Get the free Pension Perspectives

Show details

Newsletter for Los Angeles City Fire & Police Active Members providing information on purchasing service credit, DROP participation, active member pension statements, and upcoming pre-retirement seminars.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pension perspectives

Edit your pension perspectives form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pension perspectives form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pension perspectives online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pension perspectives. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

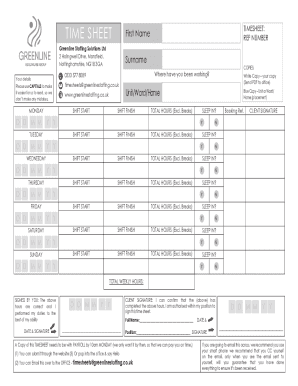

How to fill out pension perspectives

How to fill out Pension Perspectives

01

Step 1: Gather your personal information, including your name, address, and Social Security number.

02

Step 2: Obtain any relevant employment history, including employer names, job titles, and dates of employment.

03

Step 3: Collect information about your current retirement plans, such as 401(k) or pension options.

04

Step 4: Review any existing financial documents, such as tax returns and investment statements.

05

Step 5: Fill out the Pension Perspectives form with accurate and complete information.

06

Step 6: Double-check all entries for accuracy before submission.

07

Step 7: Submit the completed form according to the provided instructions.

Who needs Pension Perspectives?

01

Individuals planning for retirement who need to evaluate their pension options.

02

Employees considering job changes and wanting to understand their pension benefits.

03

Workers who need to assess their retirement savings and financial health.

04

Financial advisors assisting clients in retirement planning.

Fill

form

: Try Risk Free

People Also Ask about

How to calculate your pension payout?

The first thing to decide is your desired retirement income. How much pension do you need to live comfortably? For a quick estimate, try the '50-70' rule. This suggests that you should aim for an annual income that is between 50% and 70% of your working income.

What is a pension plan in English?

pension plan Business English a system which allows people who are working to make regular payments from their income to invest in a pension: start/take out a pension plan Some of the advice must have sunk in, though, as about two years ago she took out a pension plan.

How much is a $30,000 pension worth per month?

How much basic State Pension you get depends on your National Insurance record. The full basic State Pension is £176.45 per week.

How much is a decent monthly pension?

Financial experts are quick to point out that there are no hard and fast rules when it comes to retirement. “You can have a great retirement on $5,000 a month, and you can have a great retirement on $50,000 a month,” says Joe Conroy, financial advisor and owner of Harford Retirement Planners in Bel Air, Maryland.

Is it better to cash out pension or take monthly payments?

The general rule of thumb is to take the lump sum, especially if you are not 100% reliant on that guaranteed monthly income to live.

What is the English pension?

pension Business English a regular income paid by a government or a financial organization to someone who no longer works, usually because of their age or health: comfortable/decent/generous pension They receive a generous pension, typically 75% of last pay drawn.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Pension Perspectives?

Pension Perspectives is a reporting tool designed to provide detailed information and insights into pension plans and their financial status.

Who is required to file Pension Perspectives?

Entities that manage pension plans, such as employers or pension fund administrators, are typically required to file Pension Perspectives.

How to fill out Pension Perspectives?

To fill out Pension Perspectives, one must gather relevant financial data about the pension plan, follow the provided guidelines and formats, and submit it through the designated filing system.

What is the purpose of Pension Perspectives?

The purpose of Pension Perspectives is to ensure transparency and provide stakeholders with a clear understanding of the pension plan’s performance and obligations.

What information must be reported on Pension Perspectives?

Information that must be reported on Pension Perspectives includes financial status, funding levels, investment performance, demographic data of plan participants, and any significant changes impacting the pension plan.

Fill out your pension perspectives online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pension Perspectives is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.