CA FTB 3560 2001-2026 free printable template

Show details

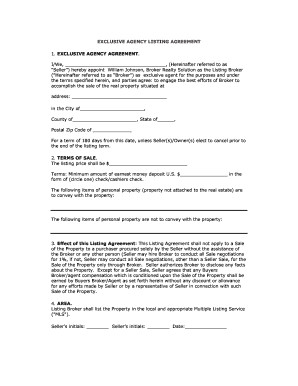

Form FTB 3560 should be filed even if it is after the 15th day of the 3rd month of the taxable year. The corporation can specify a prospective date on form FTB 3560 that is on or after the date the revocation is made. See box 2 instructions for Since a corporation is deemed to be a S election is timely filed form FTB 3560 should be provided to the FTB for informational purposes only. Of Officer Title Telephone For Privacy Act Notice get form FTB 1131. 356001109 FTB 3560 C2 2001 Instructions...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 14916702 form

Edit your california s corporation election form 3560 ftb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 3560 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA FTB 3560 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA FTB 3560. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out CA FTB 3560

How to fill out CA FTB 3560

01

Obtain a copy of the CA FTB 3560 form from the California Franchise Tax Board website.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill out the top section with your personal information, including your name, address, and Social Security number.

04

Provide details regarding your tax situation as required in the following sections.

05

Complete any necessary calculations or entries as indicated in the form.

06

Review your completed form for accuracy and completeness.

07

Sign and date the form at the designated areas.

08

Submit the form according to the instructions, either by mail or electronically, if applicable.

Who needs CA FTB 3560?

01

Individuals or entities that have received certain notices regarding California taxes.

02

Taxpayers who wish to respond to a request for information from the California Franchise Tax Board.

03

People who need to clarify their tax status or provide additional information to the FTB.

Fill

form

: Try Risk Free

People Also Ask about

How do I form an S corp in California?

How to Start an S Corp in California Step 1: Check Name Availability. Step 2: Choose Business Name. Step 3: Obtain an EIN. Step 4: File Articles of Incorporation. Step 5: Registered Agent. Step 6: Corporate Bylaws. Step 7: S Corp Director Election. Step 8: Meeting Requirements.

How much does it cost to file a 2553?

IRS Form 2553 does not have a filing fee, however, a business owner should be aware that there can be some other costs associated with electing to be taxed as an S Corp. For example, if the company is using “business purpose” to justify its fiscal year, it will incur a $5,800 fee following filing Form 2553.

What is an S election for tax purposes?

S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes.

What is form 100S for S corp in California?

Form 100S is used if a corporation has elected to be a small business corporation (S corporation). All federal S corporations subject to California laws must file Form 100S and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax. The tax rate for financial S corporations is 3.5%.

How much does it cost to form an S corp in California?

Every corporation that is incorporated, registered, or doing business in California must pay the $800 minimum franchise tax.

How do I file an S corp in California?

How to Start an S Corp in California Step 1: Check Name Availability. Step 2: Choose Business Name. Step 3: Obtain an EIN. Step 4: File Articles of Incorporation. Step 5: Registered Agent. Step 6: Corporate Bylaws. Step 7: S Corp Director Election. Step 8: Meeting Requirements.

Can you file form 2553 online?

You need to file Form 2553, Election by a Small Business Corporation to be treated as an S corporation by the IRS. You may file the form online, but only from the ElectSCorp website.

How do I file for an S corp in California by myself?

How to Start an S Corp in California Step 1: Check Name Availability. Step 2: Choose Business Name. Step 3: Obtain an EIN. Step 4: File Articles of Incorporation. Step 5: Registered Agent. Step 6: Corporate Bylaws. Step 7: S Corp Director Election. Step 8: Meeting Requirements.

What is the best way to file an S corp election?

If you want to make the S corporation election, you need to file IRS Form 2553, Election by a Small Business Corporation. If you file Form 2553, you do not need to file Form 8832, Entity Classification Election, as you would for a C-Corporation. You can file your Form 2553 with the IRS online, by fax, or by mail.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit CA FTB 3560 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your CA FTB 3560 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for the CA FTB 3560 in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I complete CA FTB 3560 on an Android device?

Complete CA FTB 3560 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is CA FTB 3560?

CA FTB 3560 is a form used by the California Franchise Tax Board for reporting the sale or exchange of real estate.

Who is required to file CA FTB 3560?

Individuals or entities that sell or exchange real estate located in California must file CA FTB 3560.

How to fill out CA FTB 3560?

To fill out CA FTB 3560, you must provide your personal information, details about the property sold, the date of sale, a description of the transaction, and any gains or losses related to the sale.

What is the purpose of CA FTB 3560?

The purpose of CA FTB 3560 is to report the sale or exchange of real estate for tax purposes and to ensure proper taxation of any capital gains.

What information must be reported on CA FTB 3560?

On CA FTB 3560, you must report your name, address, the property's location, the date of sale, sale price, and any deductions or adjustments to the gain or loss from the transaction.

Fill out your CA FTB 3560 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 3560 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.