IE RF100A 2013 free printable template

Show details

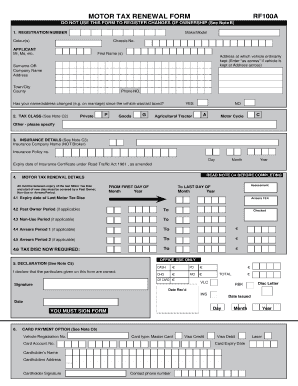

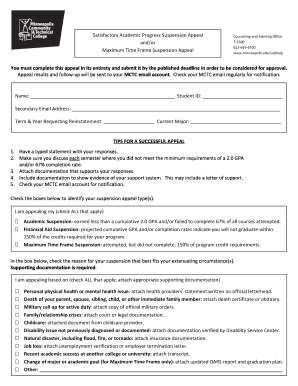

MOTOR TAX RENEWAL FORM RF100A DO NOT USE THIS FORM TO REGISTER CHANGES OF OWNERSHIP See Note B 1. REGISTRATION NUMBER Make/Model Colour s Chassis No. APPLICANT Mr Ms etc. First Name s Address at which vehicle ordinarily kept Enter as across if vehicle is kept at Address across Surname OR Company Name Address Town/City County Phone No. Has your name/address changed e.g. on marriage since the vehicle was last taxed 2. TAX CLASS See Note C2 P Private Goods G YES NO A Agricultural Tractor C Motor...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign IE RF100A

Edit your IE RF100A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IE RF100A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IE RF100A online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IE RF100A. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IE RF100A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IE RF100A

How to fill out IE RF100A

01

Collect all necessary personal information including your name, address, and identification details.

02

Obtain the proper version of the IE RF100A form from the relevant authority's website or office.

03

Carefully read the instructions provided with the form to understand what information is required.

04

Fill in your personal information in the designated sections, ensuring accuracy and completeness.

05

Complete any additional information related to the purpose of the application.

06

Review the filled form for any errors or missing information.

07

Sign and date the form where indicated.

08

Submit the form either online or in-person as directed, along with any required supporting documents.

Who needs IE RF100A?

01

Individuals or entities who are applying for a specific service or benefit that requires the completion of the IE RF100A form.

02

Business owners seeking to register or update their information with government authorities.

03

Anyone who needs to comply with regulatory requirements related to their residency or business operations.

Fill

form

: Try Risk Free

People Also Ask about

How do I tax a commercial vehicle first time in Dublin?

If you are taxing a commercial vehicle for the first time in your name you must do so at your local Motor Tax Office. You should contact them in advance to find out any supporting documentation that is needed. Motor Tax Office contact details can be got by clicking here.

Can I tax a commercial vehicle without a VAT number Ireland?

You can be perfectly tax compliant in a business that requires a commercial vehicle without being vat registered.

How do I tax a commercial vehicle in Ireland?

Online at motortax.ie. In person at your local motor tax office. By post.Apply in-person Motor tax offices. Public libraries. Garda stations.

How long can you drive without tax Ireland?

In reality this means that if you are stopped by the Gardaí while driving a vehicle and the road tax for that vehicle is out of date by two months or more, the Gardaí can seize that vehicle and impound it until such time as the owner can show proof that the motor tax has been paid for that vehicle to include the date

How do I tax a car I just bought in Ireland?

At motortax.ie, you can tax a new vehicle or renew your motor tax online. When taxing a new vehicle, you need Form RF100 (available from your motor dealer). When renewing your motor tax you need Form RF100B (computerised reminder form).

What do I need to tax a commercial van in Ireland?

Taxing of commercial vehicles Current commercial insurance certificate for the vehicle. Evidence of registration for VAT. Tax Clearance Certificate. Notice of Tax Registration Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IE RF100A directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign IE RF100A and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send IE RF100A to be eSigned by others?

When your IE RF100A is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find IE RF100A?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific IE RF100A and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

What is IE RF100A?

IE RF100A is a financial reporting form required in certain jurisdictions for businesses to report their income, expenses, and other financial details.

Who is required to file IE RF100A?

Businesses and entities operating in the respective jurisdiction that meet specific revenue thresholds or are engaged in certain activities are required to file IE RF100A.

How to fill out IE RF100A?

To fill out IE RF100A, businesses should gather their financial records, accurately report their income and expenses as per the guidelines provided, and ensure all required sections are completed before submission.

What is the purpose of IE RF100A?

The purpose of IE RF100A is to provide tax authorities with a comprehensive overview of a business's financial activities, ensuring compliance with tax regulations and assessment of liabilities.

What information must be reported on IE RF100A?

IE RF100A requires reporting of gross income, deductible expenses, net profit or loss, and any other relevant financial information as specified in the filing instructions.

Fill out your IE RF100A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IE rf100a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.