MO DoR 149 2005 free printable template

Show details

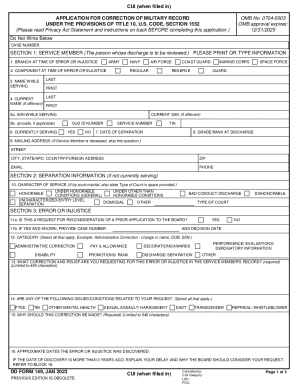

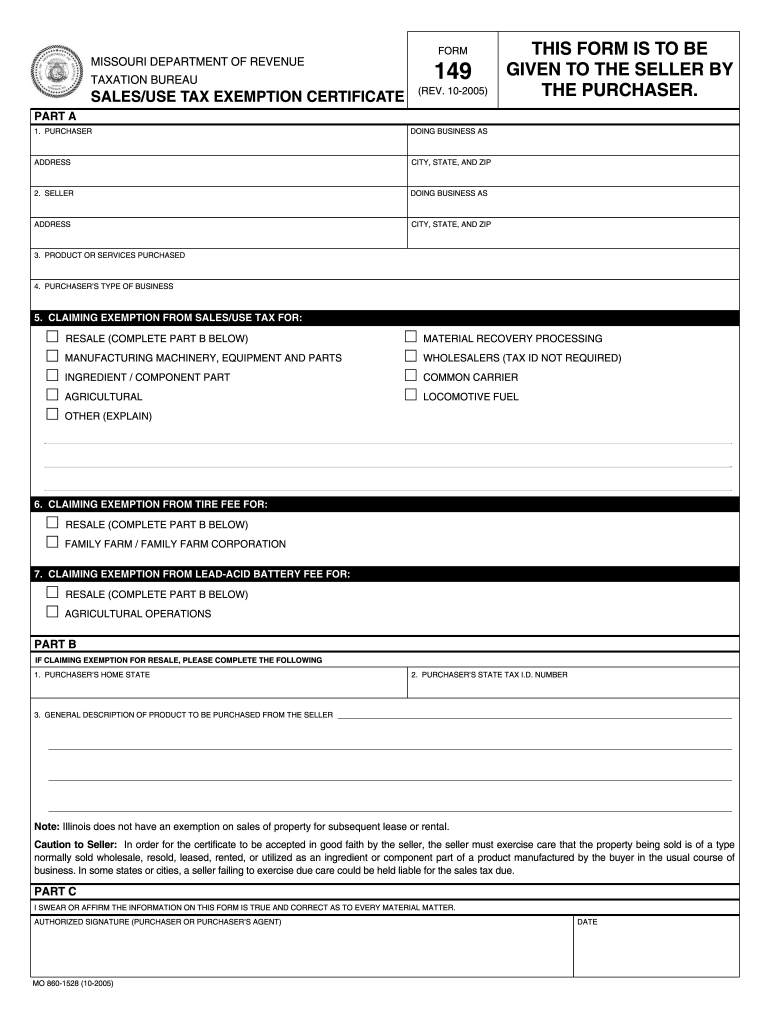

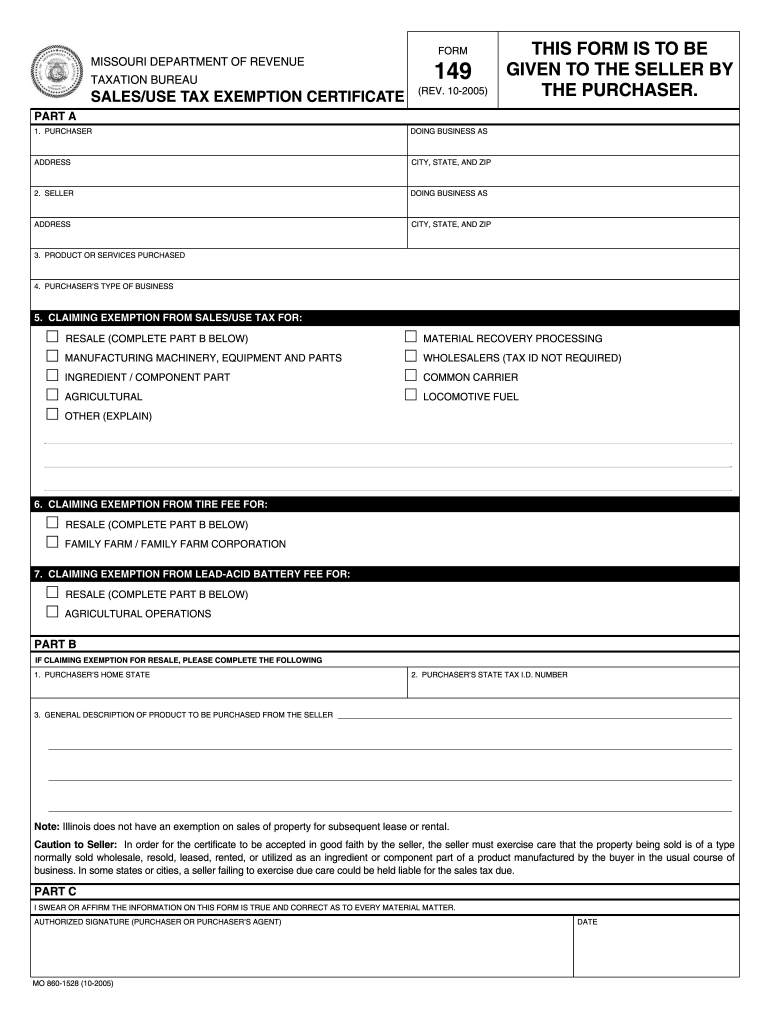

FORM MISSOURI DEPARTMENT OF REVENUE TAXATION BUREAU SALES/USE TAX EXEMPTION CERTIFICATE 149 (REV. 10-2005) THIS FORM IS TO BE GIVEN TO THE SELLER BY THE PURCHASER. PART A 1. PURCHASER DOING BUSINESS

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign missouri form 149 2005

Edit your missouri form 149 2005 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your missouri form 149 2005 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing missouri form 149 2005 online

Follow the steps below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit missouri form 149 2005. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO DoR 149 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out missouri form 149 2005

How to fill out MO DoR 149

01

Obtain the MO DoR 149 form from the official website or local office.

02

Fill in the general information section, including your name, address, and contact details.

03

Provide the relevant identification number, such as your Social Security number or tax ID.

04

Complete the financial information section with accurate figures.

05

Sign and date the form in the designated area.

06

Review the form for any errors or omissions before submission.

07

Submit the completed form via mail or in person to the appropriate department.

Who needs MO DoR 149?

01

Individuals or entities filing for specific tax benefits in Missouri.

02

Business owners seeking to claim deductions or credits.

03

Anyone required to report certain financial information to the Missouri Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a sales tax waiver in Missouri?

You may be entitled to a tax waiver if one of the following applies: A new Missouri resident. First licensed asset you have ever owned. You did not own any personal property on January 1st of the prior year. You are in the military and your home of record is not Missouri (LES papers are required)

How do I qualify for farm tax exemption in Missouri?

How to Claim the Missouri Sales Tax Exemption for Agriculture. In order to claim the Missouri sales tax exemption for agriculture, qualifying agricultural producers must fully complete a Missouri Form 149 Sales and Use Tax Exemption Certificate and furnish this completed form to their sellers.

Is Missouri a no return required military?

