Get the free U.S. TREAS Form treas-irs-8801-2002

Show details

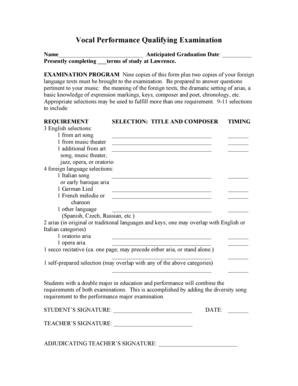

This form is used to calculate the credit for prior year minimum tax for individuals, estates, and trusts, and is attached to Form 1040, 1040NR, or 1041.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us treas form treas-irs-8801-2002

Edit your us treas form treas-irs-8801-2002 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us treas form treas-irs-8801-2002 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit us treas form treas-irs-8801-2002 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit us treas form treas-irs-8801-2002. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out us treas form treas-irs-8801-2002

How to fill out U.S. TREAS Form treas-irs-8801-2002

01

Obtain Form 8801 from the IRS website or a local IRS office.

02

Fill in your name and Social Security number at the top of the form.

03

Complete Part I to calculate your credit for prior year minimum tax.

04

In Part II, calculate your current year minimum tax by following the instructions provided.

05

Follow the worksheet instructions carefully, ensuring all figures are accurately entered.

06

Review the form for completeness and accuracy before submitting.

07

Sign and date the form at the designated section.

08

Submit the completed form to the IRS as guidance indicates.

Who needs U.S. TREAS Form treas-irs-8801-2002?

01

Taxpayers who have incurred alternative minimum tax (AMT) in previous years.

02

Individuals who have credits that can be carried forward as a result of prior AMT.

03

Persons seeking to claim a credit for the prior year minimum tax.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of IRS Form 8801?

Purpose of Form Use Form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (AMT) you incurred in prior tax years and to figure any credit carryforward to 2025.

Is an AMT tax credit refundable?

Refundable minimum tax credit. For tax years beginning in 2018 and 2019, a corporation is allowed an AMT refundable credit amount equal to 50% (100% for tax years beginning in 2019) of the excess minimum tax credit over the corporation's regular tax liability.

How to get form 8801?

Follow these steps to generate Form 8801 for an individual return: From the left of the screen, select Credits and choose Recovery Rebate, EIC, Residential Energy, Oth Credits. Click the three dots at the top of the screen and select Minimum Tax. Locate the Minimum Tax Credit (8801) section.

How to claim back AMT?

Essentially, you can carry forward the difference between the AMT and your regular tax liability for seven years, or until you use it up. It counts as a credit, but only against regular tax payable, not against future years' AMT. You can claim this credit using Form T691.

How do I get my AMT credit back?

Claim the AMT credit while filing your current year tax return by filling out Form 8801 and filing it along with your tax return. Carry forward and track the remaining credit you were not allowed to use in the current year.

Do AMT tax credits expire?

An entity that paid the AMT received a tax credit (AMT credit carryforward) for the tax paid in excess of the amount owed under the regular tax system. This AMT credit carryforward has no expiration date.

How do I claim my AMT credit refund?

Use IRS Form 8801 for these purposes: If you had an AMT liability for something other than an exclusionary item (such as a deferral item) To calculate the minimum tax credit. To calculate the amount you can carry over to future years.

How many years does AMT credit carry forward?

AMT credits carry forward indefinitely, meaning they do not expire. However, they cannot be carried backward to offset prior-year taxes. A taxpayer's regular tax liability must exceed their AMT liability in a future year to use an AMT credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is U.S. TREAS Form treas-irs-8801-2002?

U.S. TREAS Form 8801 is a form used to claim a credit for prior year minimum tax, allowing certain taxpayers to recapture the tax they paid in previous years under the alternative minimum tax.

Who is required to file U.S. TREAS Form treas-irs-8801-2002?

Taxpayers who were subject to the alternative minimum tax in previous years and are looking to receive a credit for it on their current year's tax return are required to file U.S. TREAS Form 8801.

How to fill out U.S. TREAS Form treas-irs-8801-2002?

To fill out Form 8801, taxpayers must gather tax information from previous years, complete the calculation of the minimum tax credit, and report the results on the form according to the instructions provided by the IRS.

What is the purpose of U.S. TREAS Form treas-irs-8801-2002?

The purpose of Form 8801 is to enable eligible taxpayers to recover previously paid alternative minimum tax over time through credits, thereby reducing their current tax liability.

What information must be reported on U.S. TREAS Form treas-irs-8801-2002?

Form 8801 requires reporting of prior year alternative minimum tax amounts, the current year's nonrefundable credits, and calculated minimum tax credits available for the current tax year.

Fill out your us treas form treas-irs-8801-2002 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Treas Form Treas-Irs-8801-2002 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.