profit. It involves analysing market trends and identifying opportunities to enter the market, thereby making a profit.

What is trading account details?

A trading account is an investment account that allows individuals or entities to trade securities, such as stocks, bonds, or futures and options. It serves as a gateway for conducting transactions in the stock market.

What is trading in detail?

Trading is the buying and selling of goods, services, or financial assets like stocks and money. In the stock market, investors trade shares of different companies. OPEN ACCOUNT. Trading: Definition, Working, Types and Advantages.

What is written in trading account?

Content: A trading account includes information about a business's COGS, revenue, and gross profit. A P&L account includes information about revenue, all expenses, and net profit or loss. Focus: A trading account focuses on a business's buying and selling activities and their profitability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Trading Account Related Details?

Trading Account Related Details refer to the financial information and performance metrics captured in a trading account, including revenues, costs, and profit or loss derived from trading activities.

Who is required to file Trading Account Related Details?

Individuals and businesses engaged in trading activities, including sole proprietorships, partnerships, and companies, are required to file Trading Account Related Details for tax and regulatory compliance.

How to fill out Trading Account Related Details?

To fill out Trading Account Related Details, one must gather all relevant financial data, such as sales records, purchases, and expenses, and accurately report these figures in the prescribed formats, ensuring all calculations are correct.

What is the purpose of Trading Account Related Details?

The purpose of Trading Account Related Details is to provide a clear view of the trading performance of a business, facilitating transparency, aiding in tax assessment, and helping in financial analysis.

What information must be reported on Trading Account Related Details?

The information that must be reported includes sales revenue, cost of goods sold, gross profit, operating expenses, and net profit or loss for the trading period.

Fill out your trading account related details online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trading Account Related Details is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.