Get the free Integrated Payment Services Merchant Application (IPS)

Show details

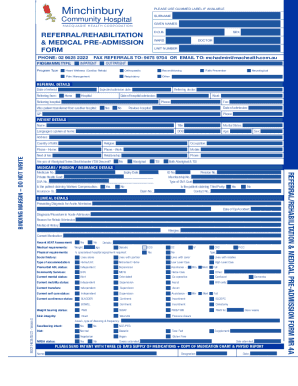

This document is an application form for merchants wishing to enroll in integrated payment services offered by Authorize.Net. It gathers personal and business information, outlines the terms of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign integrated payment services merchant

Edit your integrated payment services merchant form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your integrated payment services merchant form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit integrated payment services merchant online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit integrated payment services merchant. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out integrated payment services merchant

How to fill out Integrated Payment Services Merchant Application (IPS)

01

Gather necessary business information: Have your legal business name, trade name (if applicable), and business address ready.

02

Fill in contact details: Provide the primary contact name, email, and phone number for the application.

03

Enter business structure: Specify whether your business is a sole proprietorship, LLC, corporation, etc.

04

Provide tax information: Include your Employer Identification Number (EIN) or Social Security Number (SSN) if applicable.

05

Specify business type: Indicate the type of goods or services your business offers.

06

Add bank account information: Provide the details of the bank account where funds will be deposited.

07

Review merchant processing needs: Indicate expected monthly sales volume and transaction amounts.

08

Disclose any relevant business history: Include information on past merchant accounts and reasons for closure if applicable.

09

Sign and date the application: Ensure all information is accurate and sign to authorize the application.

Who needs Integrated Payment Services Merchant Application (IPS)?

01

Businesses looking to accept credit and debit card payments.

02

Retailers with a point-of-sale system that requires a merchant account.

03

E-commerce businesses wanting to process online transactions.

04

Service providers that need to handle customer payments electronically.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between integrated and non integrated payment processing?

Payment options: Integrated processors enable merchants to accept payment methods, including credit cards and electronic wallets. However, non-integrated systems can force you to use only a few banks or credit unions, which may put off some customers.

How long does it take for a merchant to process a payment?

Bank payment processing times in the US depend on the payment method. Card transactions usually process instantly but may take 1-3 business days for funds to clear. ACH or Direct Debit payments typically process within 1-3 business days. Wire transfers are often processed on the same day.

Why am I getting calls from merchant services?

Have you ever gotten this phone call? If it was really your current merchant services processor calling, they would identify themselves by their company name. So if you get this phone call, get ready for the telemarketer to make up some B.S. to scare you into thinking you need to switch payment processors to them.

What is merchant services payment processing?

In its most specific use, it usually refers to merchant processing services that enables a business to accept a transaction payment through a secure (encrypted) channel using the customer's credit card or debit card or NFC/RFID enabled device.

What is an example of an integrated payment?

Here's an example of an integrated payment in action: A customer visits an online store and selects several items to purchase. Customers have different payment options at checkout, such as credit card, ACH, eCheck, etc. The customer selects their preferred payment method and enters their payment information.

What is an integrated payment system?

An integrated payments solution automates accounting processes, allowing a business to bypass the process of manually entering and reconciling transaction data, which is time consuming and prone to errors. With an integrated solution, payments are automatically posted at the time of sale.

What is an example of a merchant payment?

Example of a Merchant Payment A customer visits your website, selects a product, and enters their debit or credit card details at checkout.

What is merchant payment processing?

Understanding merchant payment services The basics of merchant processing are simple enough – you sign up with a merchant payment provider so that you can accept credit cards, debit cards and other forms of payment from your customers (and receive payment yourself for all of those payments).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Integrated Payment Services Merchant Application (IPS)?

Integrated Payment Services Merchant Application (IPS) is a form that facilitates the registration and onboarding of merchants who wish to process payments through integrated payment systems. It collects necessary information to ensure compliance and smooth transaction handling.

Who is required to file Integrated Payment Services Merchant Application (IPS)?

Businesses or individuals who want to accept electronic payments through integrated payment systems are required to file the Integrated Payment Services Merchant Application (IPS). This typically includes retailers, service providers, and online merchants.

How to fill out Integrated Payment Services Merchant Application (IPS)?

To fill out the Integrated Payment Services Merchant Application (IPS), applicants need to provide accurate business information, including business name, address, type, owner details, and banking information. It's important to follow the instructions provided with the application to ensure all sections are completed correctly.

What is the purpose of Integrated Payment Services Merchant Application (IPS)?

The purpose of the Integrated Payment Services Merchant Application (IPS) is to streamline the process for merchants to start accepting electronic payments, ensure regulatory compliance, and facilitate a secure transaction environment for users.

What information must be reported on Integrated Payment Services Merchant Application (IPS)?

The information that must be reported on the Integrated Payment Services Merchant Application (IPS) includes the merchant's business details, contact information, financial information, and any necessary identification documents to verify the identity and legitimacy of the business.

Fill out your integrated payment services merchant online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Integrated Payment Services Merchant is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.