The military pay of nonresident military personnel stationed in Missouri due to military orders is not taxable to Missouri. If you are a servicemember and earned only military income while stationed in Missouri, complete a No Return Required-Military online form at the following link: Military No Return Required.

What is Missouri vendors use tax?

Use tax is imposed on the storage, use or consumption of tangible personal property in this state. The state use tax rate is 4.225%. Cities and counties may impose an additional local use tax.

What is Missouri form 149 for?

local sales and use tax under Section 144.030, RSMo. Ingredient or Component Parts: This exemption includes materials, manufactured goods, machinery, and parts that become a part of the final product. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in Missouri or other states.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in missouri form 149 2005 without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your missouri form 149 2005, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I edit missouri form 149 2005 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign missouri form 149 2005 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete missouri form 149 2005 on an Android device?

Use the pdfFiller mobile app and complete your missouri form 149 2005 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is MO DoR 149?

MO DoR 149 is a form used in the state of Missouri to report certain types of income and expenses related to businesses or individuals for tax purposes.

Who is required to file MO DoR 149?

Individuals or businesses that have specific income streams or financial activities that need to be reported to the state of Missouri are required to file MO DoR 149.

How to fill out MO DoR 149?

To fill out MO DoR 149, gather all necessary financial information, provide accurate details about income and expenses, and follow the instructions on the form for submission.

What is the purpose of MO DoR 149?

The purpose of MO DoR 149 is to ensure that the state has accurate information for tax assessment and compliance regarding business and personal income.

What information must be reported on MO DoR 149?

Information that must be reported on MO DoR 149 includes details about income earned, types of expenses incurred, and any relevant identification numbers required by the state.

Fill out your missouri form 149 2005 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Missouri Form 149 2005 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.