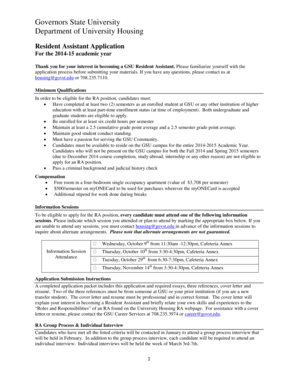

Get the free U.S. TREAS Form treas-irs-921-p-2001

Show details

This form is used by partnerships and limited liability companies to apply for a consent that extends the period for assessing federal income taxes related to partnerships' items for real estate projects

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us treas form treas-irs-921-p-2001

Edit your us treas form treas-irs-921-p-2001 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us treas form treas-irs-921-p-2001 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing us treas form treas-irs-921-p-2001 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit us treas form treas-irs-921-p-2001. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out us treas form treas-irs-921-p-2001

How to fill out U.S. TREAS Form treas-irs-921-p-2001

01

Obtain Form TREAS-IRS-921-P-2001 from the official IRS website or local IRS office.

02

Read the instructions provided with the form carefully to understand the requirements.

03

Fill out the identification section at the top of the form with your name, address, and taxpayer identification number.

04

Complete the relevant sections based on your specific situation, providing accurate and complete information for each item.

05

Double-check all entries for accuracy to avoid delays in processing.

06

Sign and date the form in the designated area.

07

Submit the completed form according to the instructions provided, either electronically or by mail.

Who needs U.S. TREAS Form treas-irs-921-p-2001?

01

U.S. TREAS Form TREAS-IRS-921-P-2001 is required for individuals or entities that need to report specific tax payments or claims related to U.S. Treasury securities.

02

It is typically used by those who are claiming an exemption on certain transactions or require documentation for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is a 1020 form for?

You may be eligible to get Extra Help paying for your prescription drugs. The Medicare prescription drug program gives you a choice of prescription plans that offer various types of coverage.

What is a form 926 transfer of property?

U.S. citizens or residents, domestic corporations or domestic estates or trusts must file Form 926, Return by a U.S. Transferor of Property to a Foreign Corporation, to report any exchanges or transfers of tangible or intangible property that are described in section 6038B(a)(1)(A) of the Internal Revenue Code to a

What is the IRS estimated tax payment form?

Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

Can you view IRS notices online?

You can find digital copies of most IRS notices in your online account, under the 'Notices and Letters' section.

What is a 921 form?

Form 921 is used to file to request an extension of the time necessary to file an income tax return due to the fact that real estate owned by the taxpayer is under contract to be sold but has not been sold yet.

What is IRS USA tax payment on my bank statement?

"IRS USA Tax Payment," "IRS USA Tax Pymt" or something similar will be shown on your bank statement as proof of payment. If the payment date requested is a weekend or bank holiday, the payment will be withdrawn on the next business day.

What is the IRS form for cash deposits over $10000?

A person must file Form 8300 within 15 days after the date the person received the cash. If the person receives multiple payments toward a single transaction or two or more related transactions, and the total amount paid exceeds $10,000, the person should file Form 8300.

What is the purpose of form 3922?

Form 3922 Transfer of Stock Acquired Through an Employee Stock Purchase Plan Under Section 423(c) is for informational purposes only and isn't entered into your return. Keep the form for your records because you'll need the information when you sell, assign, or transfer the stock.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is U.S. TREAS Form treas-irs-921-p-2001?

U.S. TREAS Form treas-irs-921-p-2001 is a form used by foreign persons to report certain transactions with the U.S. Department of the Treasury and the Internal Revenue Service related to U.S. tax obligations.

Who is required to file U.S. TREAS Form treas-irs-921-p-2001?

Generally, foreign entities or individuals who engage in certain transactions that require reporting to the IRS or Treasury are required to file U.S. TREAS Form treas-irs-921-p-2001.

How to fill out U.S. TREAS Form treas-irs-921-p-2001?

To fill out the form, provide accurate details about the foreign person, the type of transaction, amounts involved, and any other required information as outlined in the form's instructions.

What is the purpose of U.S. TREAS Form treas-irs-921-p-2001?

The purpose of the form is to ensure compliance with U.S. tax laws and to gather information about foreign transactions that may affect U.S. tax obligations.

What information must be reported on U.S. TREAS Form treas-irs-921-p-2001?

The form requires information such as the identification of the foreign person, details of the transactions, amounts involved, and any relevant tax identification numbers.

Fill out your us treas form treas-irs-921-p-2001 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Treas Form Treas-Irs-921-P-2001 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.