Get the free TAX REBATE CERTIFICATE

Show details

The document outlines the tax credit available for homeowners who install qualifying geothermal heat pumps, including specific timelines, credit percentages, and eligibility criteria related to Energy

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax rebate certificate

Edit your tax rebate certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax rebate certificate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax rebate certificate online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax rebate certificate. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

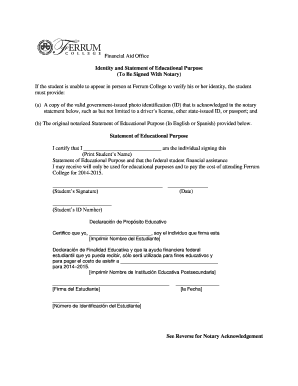

How to fill out tax rebate certificate

How to fill out TAX REBATE CERTIFICATE

01

Gather all necessary documents such as your income statements and previous tax returns.

02

Obtain the TAX REBATE CERTIFICATE form from your local tax office or download it from the official website.

03

Fill out your personal information, including your name, address, and social security number.

04

Provide details of your income sources as required by the form.

05

Calculate the eligible tax rebate by following the guidelines provided on the form.

06

Attach copies of supporting documents that verify your income and expenses.

07

Review the form for accuracy and completeness.

08

Submit the completed TAX REBATE CERTIFICATE form to the designated tax authority by the specified deadline.

Who needs TAX REBATE CERTIFICATE?

01

Individuals who have overpaid their taxes and are eligible for a refund.

02

Taxpayers who have experienced changes in their financial situation that may affect their tax liabilities.

03

Residents who qualify for specific tax rebates based on their income level or other criteria.

Fill

form

: Try Risk Free

People Also Ask about

What is a tax rebate form?

A tax rebate is a reimbursement made to a taxpayer for an excess amount paid in taxes during the year. It occurs when the taxes paid by an individual or a business – through payroll deductions or estimated payments – exceed the liability. In this case, the government will refund the taxpayer for the difference.

What is the form for tax rebate?

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

What is a tax residency certificate in the USA?

Form 6166 is a letter printed on U.S. Department of Treasury stationery certifying that the individuals or entities listed are residents of the United States for purposes of the income tax laws of the United States.

How do I get an IRS tax clearance certificate?

0:40 3:12 Website when filling out the form make sure you include all the necessary. Information such as yourMoreWebsite when filling out the form make sure you include all the necessary. Information such as your tax identification number and attach any required documents like your passport. And national ID.

What is the rebate form?

These forms typically require personal information such as name, address, and sometimes additional details to verify eligibility. For mail-in rebates, there's usually a strict deadline postmarked by which all materials must be sent for customers to qualify for their rebate check.

What does a tax rebate do?

A tax rebate is a reimbursement made to a taxpayer for an excess amount paid in taxes during the year. It occurs when the taxes paid by an individual or a business – through payroll deductions or estimated payments – exceed the liability. In this case, the government will refund the taxpayer for the difference.

Will everyone get a tax rebate?

Tax rebate eligibility Generally, federal rebates are based on your tax return information on file with the IRS. Typically, rebates are limited by your income and family size. For example, a taxpayer with adjusted gross income (AGI) at or over a certain amount may be ineligible for a rebate.

Who qualifies for the EIC?

You're at least 18 years old or have a qualifying child. Have earned income of at least $1 and not more than $31,950. Have a valid Social Security Number or Individual Taxpayer Identification Number (ITIN) for you, your spouse/RDP, and any qualifying children.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TAX REBATE CERTIFICATE?

A tax rebate certificate is an official document issued by tax authorities that certifies the amount of tax rebate an individual or business is entitled to receive, often because of overpayment or eligibility for deductions.

Who is required to file TAX REBATE CERTIFICATE?

Individuals and businesses that have overpaid taxes or qualify for specific tax deductions or credits may be required to file a tax rebate certificate to claim the rebate.

How to fill out TAX REBATE CERTIFICATE?

To fill out a tax rebate certificate, gather necessary financial documents, enter personal or business information, list the relevant tax details, and indicate the claimed rebate amount, ensuring all fields are completed accurately.

What is the purpose of TAX REBATE CERTIFICATE?

The purpose of a tax rebate certificate is to allow taxpayers to formally request a return of overpaid taxes, providing proof to the tax authorities of the amount they are entitled to recover.

What information must be reported on TAX REBATE CERTIFICATE?

Information typically required on a tax rebate certificate includes the taxpayer's identification details, tax ID number, financial records supporting the overpayment, claimed rebate amount, and any relevant tax periods.

Fill out your tax rebate certificate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Rebate Certificate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.